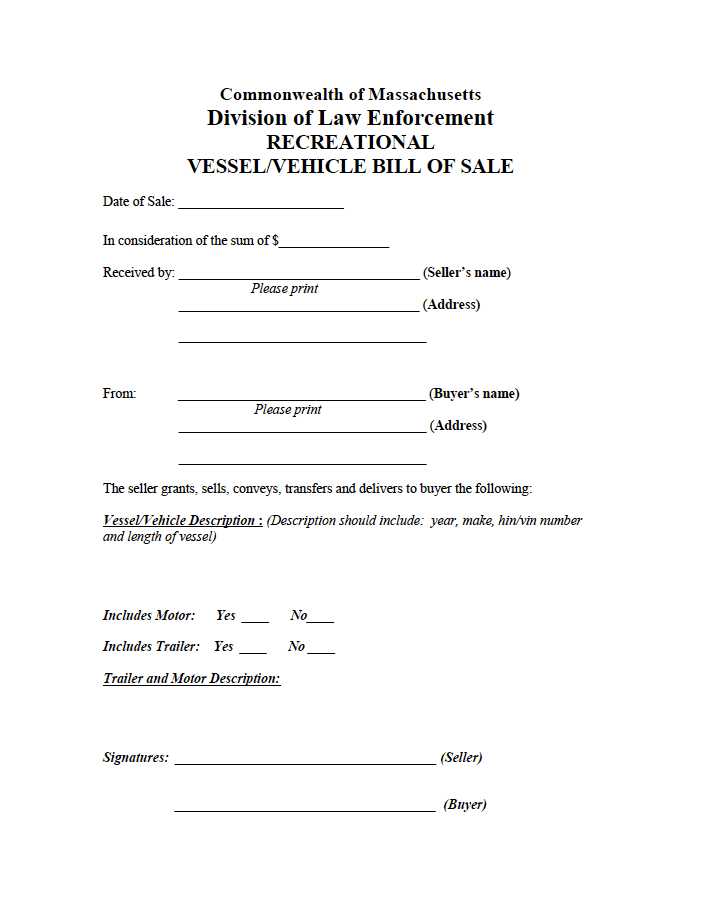

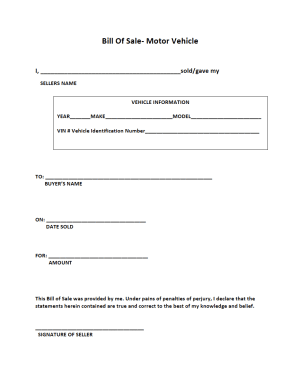

Massachusetts Motor Vehicle Bill of Sale Form

A Massachusetts motor vehicle bill of sale form promotes unity and transparency when making an automobile purchase. The state-provided document has dual purposes by acting as a receipt for boat and car sales. When used for vehicle transactions, it contains the purchase date, sales price, and the names of the buyer(s) and the seller(s). The bill of sale also describes the car’s year, make, and vehicle identification number (VIN). Each person authorizes the information in the document by signing their name in the appropriate section.

|

County Versions

Download: PDF

What is a Massachusetts Car Bill of Sale?

A Massachusetts car bill of sale stipulates the conditions of a motor vehicle transaction. It names the buyer and seller and describes the automobile. Both parties must adhere to the laws of the Commonwealth when carrying out the transfer. Generally, the document accompanies a title and/or registration. Titling documents prove ownership, whereas a bill of sales acts as a purchase receipt. All of the relevant forms must have an identical VIN and description. Otherwise, the state can turn away the paperwork.

What are the Buyer’s Tasks?

Buyers should follow the Registry of Motor Vehicles (RMV) checklist when purchasing a vehicle. It contains information about the forms necessary for a successful transaction.

Remain Cautious

Interested parties should not purchase a vehicle if the seller cannot provide a VIN or does not have a completed title on hand. The title must contain the purchase date, sales price, odometer reading, and the personal information of the buyer and seller (i.e., name, address, and signatures). The seller can also provide a bill of sale containing this information if they cannot offer a title. However, the current registration must accompany the bill of sale in this instance.

Buyers should make sure that the owner has not tampered with the odometer. Massachusetts law deems it illegal to turn back the mileage or adjust the reading. The purchaser can sue the seller if they can prove the individual changed the odometer reading.

“Curbstoning” is another trick sellers use to profit from vehicles. In this case, a person buys a car for a low price and “flips” it to obtain a higher amount. These automobiles often have a significant issue hidden by new paint or parts. Similarly, buyers should remain wary of vehicles from areas with frequent flooding or hurricanes as sellers can try the same tactic. To ensure safety, the purchaser should have a mechanic inspect the car before buying.

Take Action

Individuals must take action to prevent an unlawful sale from occurring. These steps include researching the seller and car and obtaining accurate information.

