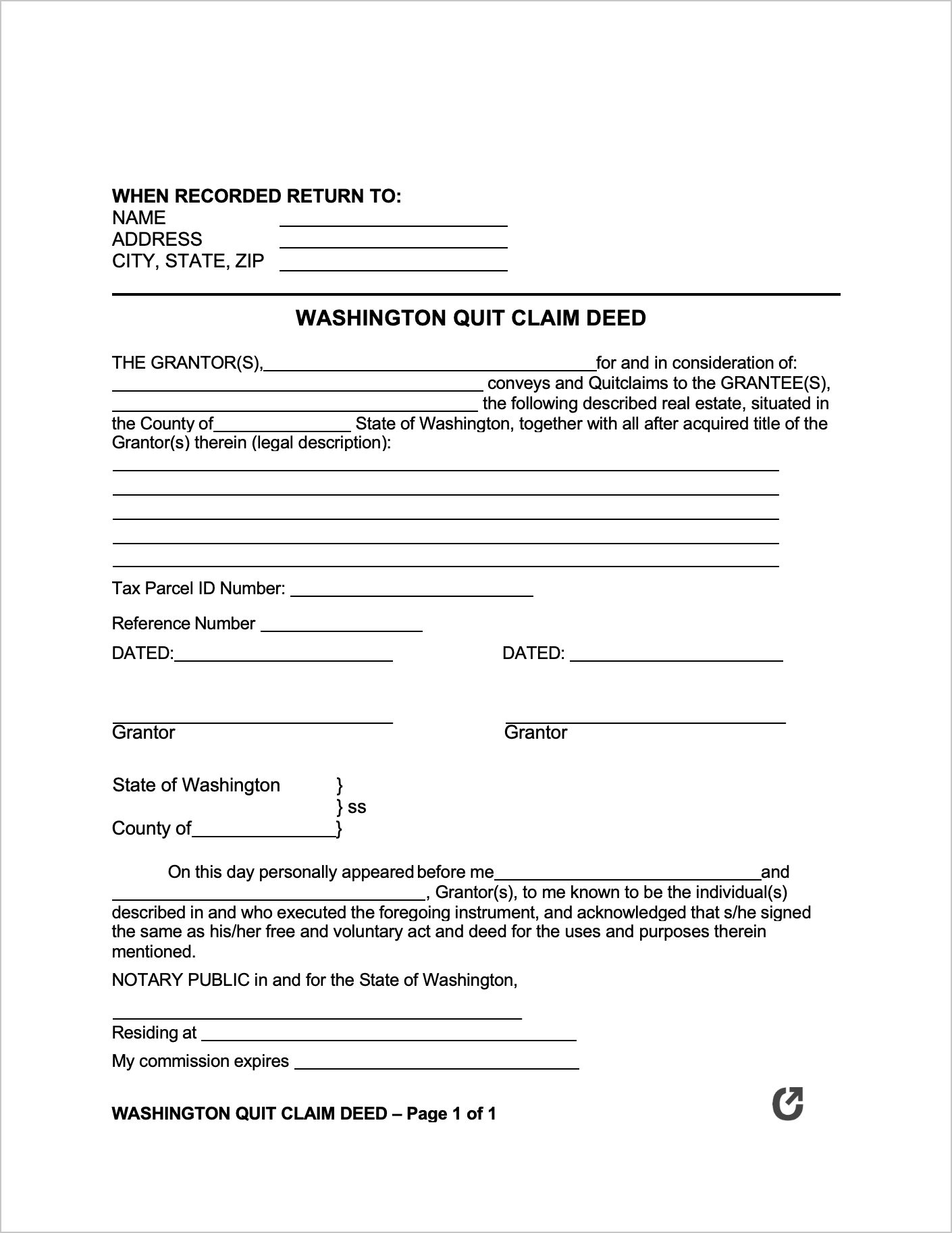

Washington Quit Claim Deed Form

A Washington Quit Claim Deed is a legal document that allows a Grantor (seller/gifter of property) to transfer their interest to another party known as the Grantee(s). A Grantor and Grantee are two individuals who, upon execution of the contract, enter into a binding deal to transfer ownership of real property. It is highly recommended that the parties already have a pre-existing relationship based on trust long before using the deed-type, as the deed offers no guarantees that the property is free from liens or interest from other parties. To mitigate said risk, it is recommended that the Grantee conduct a title search on the property.

Download: Adobe PDF, MS Word (.docx)

Laws: RCW 64.04.050

Requirements

Formatting (RCW 65.04.045): State law lists several requirements concerning the formatting of the document that must be met. A range of matters are covered, from the presentation of titles to the width of margins. Specific instructions are given, so care should be taken to ensure that the completed document bears the appearance dictated by these requirements. For example, there is a requirement that the assessor’s property tax parcel or account number must appear separately from other text in the document.

Signing (RCW 64.04.020): The deed must be signed by the Grantor and acknowledged before a Notary Public. If having the deed notarized is not feasible, the Grantor can have it acknowledged by the following individuals:

- A justice of the supreme court,

- A clerk of the supreme court,

- The deputy of a clerk of the supreme court,

- A judge of the court of appeals,

- The clerk of the court of appeals,

- A judge of the superior court,

- A qualified court commissioner of the superior court,

- The clerk of qualified court commissioner of the superior court,

- The deputy of the clerk of qualified court commissioner of the superior court,

- A county auditor,

- The deputy of a county auditor,

- A qualified notary public, or

- A qualified United States commissioner appointed by any district court of the United States for the state of Washington.

How to File

The deed must be filed with the auditor or recording officer in the same county that the property stands. As established by RCW 65.04.130, the filing will only take place once the appropriate auditor’s fees detailed are paid. More information on fees can be found at RCW 36.18.010.

Recording type: Washington has a “rate-notice recording statute” state. This means that the law will protect a subsequent purchaser of a real property who duly records their conveyance if, at the time, they had no notice of a prior conveyance concerning the same property. The law will uphold their innocent claim to the property, and by implication, no longer uphold the claim of the party who failed to record their conveyance.