Quit Claim Deed Forms

A quitclaim (quit claim) deed is a document used for conveying one’s ownership in real estate to another. At the benefit of being straightforward and fast to complete, the deed type provides no warranties that the title is free of issues.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What is a Quitclaim Deed?

A quitclaim deed is a form for transferring interest (ownership) in property from one person (the grantor) to another (the grantee). It is one of the two (2) main deed-types for property transfers, the other being the warranty deed. The quitclaim deed is different than the warranty deed in that it offers little to no protection for the individual(s) receiving the property in that the property is solely owned by the grantor.

Hypothetically, if a property was actually owned by two (2) individuals, and just one (1) of the owners signs the title over with the quitclaim deed, the title would not transfer due to the other individual also owning the property. Although the deed is less secure, the decrease in protection allows the form to be completed and recorded far quicker and is the most obvious solution for parties that trust each other.

What is the Purpose of a Quitclaim Deed?

The deed has four (4) general purposes, which are:

1. Transfer property among family members

Due to the limited protections offered by the deed, it is most commonly used for transferring property among family members, such as a parent to a child. The reason it is more commonly used among families is because of the trust that commonly exists, unlike a transaction involving two (2) unfamiliar parties.

2. Fix title defects

Title defects are known as “clouds” and result from property that was not transferred correctly. A cloud on title can be caused by:

- A public records error,

- Formatting requirements not being property followed,

- A spelling mistake,

- Another person (who was previously unknown) having an interest (ownership) in the property, or

- A boundary or survey dispute.

3. Add or remove a person from the title

Similar to transferring property to a family member, the deed is commonly used after a divorce or marriage to add or remove a spouse to the property’s title.

4. Transfer property to subsidiaries

In addition to being used as a means of transferring residential property, quitclaim deeds can be used for commercial property as well. An example is a parent company looking to transfer land and/or buildings to one of their subsidiaries (a subset/acquisition of a company).

