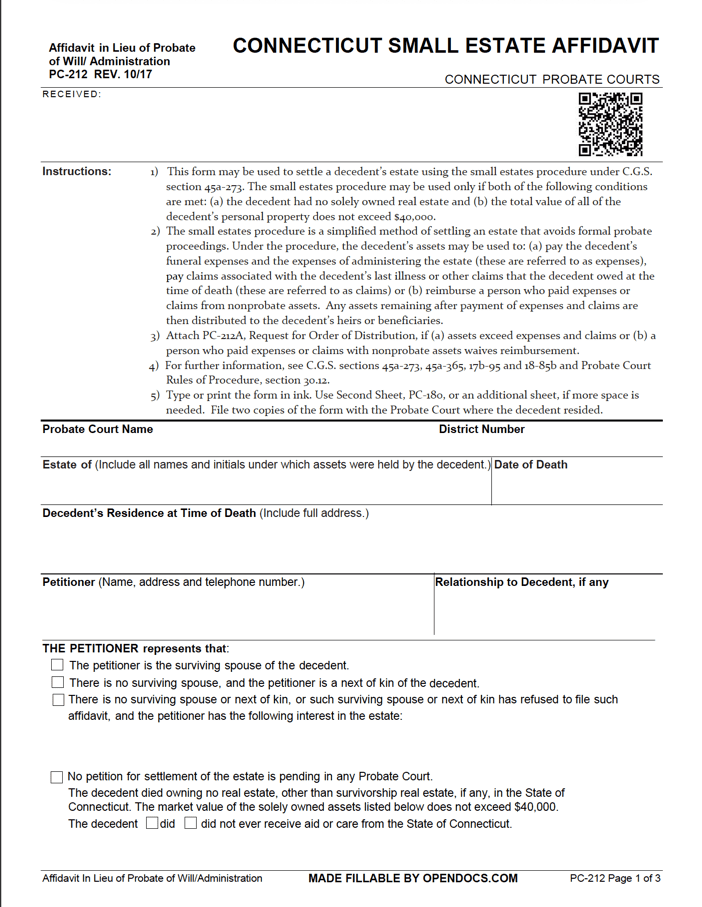

Connecticut Small Estate Affidavit Form | PC-212

The official Connecticut Small Estate Affidavit (PC-212), supplied by the Connecticut Probate Courts, authorizes an individual to collect the small estate (assets/possessions) from a family member that passed away, so long their total estate value does not exceed $40,000. The form, which also goes by “Affidavit in Lieu of Probate of Will/ Administration,” is used as an alternative to the standard probate process – saving those that use it both time and money.

Laws: § 45a-273

Requirements

Maximum Estate Value: $40,000

Required Conditions: Unlike the majority of other states, there is no minimum period a person applying for the small estate of a decedent must wait before starting the process. There are, however, other conditions that must be met. As mentioned above, there are two (2) primary ones, as follows:

- At the time of their death, the decedent had no solely-owned real estate in Connecticut.

- The total estate value falls within $40,000.

State law, namely § 45a-273(b), also gives guidance on the information which is required to be included in the affidavit. Requirements include:

- A statement whether the decedent received aid or care from the state,

- A list of the decedent’s solely owned assets, excluding assets that pass outside of probate.

- A list of all claims, expenses, and taxes due from the decedent’s estate in the categories set forth in subdivisions (1) to (7), inclusive, of section 45a-365, which list shall indicate if any of the claims, expenses and taxes have been paid and, if so, by whom.