California Small Estate Affidavit | Probate 13101

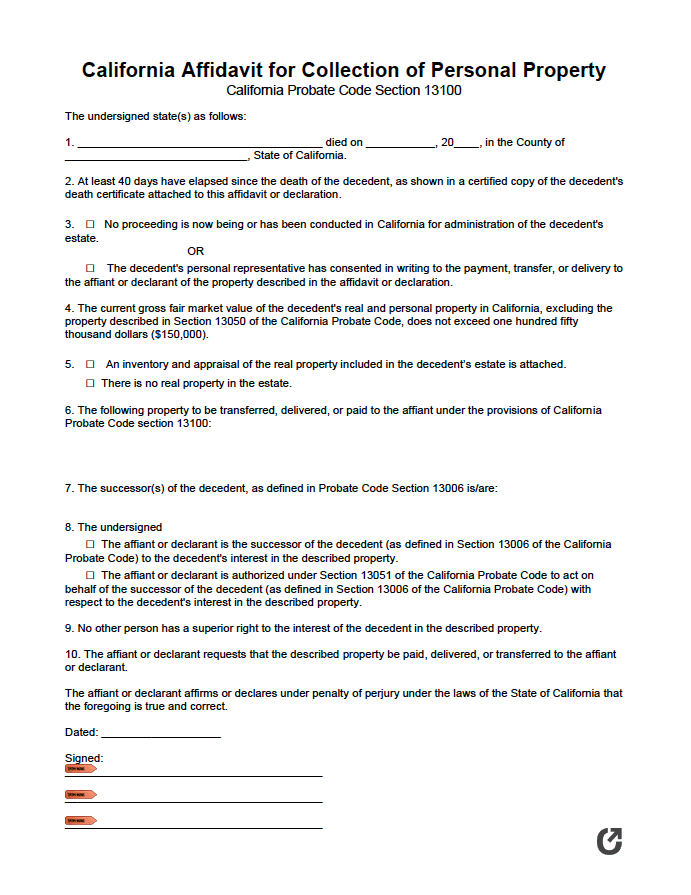

The California small estate affidavit is the official legal document used for collecting the estate of an individual who died while residing in the state of California. The form can be used so long a variety of conditions are met; such as ensuring the deceased person did not die with an estate valued at more than $150,000. Overall, the form allows for a more streamlined and time-saving means of collecting a loved one’s estate in comparison to engaging with the probate court. In other words, this document is used to lawfully represent that an individual (a party called the “successor”) has the right to claim the small estate of a deceased individual (a party termed the “decedent”).

Laws: § 13000 – 13210

Requirements

Maximum Estate Value: $166,250 (excluding the types of property that are listed in § 1350)

Required Conditions: On condition that a) the property described in § 1350 is excluded, b) the value of the estate is within the permitted limit ($150,000), and c) forty (40) days have passed from the event of the decedent’s death, the successor is permitted to furnish the affidavit to the holder of the decedent’s property so that they may, “collect money, receive tangible personal property, or have evidence of a debt, obligation, interest, right, security, or chose in action transferred under this chapter.”

The successor should note that the affidavit will only be accepted in the eyes of the law if it duly upholds all of the requirements listed in § 13101.

Additional Considerations

The successor will need to file additional forms if there is real property involved in the estate claim.

- For the transfer of real property without personal possessions, the successor must complete and file Form DE-310, “Petition to Determine Succession to Real Property”.

- For the transfer of real property as part of the decedent’s total estate, the successor must complete and file Form DE-160, “Inventory and Appraisal”. They may also need to complete and file a supplementary form to Form DE-160; Form DE-161, “Inventory and Appraisal Attachment”.