Florida Limited Power of Attorney Form

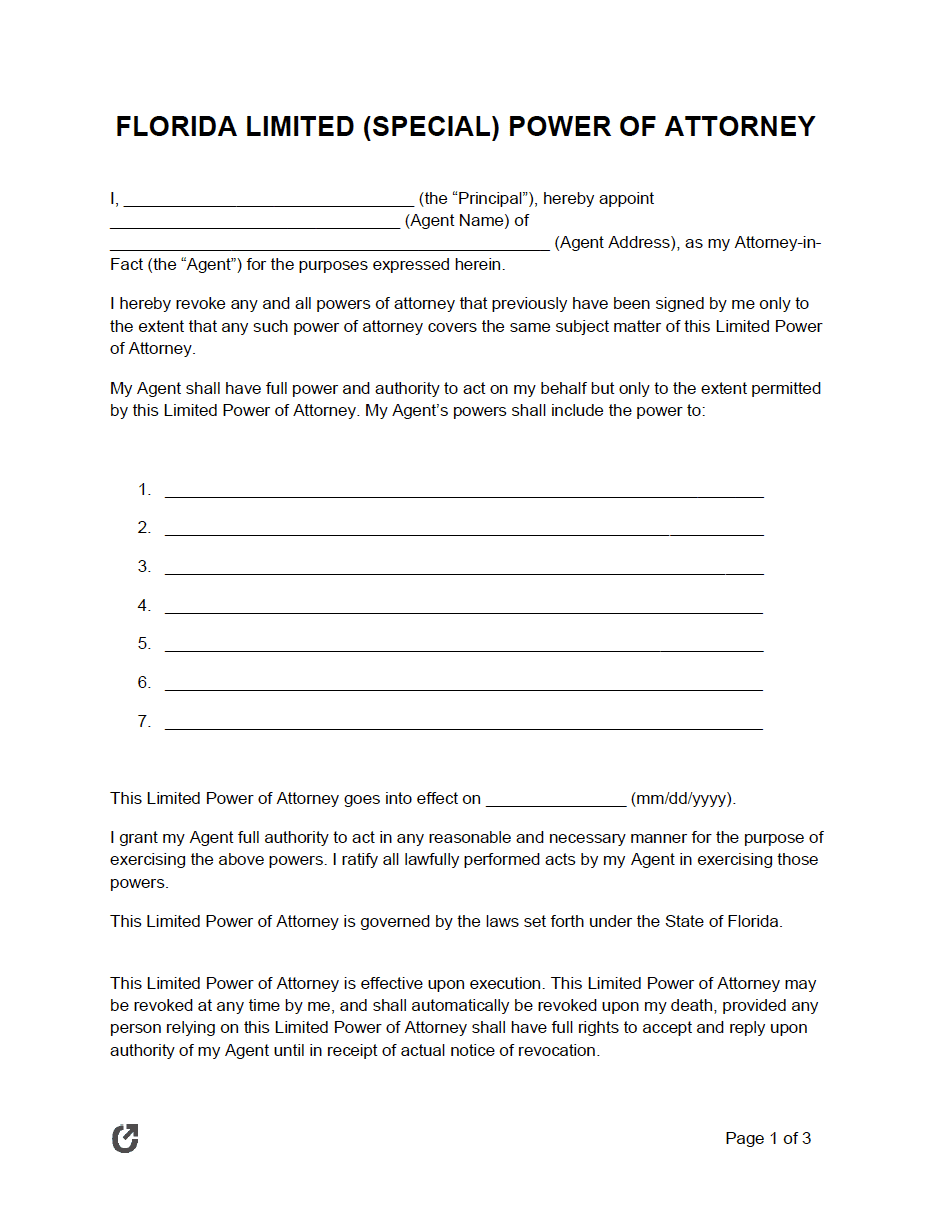

A Florida limited power of attorney is a document completed by a principal to give an agent the ability to act in their place. The agent must follow the instructions as listed by the principal.

The principal does not have limitations on the tasks they can assign. However, the individual must understand the document takes away their power and legally gives it to another person. The agent’s actions could impact the principal financially, physically, or emotionally, especially if the person makes irresponsible choices.

When completing the form, the principal must consider the length of the task and its complexity. They must use straightforward language to describe the needed responsibilities and discuss the agent’s role with them before signing. Typical duties include tax filing, paperwork signing, and selling or buying personal property.

Signing Requirements (§ 709.2105(2)): The principal must sign in front of a notary public and two (2) witnesses.