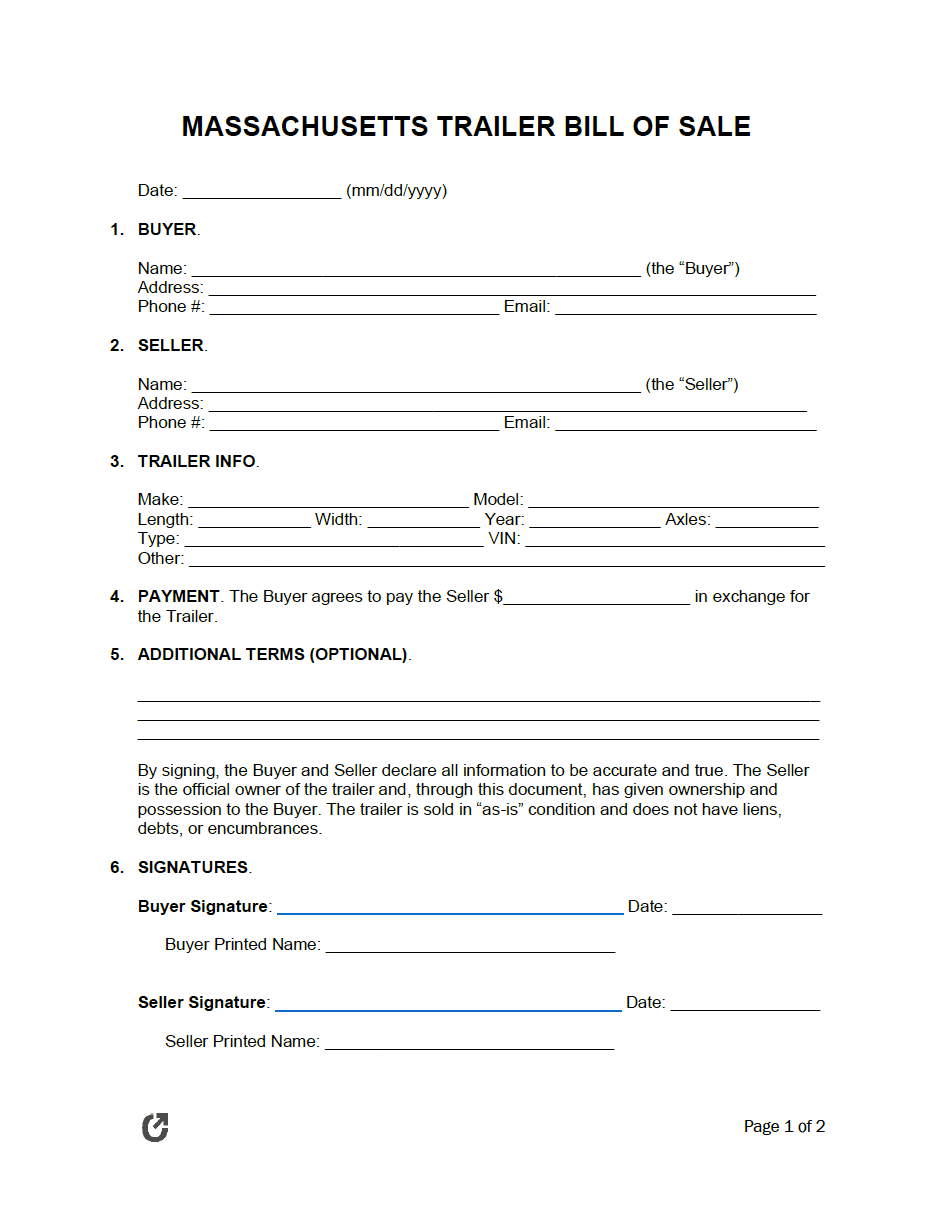

Massachusetts Trailer Bill of Sale Form

A Massachusetts trailer bill of sale form personifies agreeableness between two (2) parties while determining how to conduct a transaction. The owner of the cargo-carrying platform and the interested person discuss the logistics, such as the selling price and payment method. Once they mutually decide on these factors, they use the bill of sale to put the deal in writing. The document goes on to provide each person with verification of the transfer. By signing, the seller verifies that they have informed the buyer of known issues and did not intentionally withhold information about the trailer.

|

What is a Massachusetts Trailer Bill of Sale?

A Massachusetts trailer bill of sale offers interested parties information about the deal between a buyer and seller. It organizes the details so that a person reading it can clearly understand the terms of the transaction. Either individual can use the document to prove their ownership (or lack thereof) if anyone questions it. Since it holds importance after the sale, the buyer and seller should hold onto a copy to ensure they can provide it if necessary. The form only has significance if the parties involved sign it.

How to Register a Trailer (4 Steps)

Massachusetts does not have a grace period for trailer registrations. Established and incoming residents must obtain documentation immediately after purchasing the trailer or moving to the state.

However, Massachusetts has a transfer law. This regulation gives individuals seven (7) days to transfer their registration from a previously owned trailer to a newly purchased one. To qualify, the individual must be eighteen (18) years or older and have the transfer documents with the valid registration number. They must have sold or otherwise disposed of the former trailer and transferred the registration plates to the new one. Lastly, the two (2) trailers must have the same type and number of wheels.

