Blank Invoice Templates

An invoice is a formal document issued by a seller to a buyer, itemizing the goods or services purchased and the corresponding amount due.

EXCEL (.XLSX) |

WORD (.DOCX) |

Categories (9)

What is an Invoice?

An invoice is a form used by the seller of a product or service for giving the customer a summary of what was ordered, a breakdown of the costs, a means of contacting the seller, and instructions for paying for what was received. More simply, an invoice can be viewed as a more formal bill. Professions of all types use invoices,

It is highly recommended companies, freelancers, and contractors send an invoice following their work. This is because it:

- Eases buyer-seller relations by providing clarity on exactly both what was charged, and why.

- Allows payment to be delayed, giving the client enough time to inspect the product or service and pay for the invoice incrementally.

- Can be used as a quote – giving the buyer an outline of what would be charged if they were to approve of the job.

- Is professional and courteous, leaving the customer with a more positive impression of the company.

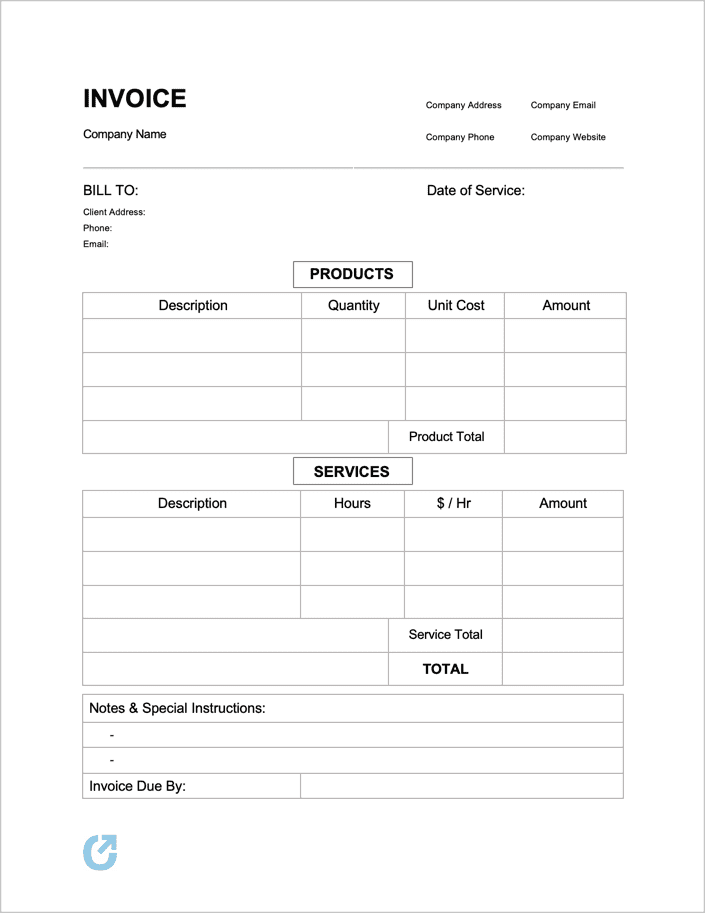

What does an Invoice Include?

Typically, an invoice includes:

- Company Contact Information

- Client/Customer Details

- Products and/or Services Purchased

- Time Until Payment is Due

- Payments Accepted, Corrections, and Other Details

Company Contact Information

The company name and address are staples of an invoice. The company name can be replaced by an individual’s name if doing freelance work. Having an address displayed clearly on the invoice allows sold products to have a return address and gives customers a means to pay invoices by check through the mail.

Client / Customer Details

A ‘Bill To’ section lists all of the significant details of the client purchasing the products or services. Their name, address, phone number, and the date of the transaction are almost always included. Additionally, most have an invoice number to track past and current clients more efficiently.

Products and / or Services Purchased

Lists of both the products and/or services purchased are the basis for the invoice. They allow for detailed descriptions of what was purchased, how many, the cost of each, and the total amounts altogether. Although some invoices only have lists for products and vice versa, all invoices have a section to list out the details of the expenses.

