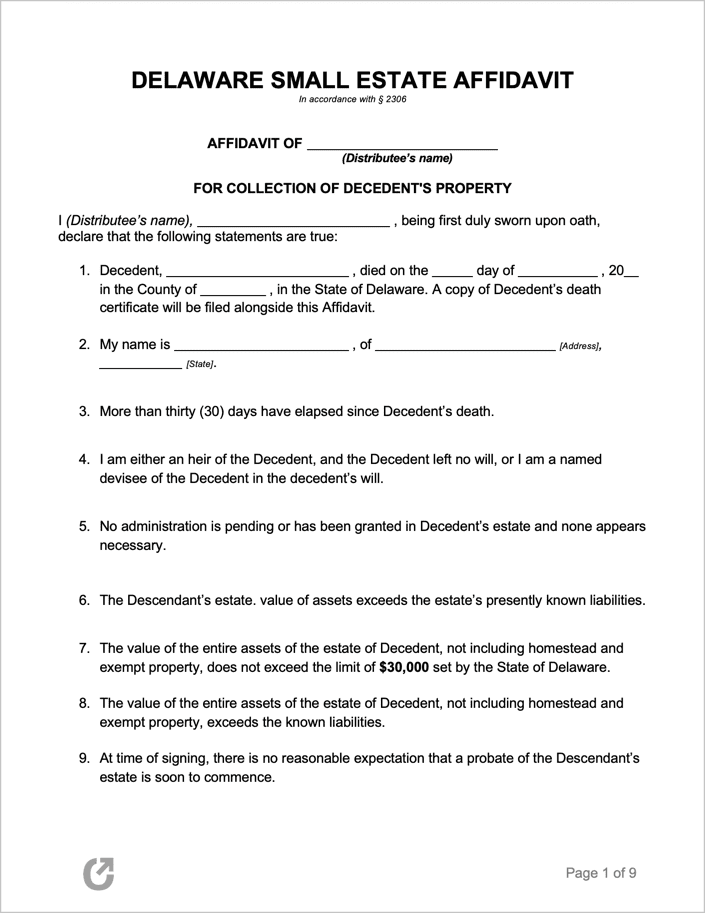

Delaware Small Estate Affidavit Form

A Delaware Small Estate Affidavit is a legal document used for acquiring the belongings of a person (typically a family member) that recently passed away. It serves to make the act of collecting an estate significantly easier than if the heirs had gone through the probate process. However, it’s important to understand that the requirements for using the affidavit process are very specific, which is touched on in the “laws & required conditions” section below. State law, namely § 2306(a), only permits certain individuals connected to the deceased party (who is legally referred to as the “decedent”) to make use of the form, and in turn, legally access the decedent’s small estate.

Laws: § 2306

Requirements

Maximum Estate Value: $30,000

Required Conditions: State law has established a certain set of rules that must be followed not only in terms of how the Small Estate Affidavit must be presented, but also who may make one.

The following individuals are permitted by § 2306(a) to file this form (a party referred to as the affiant):

- The spouse of the decedent.

- Any person who is a grandparent of the decedent.

- Any person who is a lineal descendant of a grandparent of the decedent.

- The personal representative of any of the foregoing who may be deceased.

- The guardian or trustee of any of the foregoing who may be incapacitated.

- The trustee of a trust created by the decedent.

- A funeral director licensed in the state.

- The named executor or executors in the decedent’s will if the named executor or executors satisfies all qualifications set forth in § 1508 of this title.

When no will has been left, an affiant (person completing the form) may execute the affidavit and must attest under oath that the following is true:

- A personal representative has not been appointed nor is there a motion for their appointment.

- The affidavit is filed after the waiting period (thirty (30) days) since the decedent’s death.

- The personal estate’s value is within the limits set by state law ($30,000).

- Known debts have been or will be accounted for.

- In line with § 2308, the surviving spouse’s allowance (cash up to the amount of $7,500) has been or will be accounted for.

- The decedent did not own any real estate in Delaware (in any shape or form).

- The affidavit has been furnished to “any person owing any money, having custody of any property or acting as registrar or transfer agent of any evidence of interest, indebtedness, property or right of the decedent.”