Research the dealer or private seller. If possible, look up the name of the seller or dealership before buying. The Better Business Bureau provides customer reviews for public viewing. In addition, residents can use the Attorney General’s Office’s online portal or telephone line (617-727-8400) to look up complaints.

Obtain a completed title. Ensure the seller completes and signs the title (or the “pink slip”) before handing over the money. The document must include a complete history of flooding and collisions. It also must explain if it was deemed a “total loss” or “salvage” following a wreck or damage.

Review the car’s history. Interested parties can use the VIN to research “Safety Issues & Recalls” on the National Highway Traffic Safety Administration (NHTSA) website. The state also offers a crash report, driving record, title history search, and personal information look-up on its website.

What are the Seller’s Tasks?

Sellers must follow state protocol when carrying out a vehicle transaction. They can only sell up to three (3) cars per calendar year. If they sell four (4) or more vehicles, the Commonwealth considers them a dealer and requires them to acquire a car dealer license from their local office.

Owners must provide the completed and signed title to the buyer. The state deems it illegal to provide incorrect information or fail to disclose known mechanical issues. Sellers must also submit documentation on the vehicle, including its maintenance records, ownership history, and other relevant details.

What is a Massachusetts “Lemon Law”?

A Massachusetts “Lemon Law” protects buyers from making faulty purchases. For example, if a resident purchases a vehicle from a private seller who did not notify them of apparent defects, they could be eligible for compensation. The buyer has up to thirty (30) days to prove the seller knew of the issues before exchanging ownership. Upon submitting proof, the original owner must give them back their money and retake possession of the car.

If the seller does not refund the amount, the buyer can take legal steps to get their cash back. They have multiple options depending on whether they want to get an attorney involved. Essentially, the buyer can engage in a simple mediation (without an attorney) or decide to sue the seller in court. The person who purchased the car must send the title to the seller by certified mail if they do not accept it in person. Buyers cannot get their sales tax reimbursement on the car, although they can receive a refund on the registration charge.

Transferees can prove the merchant knew about the issue before selling by retrieving previous service records. They can use the endorsed title and/or bill of sale to access these files. Furthermore, the individual can have the vehicle inspected at a licensed station. If the car fails within seven (7) days of the sale and the cost to fix it is more than 10% of the selling price, then the buyer can also request a refund.

Individuals should report criminal or suspicious activity to the city or town police department or licensing authority.

How to Register a Car in Massachusetts (5 Steps)

Massachusetts does not have a grace period for titling and registration. Therefore, owners must obtain documentation immediately after making a car purchase. The state only grants residents a seven (7) day waiting period if they transfer documentation from a sold vehicle to a newly purchased one.

Step 1 – Insurance

It is illegal to drive an uninsured vehicle in Massachusetts. Therefore, residents must have an active policy before registering and titling their cars. They must adhere to the state’s minimum requirements when creating a plan.

Drivers must have coverage of $20,000 per person and $40,000 per accident, respectively, for bodily injury to others and bodily injury caused by an uninsured motorist. The policy also needs to include $8,000 for personal injury protection (per person, per accident) and $5,000 for damage to another person’s property.

Step 2 – Inspection

Massachusetts requires annual emissions testing and safety inspections on all vehicles. Owners of newly purchased cars must have them inspected within seven (7) days of registration.

Residents can find a qualified technician through the Inspection Station Locator. They must bring payment ($35) and identification (ID) to the appointment.

If the vehicle passes, it receives an inspection sticker. It lasts for one (1) year and expires on the final day of the month listed on the decal. Cars that fail get a “reject” sticker, which indicates they must have their automobile fixed and re-inspected. The state cannot register or title a vehicle that did not pass the emissions testing or safety inspection.

Step 3 – Excise Tax

Massachusetts residents must pay an annual excise tax on their vehicles. The RMV creates the bill; however, the car owner must pay the city or town where the vehicle resides within thirty (30) days of the issuance date. They must pay the tax, even if they did not receive a document for it.

The state imposes interest and penalties on late tax payments. Outstanding excise tax bills prevent owners from registering their vehicle, renewing their driver’s license, or handling RMV-specific tasks.

Individuals must notify the RMV and local tax assessor about address changes as soon as possible. They must cancel their plate and vehicle registration to avoid unwarranted excise tax bills if they move out of the state. The same policy applies to lost, stolen, and repossessed vehicles, and cars declared a total loss.

Step 4 – Register + Title

Each vehicle operated on Massachusetts roadways needs registering and titling. Drivers must make an appointment using the reservation system.

All transactions differ by type; therefore, the list below contains the documents needed for specific transfers. The forms cannot have whited-out areas, erasures, or changes upon submission. Owners must print the application on standard white printer paper because the state does not accept applications on colored paper or card stock. Individuals who fail to abide by these laws are subject to rejection, thus resulting in paperwork delays.

If the registration and title go through, the owner receives a registration certificate, new license plates, and an expiration decal for their rear plate. Unless a lien exists, the title comes by mail in six (6) to eight (8) weeks. In this case, the state mails the title to the lienholder.