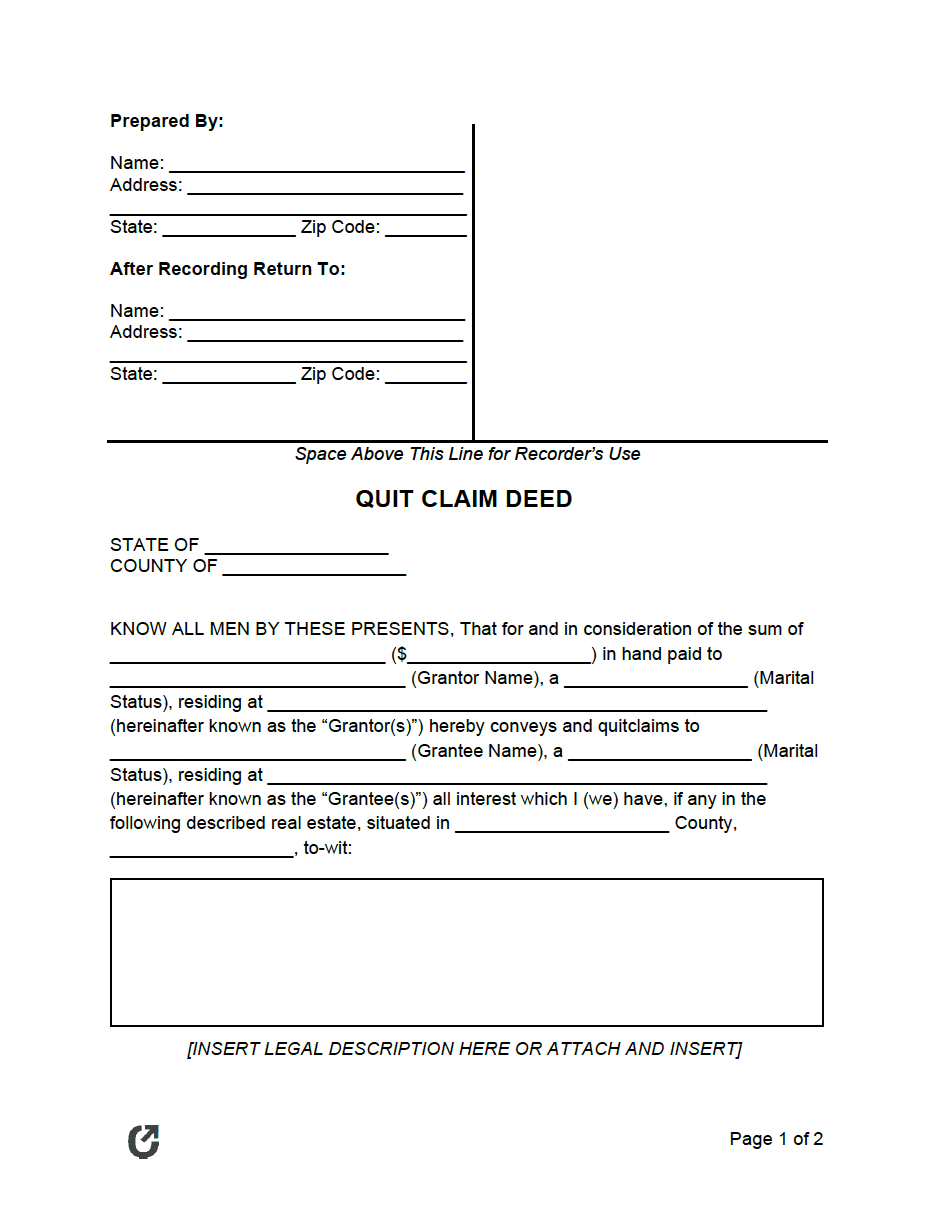

What’s Included?

A quitclaim deed should include the following information:

- The names, addresses, and marital statuses of the Grantor and Grantee,

- The amount of consideration (in dollars),

- A legal description of the property,

- The type of title the grantee will hold (e.g., tenancy in common, tenancy in entirety, etc.), and

- The date of execution.

The form will also need to be signed and acknowledged in accordance with state law requirements.

Before using the form type, there are some important considerations to keep in mind. Namely, it should be clear that the deed cannot offer the grantee (s) any of the following in regards to the title of the property:

- Guarantees,

- Warranties,

- Covenants, or

- Promises.

Conveyance (Quitclaim) Laws: By State

The following are the conveyance and quitclaim statutes of all fifty (50) states. “N/A” has been placed next to states that don’t have quitclaim statutes enacted.

| STATE | STATUTE |

| Alabama | Title 35, Ch. 4 |

| Alaska | § 34.15.040 |

| Arizona | § 33-402 |

| Arkansas | § 18-12-209 |

| California | N/A |

| Colorado | § 38-30-116 |

| Connecticut | §§ 47-36f to 47-36g |

| Delaware | § 121 |

| Florida | § 695.01 |

| Georgia | § 48-4-44 |

| Hawaii | Title 28, Ch. 502 |

| Idaho | § 55-612 |

| Illinois | § 765 ILCS 5/10 |

| Indiana | § 32-21-1-15 |

| Iowa | § 558.19 |

| Kansas | § 58-2204 |

| Kentucky | Ch. 382 |

| Louisiana | § 1839 (Civil Code) |

| Maine | § 33-161 |

| Maryland | N/A |

| Massachusetts | § 183-11 |

| Michigan | § 565.152 |

| Minnesota | § 507.07 |

| Mississippi | Title 89, Ch. 5, Art. 1 |

| Missouri | § 447.640 |

| Montana | N/A |

| Nebraska | Ch. 23 §§ 1501 to 1511 |

| Nevada | NRS 111.312 |

| New Hampshire | § 477.28 |

| New Jersey | § 46:5-1 |

| New Mexico | § 47-1-30 |

| New York | Art. 8 § 258 |

| North Carolina | Ch. 47B |

| North Dakota | Ch. 47-10 |

| Ohio | § 5302.11 |

| Oklahoma | § 16-41 |

| Oregon | § 93.865 |

| Pennsylvania | 21 P.S § 7 |

| Rhode Island | § 34-11-17 |

| South Carolina | Title 27, Ch. 7 |

| South Dakota | § 43-25-7 |

| Tennessee | § 66-5-103 |

| Texas | Title 3, Ch. 13 |

| Utah | § 57-1-13 |

| Vermont | Title 27, Ch. 5 |

| Virginia | Title 55.1, Ch. 3 |

| Washington | § 64.04.050 |

| West Virginia | Art. 3, Ch. 36 |

| Wisconsin | § 706.10 |

| Wyoming | § 34-2-104 |

Frequently Asked Questions (FAQ)

The following are the answers to frequently asked questions regarding quitclaim deed forms.

- Is a quitclaim deed safe?

- Can a quitclaim deed be revoked?

- Can a quitclaim deed be filed after death?

- Where can I get a quitclaim deed?

- Can a quitclaim deed stop foreclosure?

Is a quitclaim deed safe?

