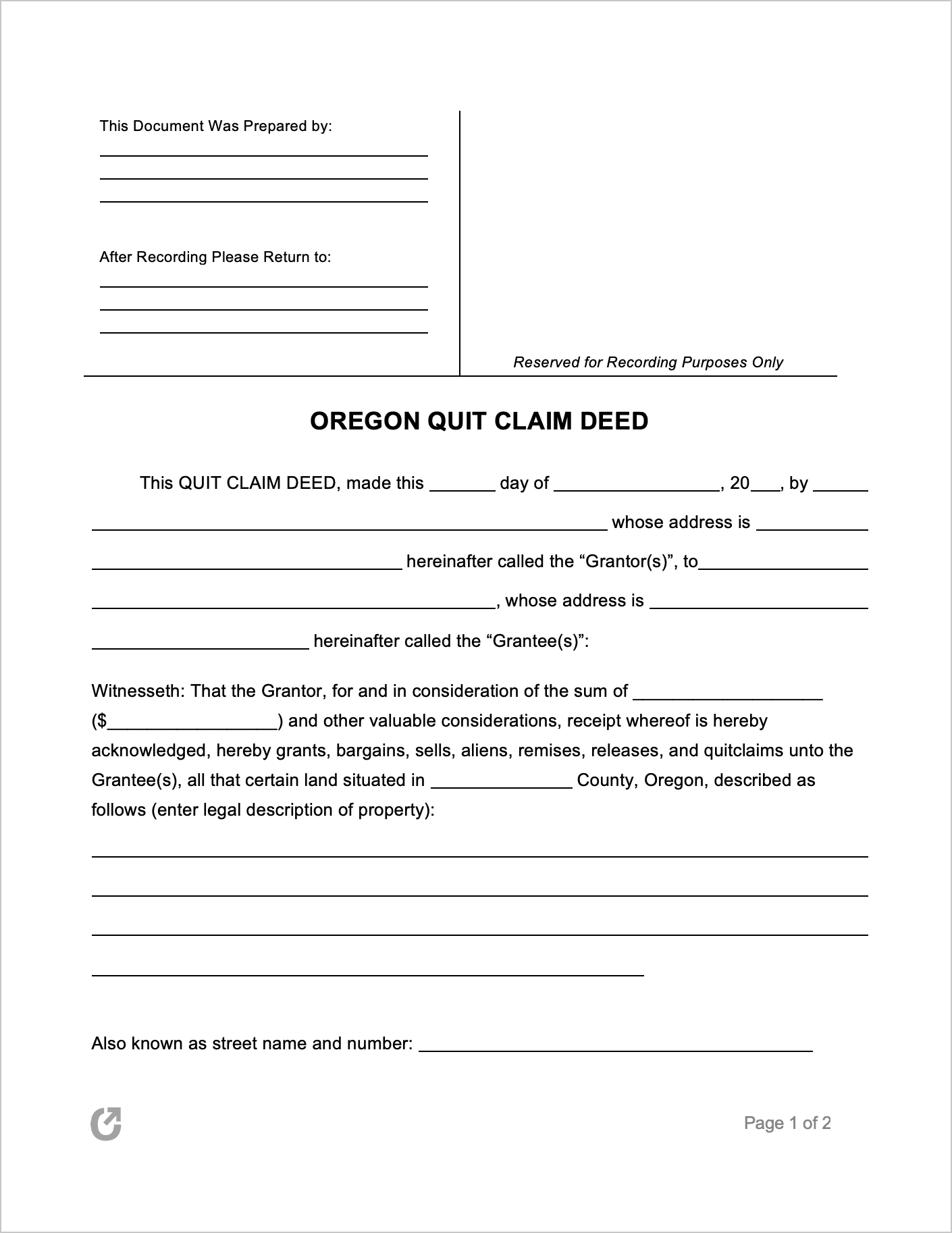

Oregon Quit Claim Deed Form

The Oregon Quit Claim Deed is an official legal document that is used for transferring interest in real estate. In comparison to a Warranty Deed, it is basic and does not include any protections or guarantees. However, so long the form is used exclusively among family and close friends, the deed does not need to include any protections – as this would only serve to make the form more confusing and costlier to use.

Situations in which the form is commonly used are divorce proceedings (such as giving a former spouse the rights to the property), to pass-down a property to a child, or for fixing an error on the property’s title.

Download: Adobe PDF, MS Word (.docx)

Laws: OR Revised Statutes § 93.865

Requirements

Mandatory Information (§ 93.865): Oregon law requires all deeds to contain the following information:

- The Grantor and Grantee’s names,

- The words, “quitclaims to,”

- A description of the property,

- The statement provided by § 93.040 (included in the download),

- The amount of the consideration (in dollars), and

- The date of the deed’s execution.

Statement of Consideration (§ 93.030): The “true and actual consideration paid for the transfer” must be written on the Deed. This amount should be stated in dollars ($).

Washington County (Chapter 3.04): Residents of Washington County must pay an additional tax dictated by county law. The tax rate, as per Chapter 3.04.070, is:

- One dollar ($1.00) per one thousand dollars ($1000.00) of the property’s selling price.

The tax must be paid within fifteen (15) days after filing the deed. The payment must be made to the director of recording of the documents transferring real property. Exemptions are stated in § 3.04.040 and rules about extensions are stated in § 3.04.080.

Signing Requirements (§ 93.010): Must be signed by the Grantor and notarized by an official Notary Public.