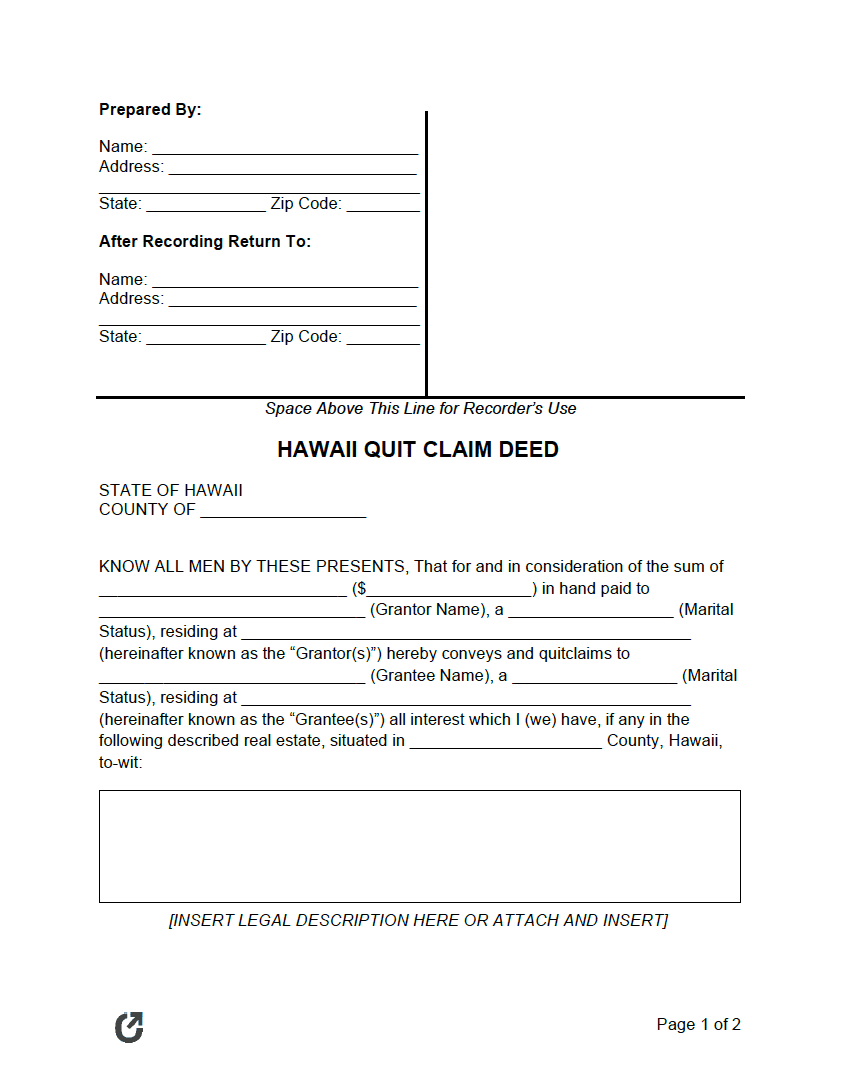

Hawaii Quit Claim Deed Form

A Hawaii quit claim deed is a form used to document the transfer of one’s ownership in real estate to another. The individual doing the transferring is known as the “grantor”, and the recipient the “grantee”. If the property is owned by two (2) people, such as a husband and wife, both of their information will be required.

Unlike warranty deeds, no guarantees are given to the grantee regarding the title’s condition. The grantee must trust the grantor in that they are the true and rightful owner, and that the property won’t come with existing mortgages, liens, filing errors, easements, or other issues. Due to the importance of trust, it’s wise the form be used for interpersonal relationships, such as a transfer to a child or other family member. Alternatively, the form is useful for resolving title defects or during divorce proceeding to transfer a spouse’s ownership to the spouse that will be keeping the home.

If the grantee is worried about the title’s condition, they can have a title search conducted. This process involves digging into the history of the property to ensure there are no hidden owners or title issues that even the grantor may have not known about.

Laws

|