The deed is safe so long as the parties understand the risks associated with the deed type. It is safest to use one when it is evident that the grantor holds a good title to the property.

In a quitclaim deed, the grantee will only receive any interest the grantor genuinely holds. Consequently, if the grantor either intentionally or unintentionally informs the grantee that they have interest, when in fact they do not, the grantee will not receive ownership of the property. Moreover, because there are no warranties to protect the grantee if such a situation occurs, they will be unable to receive any legal remedies in the event it occurs.

For this reason, grantees are urged to take the following precautions before using the form:

- Perform a title search. Performing a title search allows both parties to confirm the nature of the grantor’s interest. It will also establish whether or not there are any other parties who hold interest in the property as well as identify any clouds (errors) on the title.

- Only execute this form with someone that can be trusted. Given the risks involved, it is strongly advised that the grantee already has an already established relationship with the grantor. Common examples include a parent and child, siblings, spouses, close friends, former spouses, and business partners.

- Do not use the form for conveyances that involve large sums of money: As the grantor is not liable in any way, if it turns out that there is a problem with the title, the grantor is not legally obligated to return any money the grantee paid for the property. As such, it is safest for only a nominal amount of money to be exchanged during the conveyance.

- Do not use the form if the property has an outstanding mortgage: While this situation is “on the grantor” instead of the grantee, it can still cause a needless headache for both parties. Although it is possible for the grantor to have an outstanding mortgage on the property, a deed involving a mortgage can quickly become messy. Even if the grantor will retain their liability to the mortgage, there is a high chance of complications occurring, such as the mortgage having a due-on-sale clause, which makes it so the full loan would be due upon the title being transferred.

Can a quitclaim deed be revoked?

A quitclaim deed can be revoked in a very limited set of circumstances. As a valid contract that has been duly recorded, it is almost impossible to reverse the process.

The primary circumstance that may allow for the deed to be revoked is if it can be proven that one party was coerced into signing the form. In order to do so, the party claiming this must provide evidence of such coercion before a judge in a court of law. Specifically, the party must prove that they were made to sign the form under “undue influence.” That is, they were taken advantage of and thus did not sign their name to the form under their own free will.

Another circumstance that may result in a judge overturning the deed is if it can be proven that one party was incompetent at the time of signing. For example, if a person with dementia signed the contract but they did not have a clear idea of what they were doing, this may meet the criteria need to prove incompetence.

A final circumstance that may be grounds for the deed to be revoked is if it is invalidated due to a technical or procedural error. For example, if state law requires the grantor to sign the form before a Notary Public, and they did not do so, this may constitute a procedural error in the eyes of the law.

Can a quitclaim deed be filed after death?

There is no simple answer to whether a deed can be filed after the grantor’s death. Some state laws may allow for the filing to take place if the grantor signed and delivered the deed prior to their death, so long as certain other requirements are also met.

Whether the deed can be filed after death will also depend on any particular conditions noted in the deed and the nature of the title being held.

Even if it’s not possible to record the form after the grantor passes away, it may be possible to make the case that the grantor intended for the form to be filed upon their death. In this case, the form may be processed as a will, which will require going through the probate process.

If available, it may be more straightforward to file a Transfer on Death Deed (also known as a Beneficiary Deed). This type of deed is permitted for use in roughly half of the states. It allows for the property of a deceased individual to be passed on to another party without the need for probate.

In any case, due to the complicated nature of this circumstance, it is best to consult a legal professional to ensure that the correct procedures are taken.

Where can I get a quitclaim deed?

Those looking to complete a quitclaim deed that complies with their state requirements can do so by:

- Downloading a state-specific quitclaim deed form above (free);

- Having an attorney draft the form ($$$).

Can a quitclaim deed stop foreclosure?

Yes, a quitclaim deed can be used to stop foreclosure, so long their lender agrees. The homeowner should contact the lender ASAP and inquire about programs or other means they can take to stop the process.

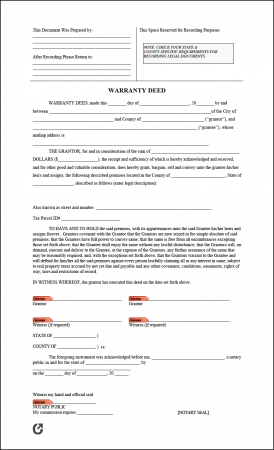

Warranty Deed Template

The other main type of deed form, the warranty deed, contains warranties (guarantees) that the title is clear and that the grantor has the right to sell the property to the grantee (s). It is more commonly used for instances where a property is sold via the traditional route, rather than being gifted or distributed.

