Small Estate Affidavit Forms

A small estate affidavit is used for settling the estate of a person without going through the probate process. Whether the form can be used depends on the state the person passed away in, as each state has specific requirements that must be met in order to skip probate.

Small Estate Affidavits by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Small Estate Affidavit?

A small estate affidavit is a form used for circumventing probate, which is the process in which a will is officially distributed in a court of law. Due to being such a time-consuming process, heirs or distributees often elect for using an affidavit to collect the belongings of the family member that passed away.

Whether or not an affidavit is required to be notarized by an official Notary Public is dependent on the applicable state law. The process of notarization is used to prove the legality of an affiant’s signatures and confirms that the signer(s) had a full understanding of what they were signing, and why.

Common Terms

Affiant – The individual filing the affidavit. If an affiant is not specified in a will – the decedent’s spouse or children can often file.

Decedent – The family member that passed away, leaving their assets to be distributed.

Distributee / Heir / Successor – An individual authorized to collect a portion (or all) of the decedent’s personal property if a will was not left behind (intestate).

Estate – The net worth of a person. Includes land, assets, and other possessions an individual owned.

How to Use a Small Estate Affidavit

The Small Estate Affidavit can be a confusing form to use. Almost every state has considerably varying laws regarding the time that must pass (after the decedent has passed away) before signing, differing maximum estate values, and required conditions that specify when a small estate affidavit can and cannot be used. The general process for filing a small estate affidavit after the death of a family member is the following:

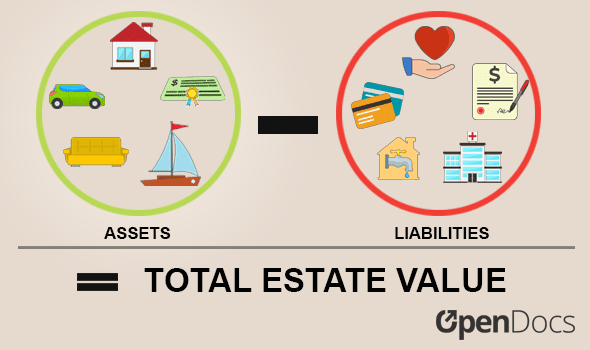

1. Calculate the Total Value of the Estate

To calculate the total monetary amount of an estate, start by adding up all the items that contribute positively towards the total assets. These include:

Intangible Personal Property

- Banks Accounts (checking, savings, etc.)

- Stocks, mutual funds, ETFs, etc.

- Retirement plans

- Percentage interests in businesses

Tangible Personal Property (anything that can be physically “touched”)

- Motor vehicles, boats, motorcycles, etc.

- Furniture & other homes items

- Paintings, collectibles, coins

Once all positively contributing assets have been identified and added together, begin subtracting all liabilities of the decedent (contribute negatively towards total assets). These include:

- Charitable deductions

- Credit card debt, medical bills, mortgages, loans, utilities, etc.

- Funeral expenses

- Attorney fees

Once the total assets have been calculated, completion of the correct state-specific form can begin (head to step 2).

2. Complete a Small Estate Affidavit Form

Select a state-specific small affidavit from the list above. Due to each state’s unique requirements, completing the form for the state the decedent passed away in is is highly recommended. Once the form has been completed, all family member(s) listed on the affidavit should be informed of the portion of the property they rightly inherited by mail.

3. Sign + Notarize the Affidavit

Depending on the state in which the affidavit is created, the form may need to be signed in the presence of two (2) witnesses and/or a Notary Public. Even if not required by the state, having the completed affidavit be notarized can not damage the legality of the affidavit in any way – it simply provides legal proof that the signature(s) recorded on the form were made willingly.

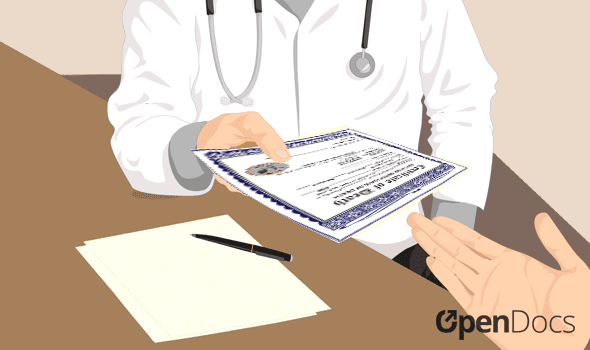

4. Obtain the Death Certificate

A death certificate is a government-issued document that states when an individual passed away, where they died, and their cause of death. It is used to legally prove the familial relationship of the distributees to the decedent in order to acquire rights to the property. If the decedent died with other possessions of significant value, such as a motor vehicle or boat, obtaining titles to said property should be done before submitting the affidavit.

