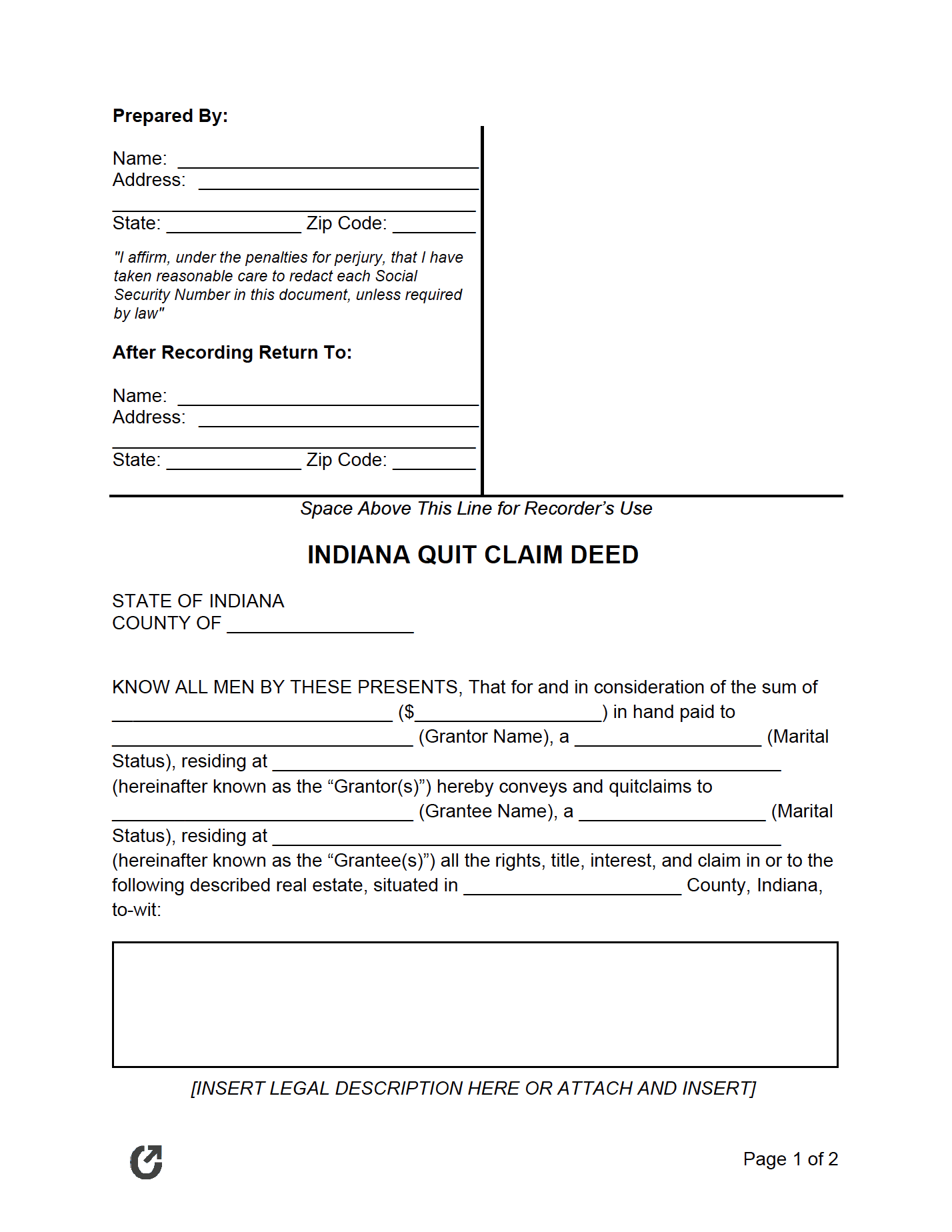

Indiana Quit Claim Deed

An Indiana quit claim deed permits the lawful release of property ownership from one person to another. The person who transfers their interest in property is called the “grantor”, and the receiving party is referred to as the “grantee”.

When compared to general and special warranty deeds, there are several advantages, which include:

- Faster and easier to complete,

- Requires less investigative work (no title search required), and

- Better for situations where the parties trust each other.

Instances in which a quit claim deed is commonly used includes a parent gifting their child their property or a divorcee relinquishing their ownership in property to their former ex spouse.

Laws

|