The other main type of deed form, the warranty deed, contains warranties (guarantees) that the title is clear and that the grantor has the right to sell the property to the grantee (s). It is more commonly used for instances where a property is sold via the traditional route, rather than being gifted or distributed.

How to Write

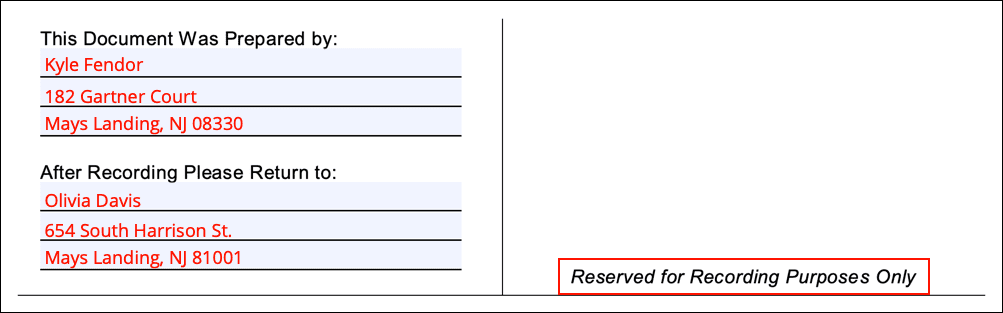

Step 1 – Recording Information

In the top left of the deed, the individual that prepared the document (typically an attorney), will write their name and address. In the second area, enter the name and address of the grantee (receiving the property).

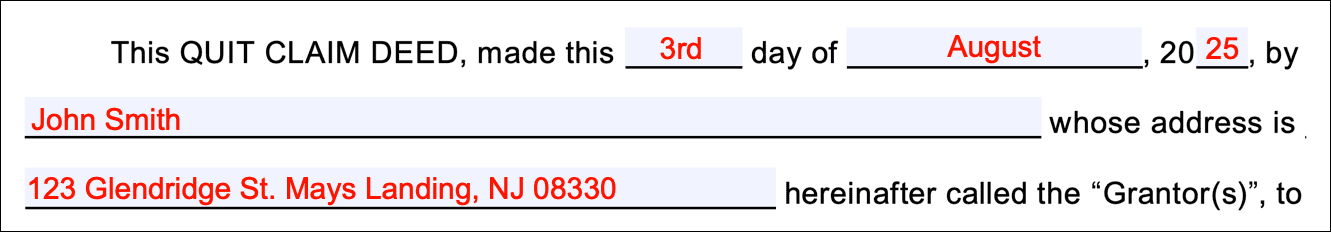

Step 2 – Date & Grantor

Write the day, month, and year in which the deed is being completed, followed by the name of the grantor (owner of the property), and the grantor’s full address (may or may not be the grantor’s current address).

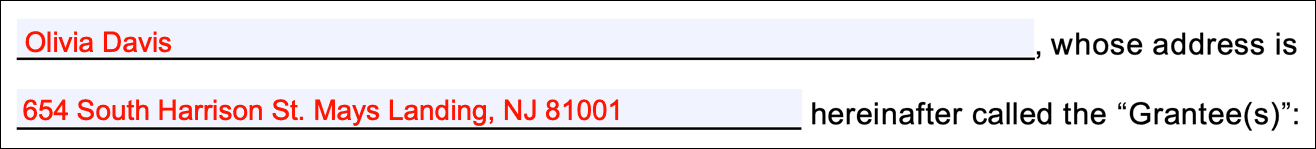

Step 3 – Grantee

In the field directly below the grantor’s address, enter the name of the grantee (receiving the property) and the grantee’s Address (street, city, state, and ZIP).

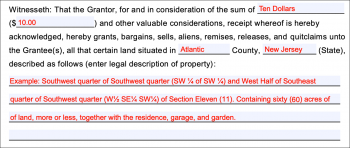

Step 4 – Consideration & Legal Description

In the first field, enter the dollar amount (in words) that the grantee is paying for the property. If it is a gift, include a monetary amount of one dollar ($1.00) or ten dollars ($10.00). Then, enter both the county and state in which the property is located, followed by a legal description of the property. The description does not have to look similar to the example provided – however, it should contain detailed information that adequately describes the property.

Step 5 – Property Address

Enter the full address of the property being quitclaimed to the grantee.

