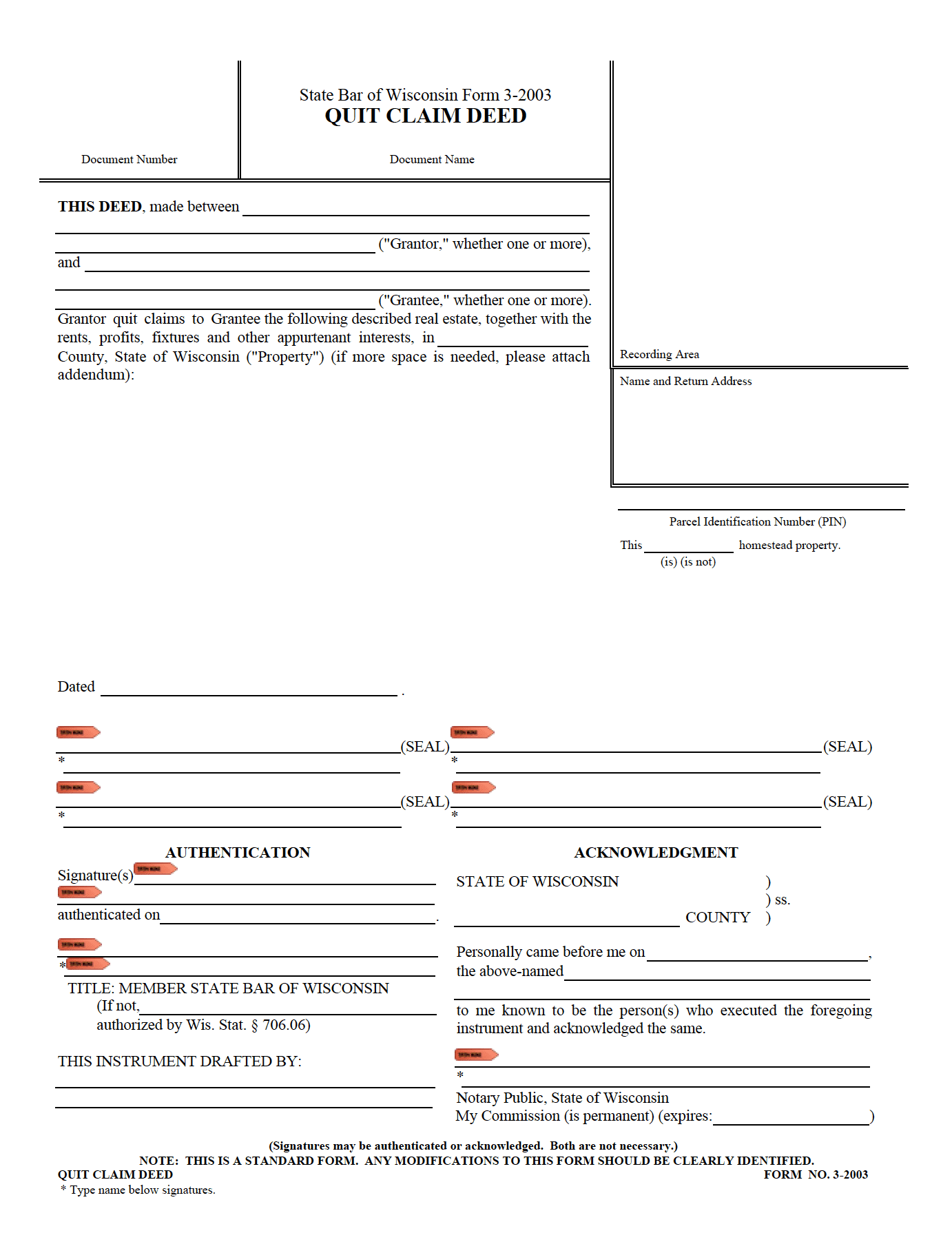

Wisconsin Quit Claim Deed | Form 3-2003

The Wisconsin Quit Claim Deed (Form 3-2003) is the official one-page document to be used exclusively in Wisconsin to convey any interest in real property from one party (called the “Grantor”) to another party called the “Grantee”. The deed type can be used for two (2) main tasks:

- For passing on interest the Grantor genuinely has to the Grantee, and

- For fixing errors in a deed, adding names to a deed, and other corrections.

Because this form offers no guarantees to Grantees, it should only be used between friends, family, and individuals that have trust in one another.

Download: Adobe PDF, MS Word (.docx)

Laws: § 706.10(4)

Requirements

- Mandatory Inclusions (§ 706.02): All deeds made in Wisconsin must identify both the Grantor and Grantee, the land, and the interest conveyed.

- Formatting (§ 59.43(2m)): State law makes it known that specific formatting requirements must be attended to in order for the Deed to be recorded.

- Legal Description (§ 706.05(2)(2m)(a)): To be duly recorded, the form must include the property’s full legal description. In most cases, this can be directly copied from the last deed so long no changes were made to the property’s boundary.

- Homesteads (§ 706.02): Except for conveyances directly between spouses, the form must be signed by or on behalf of the spouse if it alienates any interest of a married person in a homestead. A homestead in Wisconsin is defined by § 706.01 (7) as, “the dwelling, and so much of the land surrounding it as is reasonably necessary for use of the dwelling as a home, but not less than one-fourth acre, if available, and not exceeding 40 acres.”

- Document Drafter (§ 59.43(5)): The name of the individual drafting the document must be stated on the form. Their name should be written in the following statement: “This instrument was drafted by …. (name)”

- Parcel ID # (§ 59.43(5)): The document may need to include the parcel identification number. Whether it should be included or not will depend on the size of the population of the county where the property is located, as well as each county’s own requirements regarding this matter. Further information can be found in section 59.43(5).

- Real Estate Transfer Return (eRETR): A form that must be filed alongside the quit claim deed.

- Signing (§ 706.06): Must be signed by the Grantor(s) in view of an authorized Notary Public.

How to File

The deed, along with Form eRETR, must be filed at the Registry of Deeds in the same county in which the home or land is located. The Registry of Deeds’ fees stated in § 59.43(2) must be paid for the recording to take place.

Recording type: Wisconsin is a race-notice recording statute.