Time Until Payment is Due

The number of days until payment is due is a must for every invoice. Having a concrete date that the invoice is due ensures both parties are clear on the terms of payment and lets the client breathe easy if they do not have the immediate funds to cover the invoice amount.

Payments Accepted, Corrections, and Other Details

A comment box allows the issuer to list pertinent details regarding the invoice, such as the types of payment accepted, corrections to listed expenses, or thank-yous to the client.

What is an Invoice Number?

An Invoice Number is a string of characters systematically assigned to an invoice. It is used to track and identify each payment, service, or product sold. Each invoice number needs to be unique in order to efficiently organize each payment. The number doesn’t have to be an exact length – as long as it makes sense to the company or individual issuing the invoice. Examples include: “A-0001, A-0002, etc.” or “551, 5552, 5553, etc.,” or “ABCC, ABCD. ABCE, etc.”

Assigning structure to the invoicing process can provide invaluable to a business, such as adding a certain character for each month and year the invoice was issued or a code for the worker that sold the product. For example, the letter combo “MA-24” can refer to the invoice being billed on May 24th. To highlight what should go into an invoice number, keep in mind the points below.

- Assign a unique Invoice Number to each document

- Make the number sequential

- Avoid Special Characters (with the exception of dashes “-“)

- Create Character Combinations (“JC-21”) to track dates, types of products, service people, etc.

How to Price Services

There is no “correct” price for a service, as depending on the experience of those doing the job, the length the job takes, the number of companies bidding for the work, and the customer’s perceived value of the service rendered, the price point can vary greatly from person to person. However, for freelancers and companies looking to price their services, the points below should be taken into account.

1. Determine the Costs

Before setting a price for a service a freelancer or company provides, the first step is to find and add up all the costs that go into providing the service. These costs include:

- Labor Cost – Employee wages, the cost of hiring a contractor, and other hourly-based work should be accounted for. There are generally two (2) ways to charge for labor. Each has there advantages and disadvantages, and are typically chosen depending on the type of service provided.

i. Hourly Pricing – By charging hourly, the company or individual conducting the services charge a pre-determined hourly rate. While the hourly rate is set, the number of hours that the job will take is not. If the job goes over, the company gets paid for each hour of work. While good for the company, this type of pricing can leave clients unsatisfied with the cost of the job as they can end up paying far more than they had expected. Additionally, companies that charge this type of pricing can find it leaves workers rather unmotivated, as the speed in which they complete their work does not benefit them in any way.

ii. Flat Fee – This method of pricing is preferred by customers as they know the price they are paying from beginning to end. Companies that charge a flat rate can either benefit or falter as a result of charging hourly – if they can complete the job in less time than anticipated, they make the same amount. However, if the job takes significantly longer to finish, the job can prove costly to the business.

- Materials Cost – Any products or items that were purchased in order to complete the job. Things that can be used more than once, such as a tractor or wrench set are typically not included. Mulch, nails, plumbing, paint, wood, and any other material that will be left with the client should be included in this cost.

- Overhead – Any costs that cannot be pinpointed to a direct service should be included here. The electricity bill, rent, depreciation of vehicles/equipment, legal fees, and general supplies.

2. Analyze Competitors’ Pricing

By comparing prices to those of a competitor, one can get the idea of the general price point the service should hover around. While lower may sound more appealing, charging a slightly higher price can give prospective customers the sense that the service is better; however, the service should be better if the company or contractor plans on retaining long-term customers.

3. Account for Profit

After expenses have been calculated, markup the total expense cost to account for profit and unexpected events. The amount of money that is kept as profit depends on several variables, including what competitors are charging, the competitiveness of the field, and the current state of the economy. Once the project cost has been calculated, the company or individual can offer clients an hourly rate, a one-time fee, or a combination of the two.