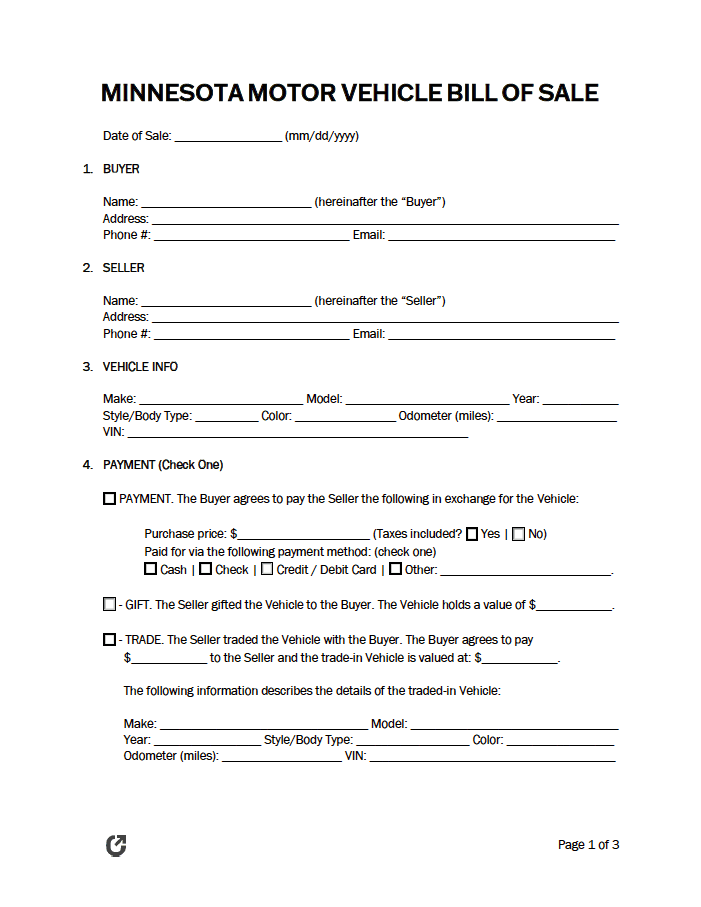

Minnesota Motor Vehicle Bill of Sale Form

A Minnesota motor vehicle bill of sale form allows buyers and sellers to record the complexities of a car transfer. The document has a structured format for inputting information about the automobile, such as its condition and primary identifiers. It also includes space for buyers and sellers to enter their personal details. While the form is not required for titling and registration, it holds significance by verifying the ownership change.

|

What is a Minnesota Car Bill of Sale?

A Minnesota car bill of sale highlights the essential details of a vehicle transaction. The buyer and seller complete the form after negotiating the deal’s terms. Once each person signs, they exchange the property and funds (if applicable). Sales that occur by trade require the buyer to hand over a vehicle with an equivalent value. In this case, the bill of sale must include information about both automobiles, such as their selling price, vehicle identification number (VIN), make, and model.

What are the Buyer’s Tasks?

Buyers should use caution when purchasing vehicles through private vendors. Sellers can scam individuals into buying unreliable cars. Dealerships, however, must follow a standard protocol to ensure the automobile does not need additional repairs. They also offer warranties, which further protect the person acquiring the vehicle.

Before purchasing, the potential buyer should check the vehicle’s history. They can request a report from the dealer or the National Motor Vehicle Title Information System (NMVTIS) online system. The person pulling the data sheet should not buy the car if they notice red flags, such as flood damage, previous accidents, or other suspicious information.

A vehicle should only change owners if the buyer and seller correctly fill out the certificate of title. Neither party can prove the transaction happened without the title, thus making it essential. It only holds value if it contains the birthday, signature, and address of the buyer(s).

In addition, it should contain the full names of the previous and new owners and the correct vehicle identification number (VIN). If lienholders exist, their name must appear on the front of the title, and a signed lien release card or notarized lien release form must accompany it.

What are the Seller’s Tasks?

Sellers must ensure they have the appropriate documents ready before listing their vehicle. They must apply for a new record before selling if they lost or destroyed the current title. Cars that have never had a title require the owner to present their Minnesota registration card or an application for registration (Form PS2000). They can also use a bill of sale that contains the purchase date, buyer’s name, and a description of the sold vehicle.

The registration card does not serve as ownership verification if the car came from a foreign state, even if that state does not issue titles. Sellers must 1) handprint and sign their name in the indicated section of the document, 2) list the purchase price under the “sales tax declaration” portion on the back of the title, 3) enter the sale date, and 4) complete disclosure statements as needed. For example, the seller might complete an odometer or damage disclosure statement.

Per state law, merchants must report the sale to the DVS. This process can happen online or by mailing the “The Recorded Owner(s) Record of Sale” stub to the office. The seller can find the stub on the title and must detach it following the transaction.

How to Register a Car in Minnesota (4 Steps)

Established residents have ten (10) days after the sale to transfer ownership on the certificate of title. Incoming residents must obtain an in-state vehicle registration within sixty (60) days of their move-in date. Individuals must apply through their nearest deputy registrar’s office, which they can find by visiting dvs.dps.mn.gov or calling (651) 297-2005.

Minnesota does not require car inspections except in the case of commercial vehicles. Leased automobiles require a duplicate of the leasing agreement or a power of attorney between the company and lessee and their identification (ID) number.

