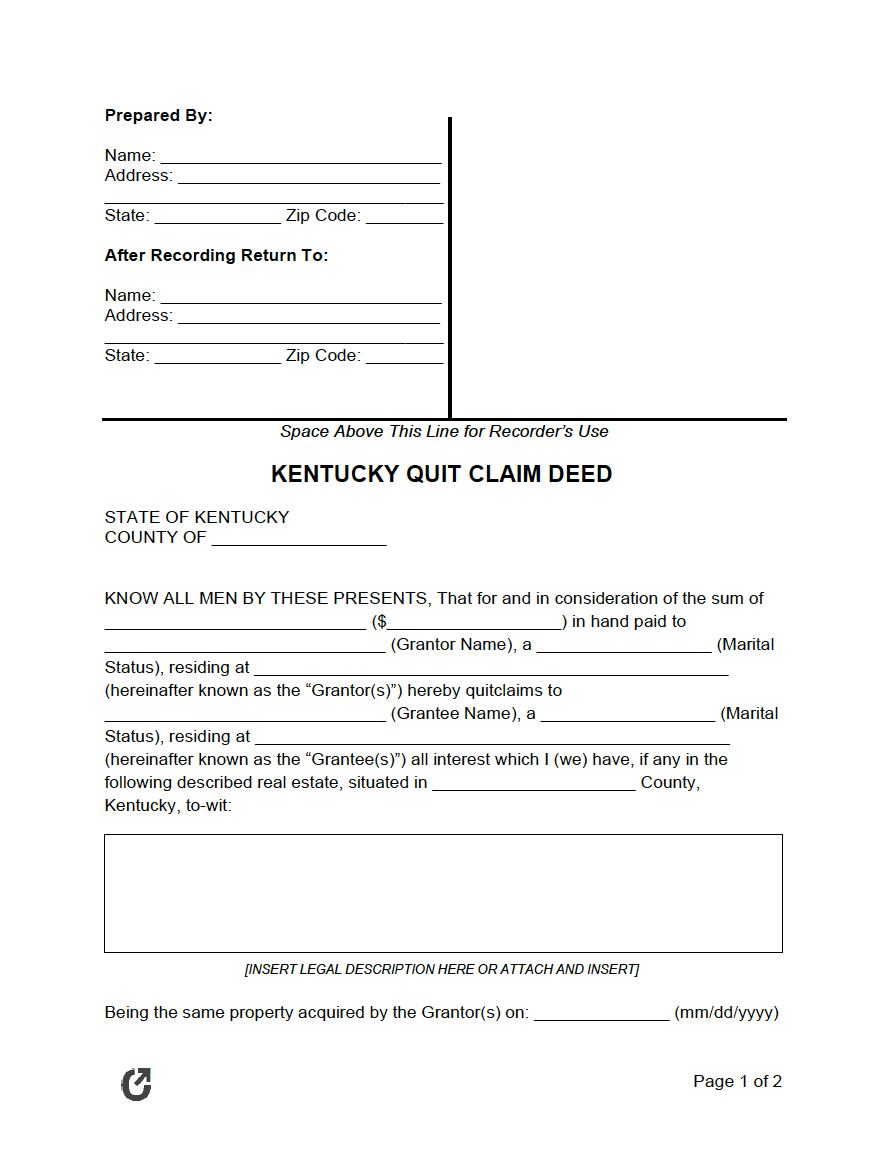

Kentucky Quit Claim Deed Form

A Kentucky quit claim deed is a legal form used to convey real property in Kentucky. By writing and recording the form, the owner (grantor) gives up any rights they have in the real estate to the recipient (grantee). Of the major deed types, it provides the fewest guarantees to the grantee. This is advantageous in cases where the grantee has a personal relationship with the grantor, as the process can be completed quickly without the need to have a title search conducted.

For monetary transactions where there’s a buyer and a seller, the parties are better off using a form that provides warranties to the title, such as a general or special warranty deed. As in the event the title has clouds or other issues that were uncommunicated to the grantee, the grantee will have no legal recourse for financial compensation from the grantor.

Because of the liability involved with the form, it is only recommended for use by parties that are well acquainted with each other, such as family and friends.

Laws

|