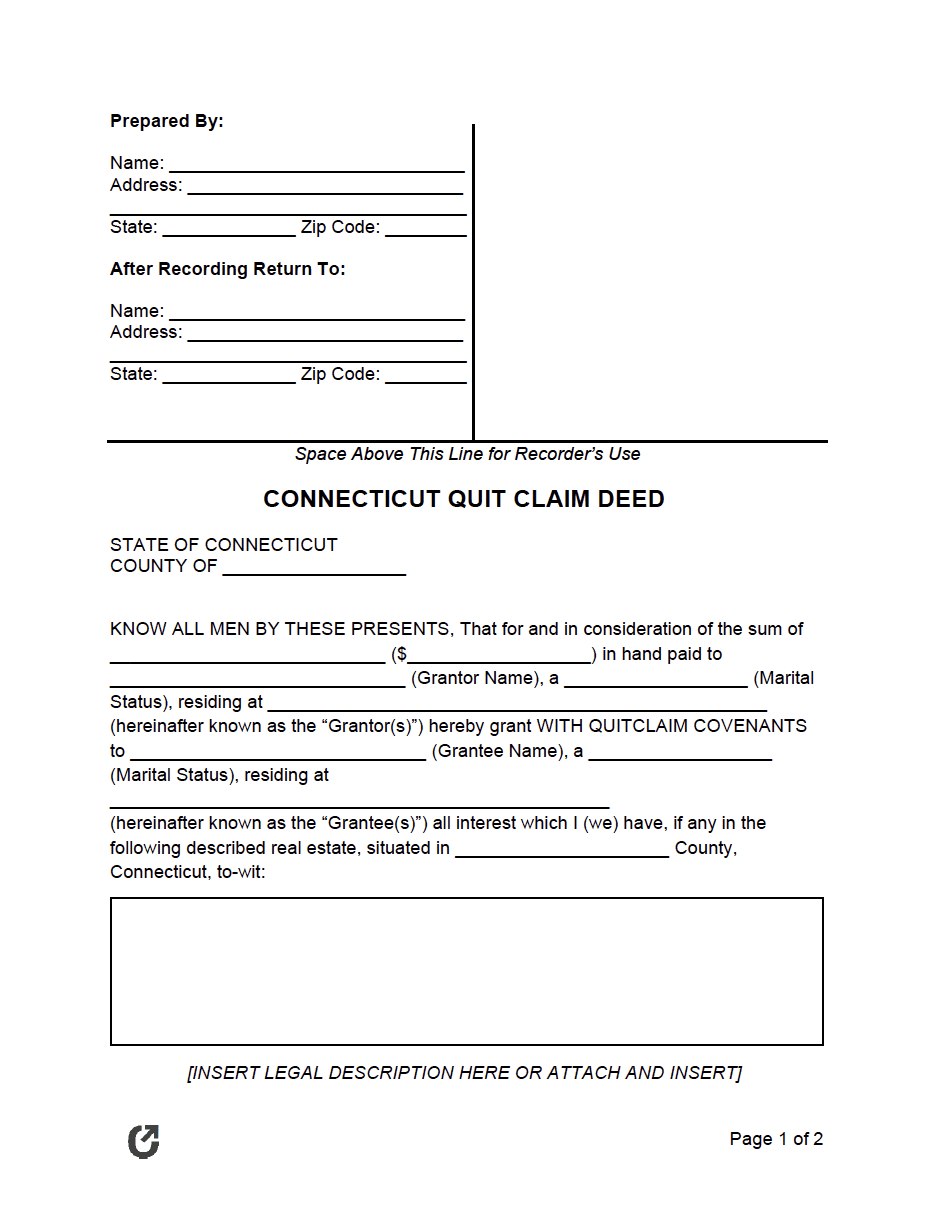

Connecticut Quit Claim Deed Form

A Connecticut quit claim deed is a conveyance document that relinquishes one’s ownership interest in real property. The deed type offers no promises as to the quality of the title or that the owner (grantor) is even the rightful owner themselves. Because of this inherit risk, quit claim deeds are best suited for transactions among those that have a personal relationship, such as children, a spouse (or former spouse), or close friend.

Before (or after) signing and recording the deed, the grantee can conduct a title search to confirm the real estate is free of any title clouds. The form is commonly used during the divorce process. The spouse that “gives up” the property would complete the deed to release any ownership they previously had.

Laws

|

How to Fill (Complete)

Step 1 – Download

Save the deed in either PDF or Word (.docx) format.

Step 2 – Prepared By / Return To

The “prepared by” fields are for establishing the name and address of the person that filled-in the deed. This is most likely the grantor, although some choose to have an attorney or other professional complete all information.

The “return to” fields are for naming the person the deed should be sent to after recording takes place. This should be the grantee’s full name and mailing address.

Step 3 – Conveyance

The following information will need to be inputted regarding payment and the parties:

- The amount the property sold for (if a gift, enter a value such as “$1”). The value will need to be written in words, followed by the numerical value. Example: “Three-hundred thousand dollars” ($300,000)”;

- The full name(s) of the grantors, their marital status, and the mailing address of their residence; and

- The full name(s) of the grantees, their marital status, and the address they are currently residing.

Step 4 – The Property

After “situated in”, enter the name of the Connecticut-specific county that the property is located in, followed by the full legal description of the real estate. If exceptionally long, the description can be attached as an addendum.

Step 5 – Signing

Connecticut law requires the grantor(s) to sign their name in view of a notary public and two (2) witnesses. The grantee(s) do not need to sign. A notary public will not notarize a form that already has signatures, so it is imperative the grantor(s) wait to sign until directed to do so by the notary.