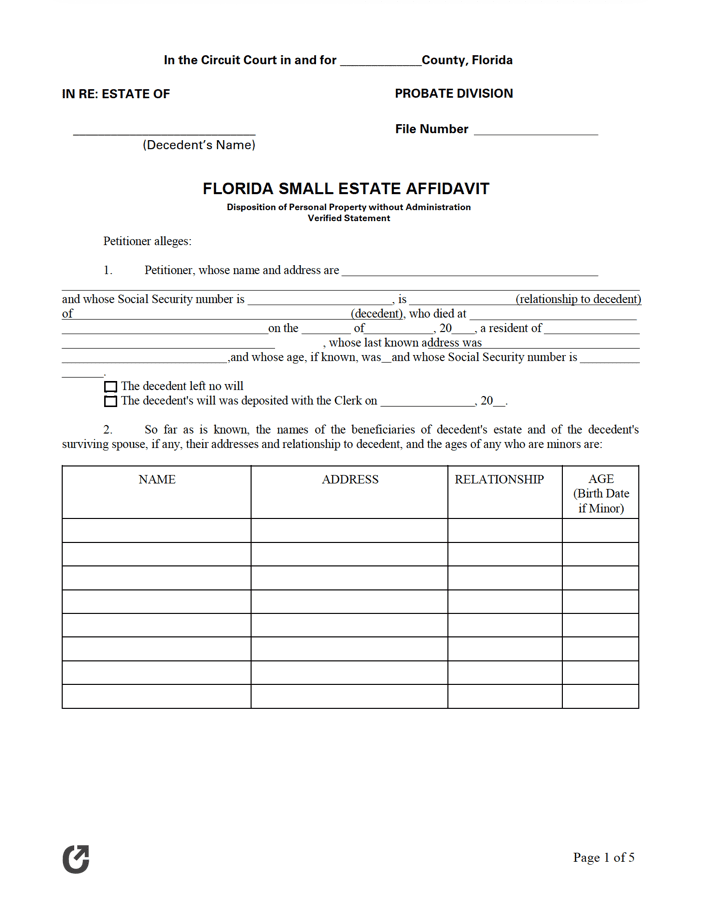

Florida Small Estate Affidavit Form

The Florida Small Estate Affidavit, also called the “Disposition of Personal Property Without Administration” form, is a contract used for permitting the rightful heir to a deceased individual (the “decedent”) with the legal right to collect their assets, so long the total value of their belongings does not exceed $75,000. The term “Without Administration” refers to the fact that the form provides a lawful avenue to file an estate claim without formal administration. Instead, it allows for estate proceedings to be initiated by a quicker and less expensive type of probate proceeding permitted by the state—summary administration. For the affidavit to be lawful, it must be filed with the county’s court in which the deceased lived. The court will then issue a granting disposition so long it was filed correctly.

Laws: Chapter 735 (§§ 735.201 – 735.302)

Requirements

Maximum Estate Value: $75,000

Required Conditions: Initiating a summary proceeding via the affidavit provided above is permitted by § 735.201 so long as two (2) provisions are met:

- If a will was left by the deceased, it does not necessitate direct administration as governed by § 733, and

- The total estate is not worth more than $75,000 [or] It has been more than two (2) years since the deceased passed away.

For a Small Estate Affidavit (a.k.a. the “Disposition of Personal Property Without Administration” form) to be duly accepted in the state of Florida, it is stated on the form that the following documents must be completed and filed:

- The Small Estate Affidavit, of which must be notarized.

- The certified death certificate of the deceased.

- If there was a will and it has not been already filed, the original will must be filed with the verified statement.

- A copy of the paid funeral bill.

- A copy of the paperwork showing the deceased’s assets.

- A copy of the last sixty (60) days of medical expenses with receipt(s).

- Consent(s) of any additional heirs with address(es) and notarized signature(s).

- Statement Regarding Creditors.

- An affidavit stating that the deceased was never married and had no children may also be required.