- In-State Dealership Purchase

- Private Sale

- Transfer by Gift

- Transfer by Family Member

- Inheritance

- Transfer from Out-of-State

In-State-Dealership-Purchase

In most cases, Massachusetts dealers handle registration and titling for the customer. If the dealership does not manage these transactions, the new owner becomes responsible for bringing the required forms to their nearby service center.

Before the appointment, the person possessing the car must complete and sign the application (Form TTLREG100_1119) with the dealer. Then, they must visit a licensed Massachusetts insurance agent to take out an insurance policy for the car. To acknowledge the plan, the agent must stamp and sign the application. The owner must bring the signed and stamped application to the service center, where they accept or deny it. Information about the lienholder must also exist in the appropriate section of the form.

In addition to bringing the application, the owner must submit proof of ownership and an accepted form of (ID). They must also pay for the registration and titling fees and a 6.25% charge for sales taxes.

Private Sale

New owners must register and title their vehicle independently, meaning the seller does not have a legal obligation to attend the appointment or handle tasks for the buyer.

The registrar must provide the completed application (Form TTLREG100_1119) with a stamp and seal from their insurance agent. This document must also contain accurate lienholder information if they have an active loan on the vehicle.

Buyers must also bring the certificate of title signed by the seller. If a title does not exist, it does not contain the required information, or the state deems the car exempt because of its age, the individual must present the current registration and a bill of sale instead. In this case, the bill of sale must contain the sales price and the printed names and signatures of the buyer and seller.

The applicant must show their ID and pay the required processing fees during registration and titling. They also owe a sales tax. The state takes the higher of the following two calculations: 1) 6.25% of the purchase price, or 2) the car’s National Automobile Dealers Association (NADA) trade-in value.

Transfer by Gift

Owners who obtained a vehicle as a gift must pay a $25 charge and the title and registration fees. Vehicles that qualify as tax-exempt require the previous owner to complete an affidavit (Form MVU-24). If the recipient received the car as a gift from a family member, the individual must complete another affidavit (Form MVU-26) instead.

The person who acquired the car must register and title it by making an appointment with a service center. They must bring the application after completing and signing it with the previous owner. It must also have a stamp from the associated insurance company. The state also requires the title assigned to the new owner unless it qualifies as exempt due to age. In this case, they must provide the completed registration and bill of sale.

Individuals must settle their payment with the state to receive documentation. If they do not have the finalized tax exemption form from the previous owner, they must also pay taxes on the car.

Transfer by Family Member

If an individual transfers their vehicle to a family member, the new owner does not need to pay sales tax. Fathers, mothers, brothers, sisters, husbands, wives, sons, and daughters qualify as “family members.” Grandparents, cousins, aunts, and uncles do not fit this category. The person who transferred the vehicle must apply for tax exemption using an affidavit (Form MVU-26).

Inheritance

Three (3) people can legally transfer a deceased vehicle owner’s title, including the surviving spouse, the personal agent of their estate, and a court-appointed representative.

The surviving spouse only qualifies if they were married to the deceased individual upon their death. This ability does not apply to loved ones living with the person or ex-spouses. To transfer the title and registration into their name, they must bring an application (Form TTLREG100_1119), the decedent’s title assigned by the spouse, an affidavit (Form TTL 103-0421), and a copy of the death certificate that includes the name of the spouse.

The personal agent must transfer ownership of the vehicle to the individual listed on the deceased person’s will. They must provide them with a copy of the appointment of a personal representative and the decedent’s certificate of title.

Deceased individuals who did not create a will must have a court-appointed representative take care of the transfer. The representative must give the inheritor a copy of the appointment and the decedent’s title.

Transfer From Out-Of-State

Car owners moving to Massachusetts from another state must immediately transfer their title and registration. They need to provide the service center with an application, proof of their insurance, verification of ownership (i.e., the previous title or the registration with a lien), and payment. In addition, they must complete an affidavit (Form MVU-29) stating they purchased the car in another state and, therefore, do not need to pay Massachusetts taxes.

Step 5 – Renew

The license plate type determines the registration length, with the standard being one (1) or two (2) years. Individuals can renew in person and receive their documentation immediately. They can also send the paperwork online or by mail to obtain their registration and plate decals within ten (10) days.

Upon renewal, the applicant must make the required payment and have an active insurance policy. To verify the plan, they must have the insurance agent stamp their completed and signed renewal document (Form TTLREG100_1119).

Owners who have a suspended or revoked registration cannot renew. Similarly, the state rejects the application if they have unpaid parking tickets and excises taxes or EZ-pass violations. Individuals can check for penalties using the online check status portal.

| Mailing Address: |

| Registry of Motor Vehicles Attention: Mail-In Registration Department P.O. Box 55891 Boston, MA 02205-5891 |