Minnesota Quit Claim Deed Form

A Minnesota quit claim deed transfers the property ownership among willing parties. This type of deed differs from warranty deeds or others because it does not guarantee that the property is free from other claims or liens. It is a practical option when the person receiving the property, known as the grantee, trusts the person transferring the property, the grantor. For example, in a divorce where one party needs to transfer their interest in the property to the other, a quit claim deed is ideal since it simplifies the process without requiring further proof of clear ownership.

Laws: § 507.07

Versions (5)

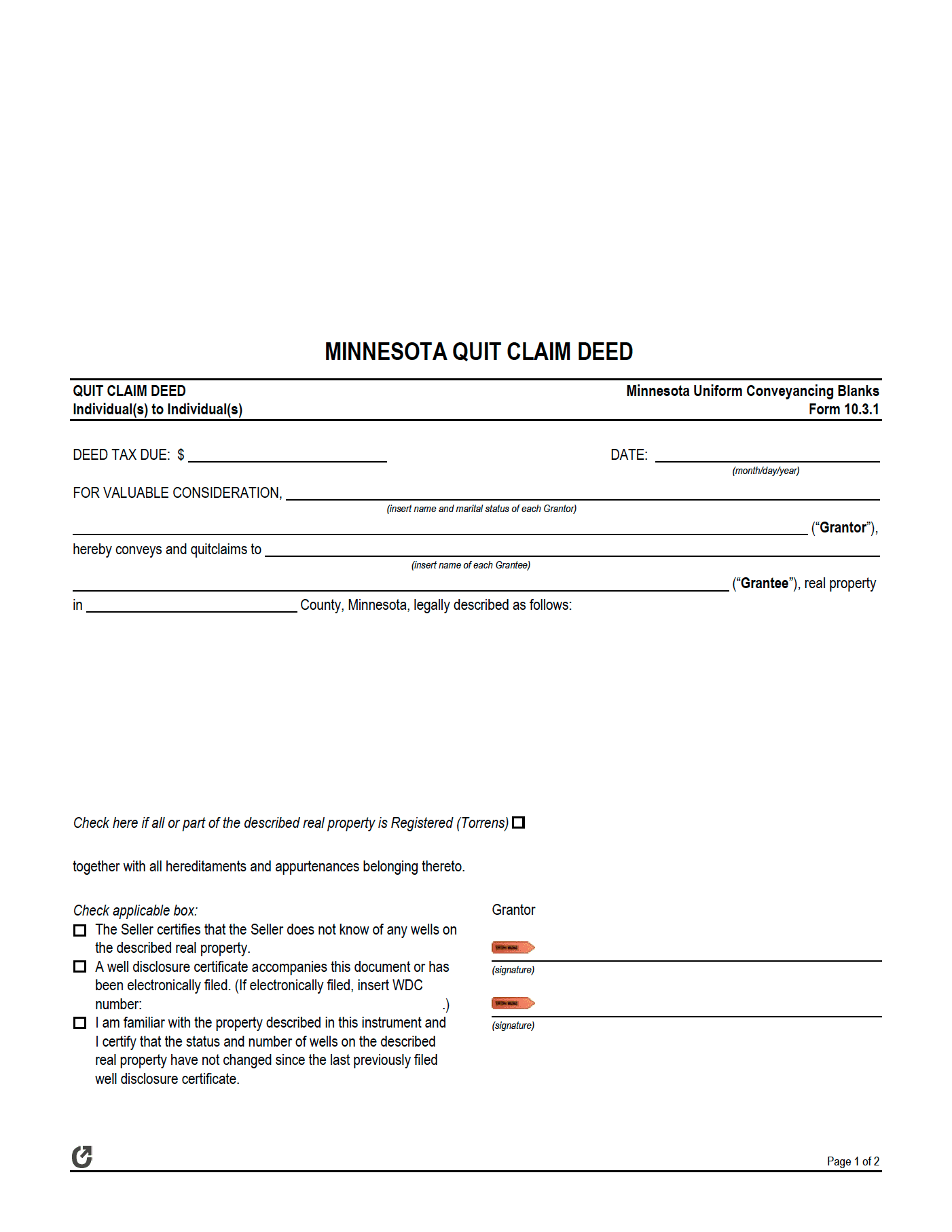

Form 10.3.1 – Individual(s) to Individual(s)

Form 10.3.1 – Individual(s) to Individual(s)

Download: Adobe PDF

Form 10.3.2 – Individual(s) to Business Entity

Form 10.3.2 – Individual(s) to Business Entity

Download: Adobe PDF

Form 10.3.3 – Individual(s) to Joint Tenants

Form 10.3.3 – Individual(s) to Joint Tenants

Download: Adobe PDF

Form 10.3.4 – Business Entity to Individual(s)

Form 10.3.4 – Business Entity to Individual(s)

Download: Adobe PDF

Form 10.3.5 – Business Entity to Business Entity

Form 10.3.5 – Business Entity to Business Entity

Download: Adobe PDF

Requirements

Mandatory Information: In order for the form to be approved, it needs to contain the following (NOTE: the form offered for download complies with all requirements):

- The Grantee and Grantor’s names,

- Details of the party who drafted the form,

- The county the property is located,

- A legal description of the property,

- Indication if the property is Registered (Torrens),

- The Grantee’s residential or business address,

- A Well Disclosure and/or Well Disclosure Certificate (if applicable),

- The Grantor’s signature, and

- Acknowledgment by a Notary Public.

Signing Requirements (§ 507.24): The deed must be signed by the Grantor and notarized.

Additional forms

The following two (2) forms may also need to be completed and filed:

1. Electronic Certificate of Real Estate Value (eCRV)

Provided by the Minnesota Department of Revenue, this form documents a property sale in the state. It must be filed when the property is sold or transferred for consideration of more than a specific amount, as follows:

- Prior to January 1, 2020: A consideration of at least one thousand dollars ($1,000).

- From January 1, 2020: A consideration of at least three thousand dollars ($3,000).

To receive more information and complete the form, and head to the Department of Revenue’s website.

2. Well Disclosure Certificate

The MN Department of Health Well Management Section requires a Well Disclosure Certificate.pdf be attached to the Deed if there are any wells on the property. The filing fee for this form is fifty dollars ($50.00).

If a Well Disclosure Certificate has already been filed and the number or status of the wells has remained the same, filing a new certificate is not necessary. However, the following statement, which must be certified by the buyer or seller, must appear on the form:

“I am familiar with the property described in this instrument and I certify that the status and number of wells on the described real property have not changed since the last previously filed well disclosure certificate.”

How to File

Upon completing the form in-full, it must be filed with the County Recorder’s Office. The office must be in the same county where the property is located. The form may be recorded electronically, so long as the guidelines set by § 507.0943 are followed.

The office will charge a recording fee that must be paid for by the party filing the form. The additional forms outlined above may also need to be filed.

In addition to the recording fee, the MN Department of Revenue charges a deed tax of 0.0033% of the property’s selling price. Deeds filed in Hennepin County and Ramsey County are also charged an additional Environmental Response Fund Tax (also called ERF Tax) at a rate of 0.0001% of the property’s selling price.