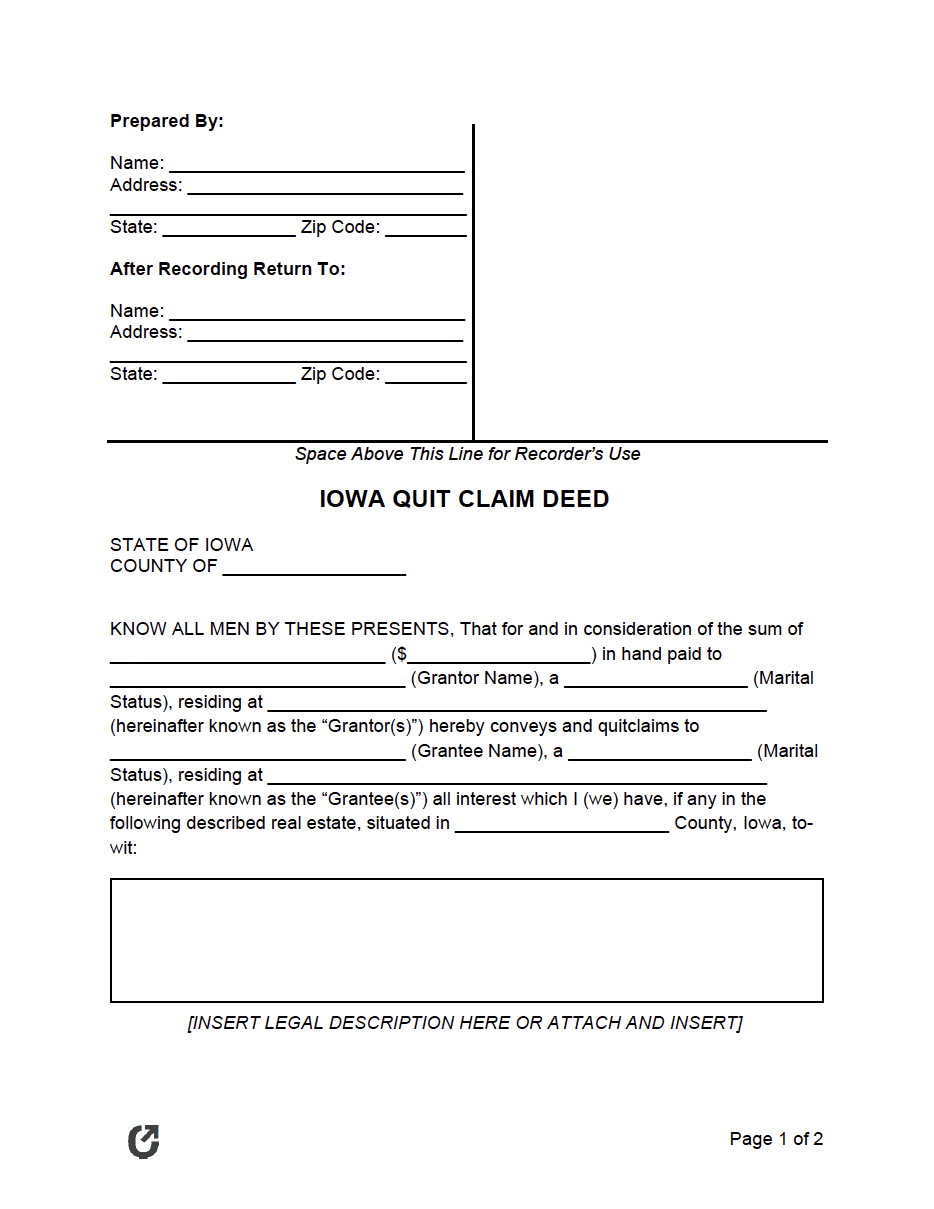

Iowa Quit Claim Deed Form

An Iowa quit claim deed is the standard legal document used for giving up ownership interest in a home or land. The deed can be used effectively for any deed-related tasks, whether it is for gifting or selling property, fixing issues with a deed, or for giving up a house after a divorce. Notable to quit claim deeds is the lack of any assurances offered to the recipient. This contrasts with warranty deeds, which give the recipient the “guarantee” that the property they’re receiving is without issues.

The document involves two (2) parties: the grantor (owner) and the grantee (recipient). If the real estate is jointly owned by a couple, both should be written into the document as the grantors. The same goes for the grantee, although in the majority of cases, the grantee is just one person.

Laws

|