Trailers in Massachusetts require a valid registration. It must also have functional components, including two (2) taillights, fenders, stop lights, safety chains, and directional signals. Otherwise, the state can reject the registration application, thereby causing delays. The Registry of Motor Vehicles (RMV) handles trailer documentation.

Step 1 – Taxes

Massachusetts residents must pay sales and excise taxes on their trailers unless the state deems them exempt. Each jurisdiction has specific laws relating to taxes; therefore, the individual must ensure they follow each step accordingly. Otherwise, they can face penalties and interest charges.

Excise Tax

Owners must pay annual excise taxes to the municipality where the trailer resides the most each year. The county tax assessor determines the amount by charging $25 per $1,000 of the vehicle’s value. At a minimum, the resident must pay $5, regardless of the assessment.

Tax assessors determine the car’s value by taking a percentage of the manufacturer’s suggested price (Chapter 60A § 1). The rate decreases with each year of ownership. For example, during the manufacturing year, the owner must pay 90% of the manufacturer’s listing price. However, in the fifth year, the county only charges 10% of the vehicle’s value.

Residents have thirty (30) days from the issuance date to pay their taxes unless they qualify as exempt. In this case, they would need to complete a short- or long-form and submit it to their county tax assessor.

Sales & Use Tax

The state assesses a 6.25% tax on the trailer’s purchase price. Customers generally pay the tax and other fees when buying through a dealer. However, private sales require the owner to pay sales and use taxes to the Department of Revenue before registering.

Individuals must pay the tax by the 20th of the month following the sale. For example, if they obtained the trailer on May 22nd, they must pay their taxes before June 20th.

The following list provides scenarios where the state exempts individuals from registration. If the person qualifies, they must complete the required form accordingly. It must contain signatures as needed.

Affidavits for Exemption of Sales or Use Tax for a Motor Vehicle Transferred by:

- Insurer (MVU-23)

- Gift (MVU-24)

- Business Entity (MVU-25)

- Family (MVU-26)

- Intestacy, Will, or Otherwise (MVU-27)

- Purchased Outside of Massachusetts (MVU-29)

- Repossession (MVU-30)

- Disabled Person (MVU-33)

Step 2 – Title

Trailers only require a title in Massachusetts if the owner uses it commercially and the bed weighs over 3,000 pounds. The owner must have someone inspect their trailer and assign a vehicle identification number (VIN). Individuals can reference the RMV-provided flow chart (Form VSC115_0521) to determine requirements.

If the trailer needs a title, the owner must obtain it within ten (10) days of making the purchase. When applying for a title, the state requires the following information:

- Registration and Title Application. The person applying for the title must complete sections A through D, and I through M. Parts E through H are optional. These sections could need completing if the owner leases or garages the trailer, has a lien, or a business owner possesses it.

- Proof of Ownership. Owners can prove they legally acquired the trailer by submitting 1) the previous title signed by the seller to the buyer or 2) the registration and bill of sale. If the individual purchased a new trailer, they could also provide the certificate of origin or dealer reassignment form. Regardless of the transfer document, it must contain the purchaser’s and merchant’s signatures.

- Payment. Individuals cannot title their trailer until they have paid sales taxes on the trailer. If exempt, they must provide the required paperwork with signatures as needed.

Step 3 – Registration

The Registry of Motor Vehicles (RMV) regulates the registration process according to the owner’s specific situation. Sometimes, the person transfers their registration from a previous trailer to a new one. Other times, they obtain a first-time registration after buying from a dealer or private seller. Therefore, individuals must follow the specific instructions for registering their trailer per state law.

Under all circumstances, the transfer document must contain the purchase date, sales price, and the printed names and signatures of the dealer or previous owner and new owner. This document is the manufacturer’s certificate of origin (MCO) or title during dealership and private sales. Title-less vehicles require the owner to hand in a bill of sale with the listed information and signatures instead.

The required ownership documents depend on the transaction type. Individuals transferring registration from a dealer (or obtaining a new registration) must provide the MCO, bill of sale, and/or dealer reassignment form. Both dealership and private sales require the previous owner’s title. If the trailer does not have a title, they must provide the former registration and bill of sale instead.

| Bring the Following: |

Step 4 – Renew

Trailer registrations last for one (1) calendar year and, therefore, require an annual renewal. Owners can submit documentation online, by mail, or in-person as long as they do not have violations. For example, they cannot have a suspended or revoked registration. In addition, they must settle all parking tickets, excise taxes, and EZ pass violations before renewal. The state provides residents with an online checker to ensure their good standing with the RMV, Department of Revenue (DOR), and county tax assessors.

When renewing online, the trailer owner needs their driver’s license number, the last four (4) digits of their social security number, email address, and digital payment (i.e., a credit or debit card). Mail renewals require the completed renewal form and a check or money order made to the MassDOT.

| Mailing Address: |

| Registry of Motor Vehicles Attention: Mail-In Registration Department PO Box 55891 Boston, MA 03305-5891 |