5. File the Affidavit

With the signed affidavit in-hand along with the death certificate and any additional legal documents, the affidavit can be filed with the court. Once approved, the heirs will be given the authorization to collect the possessions of their deceased family member.

Small Estate Laws: By State

| STATE | MAX. ESTATE VALUE | MIN. ELAPSED TIME |

| Alabama (§ 43-2-692) | $25,000 | 30 days |

| Alaska (§ 43-2-692) | Vehicles – $100k; personal property – $50k | 30 days |

| Arizona (§ 14-3971) | Personal property – $75k; real property – $100k | 30 days (personal property); 6 months (real property) |

| Arkansas (§ 28-41-101) | $100,000 | 45 days |

| California (§ 13000 – 13210) | $150,000 | 40 days |

| Colorado (§ 15-12-1201) | $69k (if died in 2019) – $66k (if died in 2017-2018) | 10 days |

| Connecticut (§ 45a-273) | $40,000 | No min. time |

| Delaware (§ 2306) | $30,000 | 30 days |

| Florida (§§ 735.201 – 735.302) | $75,000 | Two (2) years (if over $75k) |

| Georgia (§ 7-1-239) | No max value. | 90 days |

| Hawaii (§ 560:3-1201) | $100,000 | No min. time |

| Idaho (§ 15-3-1201) | $100,000 | 45 days |

| Illinois (755 ILCS 5/9-8) | $100,000 | No min. time |

| Indiana (§ 29-1-8-1) | $50,000 | 45 days |

| Iowa (§§ 635.1 to 635.13) | $100,000 | No min. time |

| Kansas (§ 59-1507b) | $40,000 | No min. time |

| Kentucky (§ 391.030 & § 395.455) | $15,000 | No min. time |

| Louisiana (CCP 3421 to CCP 3434) | $125,000 | No min. time |

| Maine (18-A, Part 12) | $20,000 | 30 days |

| Maryland (§§ 5-601 to 5-608) | Spouses – $100k; non-spouses – $50k | No min. time |

| Massachusetts (MGL c. 190B, Section 3-1201) | $25,000 | 30 days |

| Michigan (§ 700.3982) | $15,000 | 28 days |

| Minnesota (§ 524.3-1201) | $75,000 | 30 days |

| Mississippi (§ 91-7-322) | $50,000 | 30 days |

| Missouri (§ 473.097) | $40,000 | 30 days |

| Montana (§§ 72-3-1101 to 72-3-1104) | $50,000 | 30 days |

| Nebraska (§§ 30-24,127 to 30-24,129) | $50,000 | 40 days |

| Nevada (NRS 146.080) | Spouses – $100k; non-spouses – $25k | 40 days |

| New Hampshire (§ 553:32) | $10,000 | No min. time |

| New Jersey (3B:10-3 & 3B:10-4) | Spouses – $20k; non-spouses – $10k | No min. time |

| New Mexico (§ 45-3-1201) | $50,000 | 30 days |

| New York (§§ 1301 to 1312) | $30,000 | No min. time |

| North Carolina (§§ 28A-25-1 to 28A-25-7) | Spouses – $30k; non-spouses – $20k | 30 days |

| North Dakota (Chapter 30.1-23) | $50,000 | 30 days |

| Ohio (§ 2113.03) | Spouses – $100k; non-spouses – $35k | No min. time |

| Oklahoma (OS 58 § 393 & OS 6 § 906) | $20,000 | 10 days |

| Oregon (§§ 114.505 to 114.535) | Real property – $200k; personal property – $75k | 30 days |

| Pennsylvania (20 § 3102) | $50,000 | 60 days |

| Rhode Island (§ 33-24-1) | $15,000 | 30 days |

| South Carolina (§ 62-3-1201) | $25,000 | 30 days |

| South Dakota (§ 29A-3-1201) | $50,000 | 30 days |

| Tennessee (§§ 30-4-101 to 30-4-105) | $50,000 | 45 days |

| Texas (§ 205.001) | $75,000 | 30 days |

| Utah (§§ 75-3-1201 to 75-3-1204) | $100,000 | 30 days |

| Vermont (14 V.S.A. § 1902) | $50,000 | No min. time |

| Virginia (§§ 64.2-600 to 64.2-605) | $50,000 | 60 days |

| Washington (RCW 11.62.010) | $100,000 | 40 days |

| West Virginia (§ 44-3A-5) | $100,000 | No min. time |

| Wisconsin (§ 867.03) | $50,000 | No min. time |

| Wyoming (§ 2-1-201) | $200,000 | 30 days |