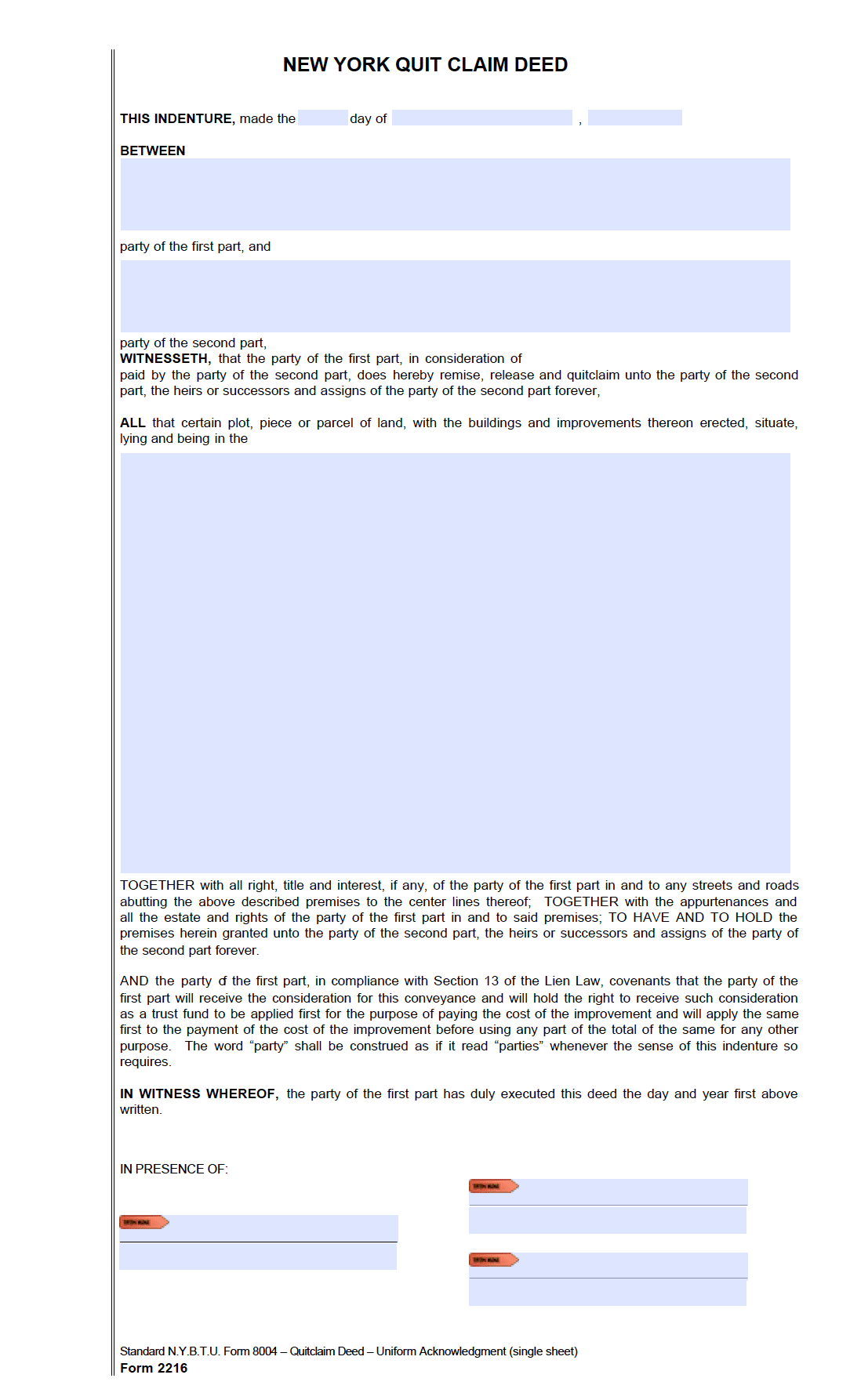

New York Quit Claim Deed Form

A New York Quit Claim Deed transfers interest in real property from one person to another. Unlike similar types of deeds, the quit claim deed does not offer any guarantee that the title is free claims, defects, or liens. To the form’s benefit, it is the easiest to complete and requires little work on behalf of the grantor and grantee. So long the parties trust one another, the form is one of the most popular methods of property interest transfer.

Download: Adobe PDF

Laws: (Real Property): Conveyances and Mortgages

Requirements

Recording and Endorsement Page / Cover Page: The majority of counties in the state of NY have made it mandatory to use a “cover page” when filing the form with the respective county office. The cover page is referred to by different names in different counties, although it is usually referred to as a “Cover Page,” “Recording Page,” or “Recording and Endorsement Page.”

Some counties, such as Suffolk County, allow for the page to be prepared beforehand. Whereas other counties, such as Clinton County, will generate the page at the time of filing. It should be kept in mind that a fee will likely be charged for the cover page. Most counties will list any fees associated with the page (as well as any other relevant fees) on their county’s website.

Signing Requirements (NY Real Prop L § 306): Must be signed by the Grantor and acknowledged by a Notary Public.

Additional Forms: See below for additional forms that need to be filed alongside the deed.

How to File

To file the form in New York it must be presented to the County Clerk’s Office for recording in the county in which the real estate is located. Each county has its own form requirements and recording fees. [Recording Office Locator].

Mandatory Forms

According to NY Real Prop L § 333(1-e), the deed must be accompanied by two (2) forms.

These are:

- Form TP-584 and

- Form RP- 5217-PDF (for all counties except NYC) or Form RP – 5217NYC (for NYC only). Filing fees will apply.

Furthermore, any parties who make a property transfer as a gift must also file Form 709. If the Grantor is a non-resident of NY, they also need to file Form IT-2663, per § 633.

The following table outlines the forms required for a successful filing:

| County / City / Other | Form | Additional information |

|---|---|---|

| All counties | Form TP-584: Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax | Instructions |

| All counties except New York City | Form RP-5217-PDF: Real Property Transfer Report | Instructions |

| Only New York City | Form RP-5217NYC (File Online): Real Property Transfer Report | Instructions |

| All counties: Use if the transfer is a gift | Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return | Instructions |

| All counties: Use if the Grantor is a non-resident of NY | Form IT-2663: Nonresident Real Property Estimated Income Tax Payment Form. | Instructions |