![]()

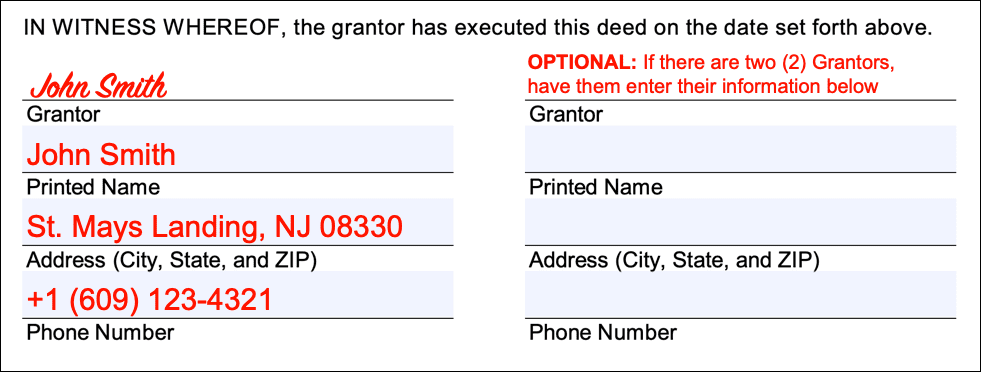

Step 6 – Grantor Signature(s)

In this section, the grantor (or grantors, depending on if there are one (1) or two (2) of them) will need to write their signature(s), printed name(s), address(es), and phone number(s).

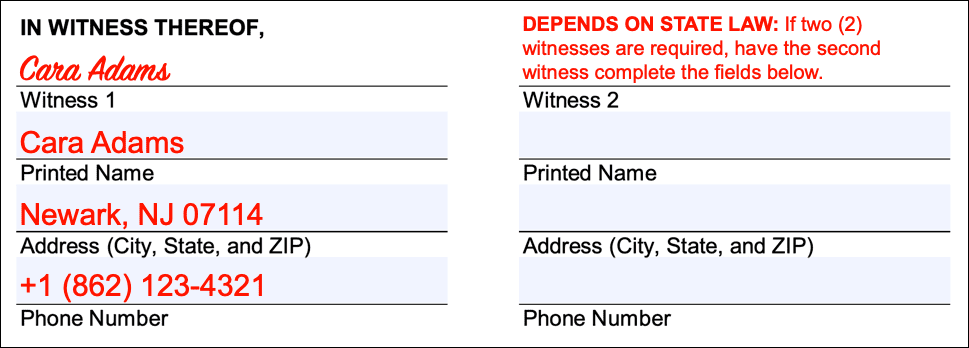

Step 7 – Witness Signature(s)

Here, the witness(es) to the deed, much like Step 6, will need to write their signature(s), printed name(s), address(es), and phone number(s). Whether or not the deed is required to be signed by one (1) or two (2) witnesses depends on the state statutes in which the property is located.

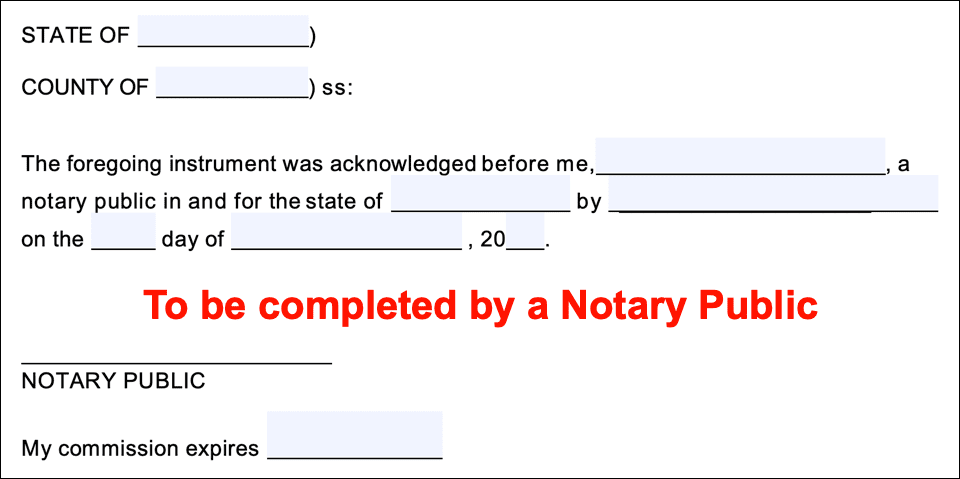

Step 8 – Notarization

The section at the bottom of the second (2nd) page is to be completed by a Notary Public only. No information needs to be (or should be) entered into this section by the grantor or preparer.