Step 1 – Insurance

Minnesota residents must have a car insurance policy that qualifies under the “No Fault Act” (§ 65B.48). This plan means that the owner has the following minimum coverage: 1) $30,000 for the bodily injury of one (1) person per accident, 2) $60,000 for the bodily injury of two (2) or more people per accident, and 3) $10,000 for property damage (§ 65B.49(3)(1)). Proof of the plan must always remain in the vehicle (§ 169.791).

Step 2 – Title

Owners who acquire their car through a private sale must title it at the deputy registrar’s office. If they purchased the vehicle through a dealership, the dealer typically handles the paperwork for registration and titling.

The car owner and lien holder (or lender) often sign a security interest. This contract uses the vehicle as collateral, meaning the owner must forfeit it if they cannot make their payments.

The DVS sends the title to the car owner and a lien card to the lender, verifying the information in their system. It also contains a permanent mark for cars identified as flooded, prior salvage, reconstructed, rebuilt, or vehicles with lemon law concerns.

Established Residents

Individuals living in Minnesota have ten (10) days to transfer the title of a newly purchased vehicle. They must present the appropriate paperwork and the required fees to the deputy registrar’s office, which includes general titling charges and a 6.5% tax or $10 In-Lieu tax.

New Residents

Out-of-state vehicle owners moving to Minnesota have sixty (60) days to provide documentation to the state. However, if the individual’s registration expires before this grace period, they must obtain new tags immediately.

The deputy registrar’s office requires the following to apply for a title: 1) proof of vehicle ownership (current title or registration card), 2) an application (Form PS2000), 3) identification, 4) leasing or power of attorney agreement (if applicable), 5) motor vehicle and tax fees, and 6) proof of insurance.

No Ownership Verification

The DVS considers an incoming resident unable to verify ownership if they do not have a foreign title and their online system does not have a record of the car. Foreign registrations do not serve as evidence either. Instead, the individual must present the following forms:

- Application (Form PS2000);

- Bill of Sale with the car’s year, make, and vehicle identification number (VIN), purchase date, and buyer’s name (OR complete section C of application);

- Titling, registration, and sales tax fees;

- Statement of Facts (Form PS2002) completed and signed by the seller with the vehicle’s history, year, make, model, VIN, an explanation of how they acquired the car, and why the documentation does not exist;

- Statement of Protection signed by the buyer with the following script: “I agree to defend and protect the State of Minnesota against any future claims of ownership which may arise after I am issued a Minnesota title and registration card.”;

- Photographs of all sides of the vehicle and its VIN. The owner can also provide a precise, legible tracing of the VIN in place of a picture. The state prefers scanned, digital color images instead of physical copies.

Vehicles Without Title

All vehicles in Minnesota require a title. The owner can present a Minnesota registration card to prove ownership if the car has never had an in-state title. However, if the person owned the vehicle out of the state, they must present a foreign title. They cannot provide an out-of-state registration as it does not qualify as ownership verification. If the owner loses the title, the vehicle owner listed in the DVS records must apply for a duplicate.

Minnesota vehicles do not need a title if they are:

- Owned by US government (unless registered in-state);

- Used by the manufacturer for testing only;

- Owned by a non-resident and not required by law to have Minnesota registration;

- Regularly used to transport people or property with title from another state;

- Moved solely by animal power;

- Considered tools or equipment for farming;

- Special mobile equipment; and/or

- Wheelchair or tricycle manually powered.

Step 3 – Registration

When registering a vehicle in Minnesota, owners must pay a 6.5% tax fee. Cars ten (10) years or older with a purchase price (or value) under $3,000 qualify for a tax exemption. Instead of paying 6.5% in taxes, the registrar must pay a flat-rate fee of $10.

The owner must determine the fair market value of the vehicle. Websites like Edmunds, Kelley Blue Book Price Guide, and NADA Guides provide accurate estimates to users. Individuals can also calculate the purchase price by assessing the car’s year, make, style (2WD, 4WD, or convertible), model (standard, deluxe, or master), motor (V8, V6, or hemi), and condition (running status, missing parts, body, engine, and interior).

The following groups qualify as exempt, meaning they do not have to pay taxes on their automobile: giftees (spouses, parents, children, grandparents, and grandchildren only), situations where no monetary consideration occurs, divorced individuals, beneficiaries, joint ownership transferees, companies, non-profit groups, disabled veterans, government employees, instructional aid teachers (i.e., private, non-profit, or public-school use), and/or road maintenance vehicles.

Bring the Following:

|

Step 4 – Renew

Minnesota vehicle tabs expire yearly. Residents with standard passenger class vehicles can renew online. The state also offers mail and in-person submissions.

Mail renewals require the owner to fill out the notice and provide permanent address changes. They must send the document along with a check or money order to “DVS Renewal.” It takes ten (10) days for the office to process the request. The official mailing address is:

DVS Renewal

PO Box 64587

Saint Paul, MN 55164-0587

Individuals with a legal name change can only renew at deputy registrar offices. In this case, the person of interest must provide their certified marriage certificate, certified divorce papers, the dissolution of marriage decree, or court order. They must also apply for a new driver’s license within thirty (30) days of making a legal change to their name or address.

| Mailing Address: |

| Driver and Vehicle Services – Central Office Town Square Building 445 Minnesota Street, Suite 187 Saint Paul, MN 55101-5160 |