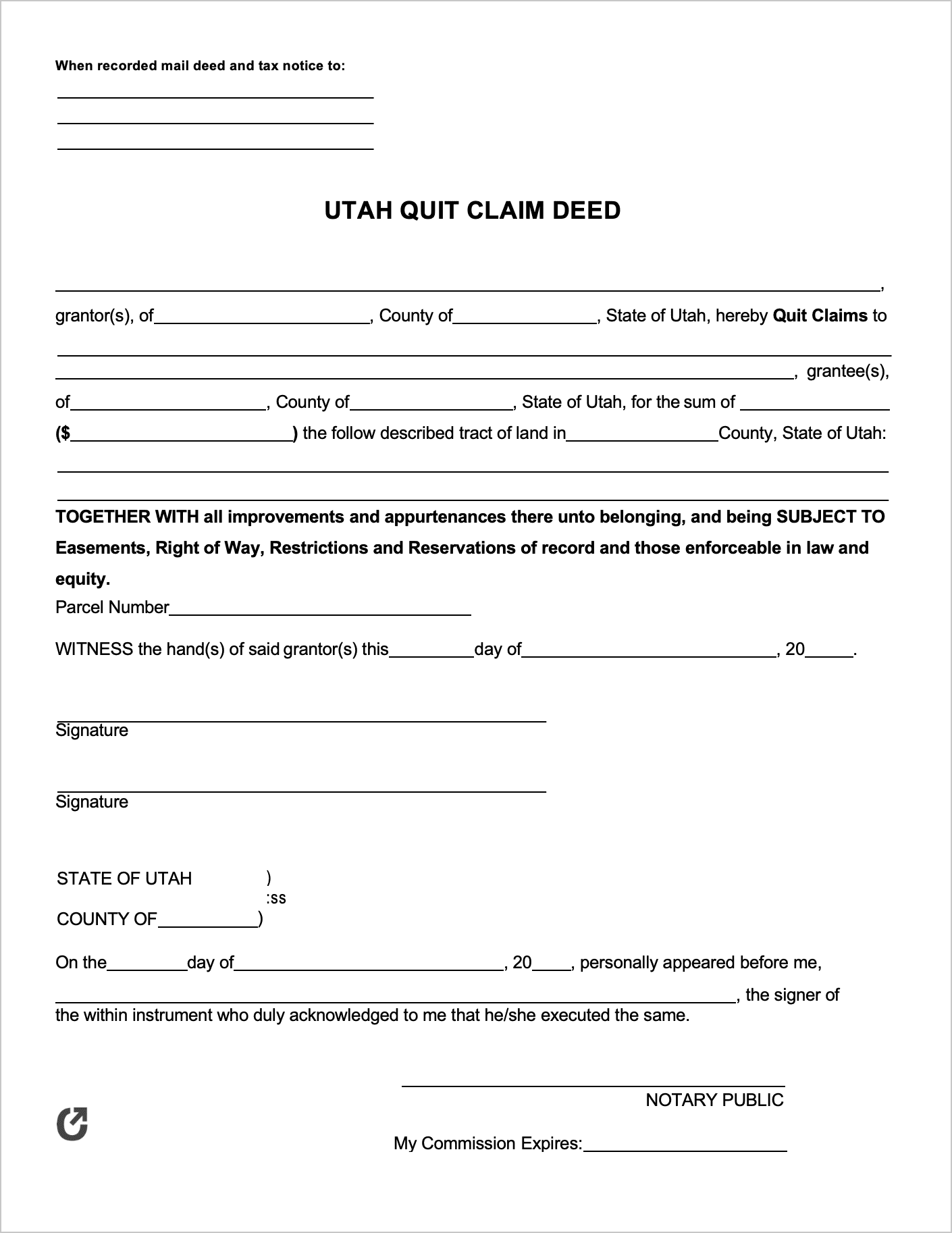

Utah Quit Claim Deed Form

A Utah Quit Claim Deed is a one (1) page legal form used for transferring interest in a Utah-based property (owned by a “Grantor”) from one person or entity to another. The deed type is typically used among friends and family due to the liability it poses on the Grantee (person receiving the property). Unlike warranty deeds, there is no guarantee that the property is free of defects, covenants, or other issues. To help reduce liability, Grantees can conduct a title search to look back into the property’s past. This allows them to look for signs that there may be other persons with an interest in the property.

Download: Adobe PDF, MS Word (.docx)

Laws: § 57-1-13

Requirements

Brief Caption § 57-3-106(2)(a)(ii): The first page of the form must include a brief caption that states the nature of the conveyance.

Grantee’s Details (§ 57-3-105(3)): The form must state the Grantee’s name and mailing address that will be used for assessment and taxation.

Legal Description of the Property (§ 57-3-105(2)): The deed must contain a legal description of the property in order to be approved for recording.

Water Rights Addendum (§ 57-3-109): State law requires a water rights addendum to be submitted as an addendum to any deed filed at the County Recorder’s Office. The Grantor is responsible for completing the addendum. The completed document requires the signatures of the Grantor and Grantee.

Signing Requirements (§ 57-3-101): Signed by the Grantor in view of a Notary Public.

How to File (§ 57-3-101): Once the deed has been correctly completed and signed, it must be recorded in the office of the recorder in the same jurisdiction that the property is located in.