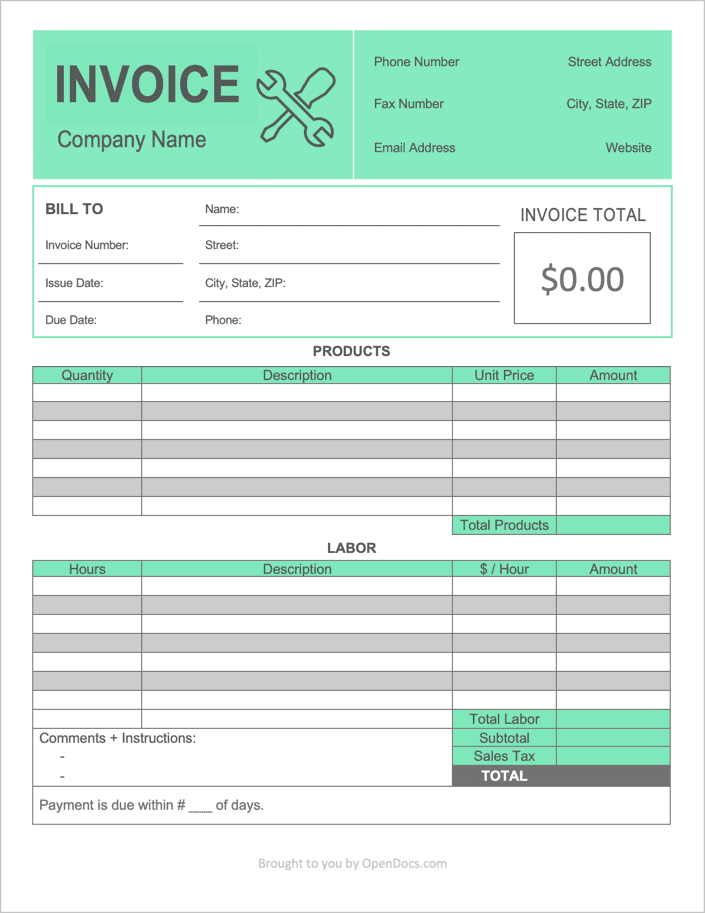

Contractor Invoice Template

The Contractor Invoice Template is a document used by those that work on construction sites to bill their clients for the hours that it took to complete the project as well as the cost of all products and materials used during the job. The four (4) invoice formats below, offered in PDF, Word, RTF, and Excel, were designed to combat that issue, allowing for simpler and more organized filing at the benefit of both the customer and contractor.

How to Write in PDF and Word

Step 1 – Download

Download the template in Adobe PDF or Microsoft Word (.docx).

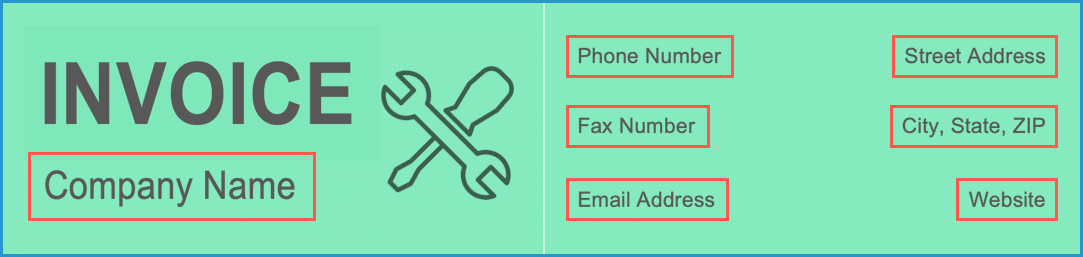

Step 2 – Company Info

Enter the name of the contracting company in the upper left-hand corner of the form, followed by the contact details of the contractor. If a field doesn’t apply, leave it blank.

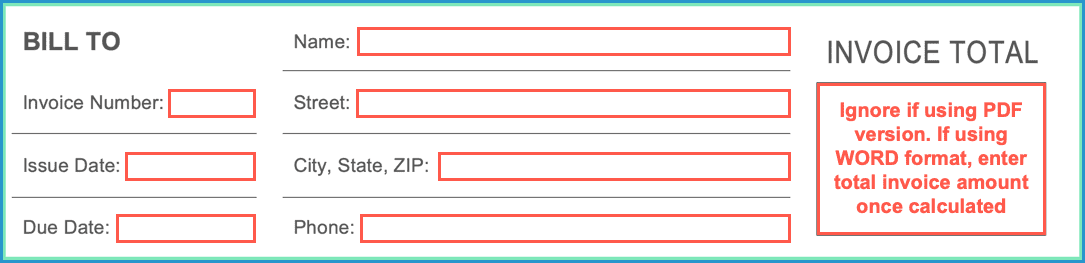

Step 3 – Client Contact Information

Recording the customer’s contact information is very important to provide that the contractor can contact them in the future for whatever reason. Additionally, assigning a unique invoice number to the job is suggested to easily organize invoices. Although invoice numbers can be any unique string of numbers, creating them sequentially is the most-preferred method.

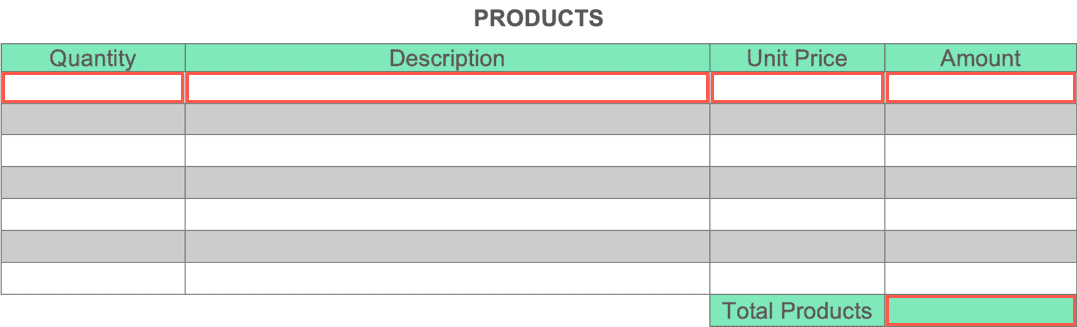

Step 4 – Products / Materials / Parts

Enter the products and/or materials that were purchased during the job. In the table, enter the following:

- Quantity – the number of items

- Description – a few words describing the type of product, part, or material purchased

- Unit Cost – the price of a single item

- Amount – the total cost of each product type (quantity x unit price)

Sum the value(s) in the amount column (far right side) and enter the resulting value into the “Total Products” field.

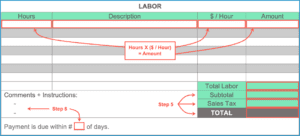

Step 5 – Labor Costs + Totals + Comments

Similar to step 4, enter the labor charges that will be added to the total invoice.

After summing the “Amount” column and adding the value to the “Total Products” field, add both the “Total Products” and the “Total Labor” values to calculate the “Subtotal”. Add on any sales tax to the subtotal and enter the value that results into the “Total” field.

Be sure to state the number of days the client has to pay the invoice in full. Directly to the right of the days, the date the invoice was (or will be) given to the client should be written so the client knows when the due date is.