Idaho Small Estate Affidavit | Form CAO Pb 01

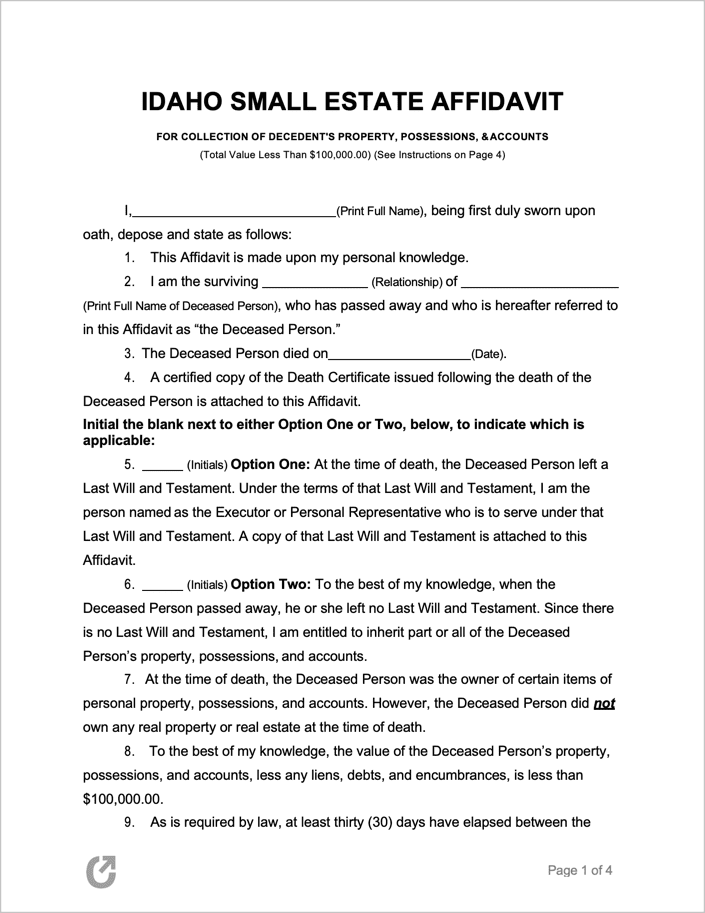

The Idaho Small Estate Affidavit – Form CAO Pb 01 (also known as the “Affidavit Collecting Personal Property of the Decedent”), allows a family member (or other individual as stated in a Will), to collect the personal belongings of a person that recently died (called the “decedent”). Once the form has been completed, the person responsible for collecting the estate can show it to anyone that is in possession of property legally owned by the decedent, which can include banks, stock brokerages, and the Department of Transportation, to name a few.

The state, as per § 15-3-1201, defines an affidavit as, “A written statement of facts confirmed by the oath of the party making it, before a notary or officer having authority to administer oaths.”

Included in the affidavit are comprehensive instructions for completing and using the form as to the requirements of Idaho law.

Laws: § 15-3-1201

Requirements

Maximum Estate Value: $100,000

Required Conditions: It is the responsibility of the individual completing the form (the claiming successor) to ensure of the following:

The form can be used only if:

- The personal property has a value of $100,000 or less.

- Thirty (30) days have passed since the death of the decedent/

- The claiming successor is indeed legally entitled to the estate, in accordance with § 15-3-1201.

The form cannot be used to:

- Collect real property (if the decedent owned any property at all, this process cannot be used).

- Collect a motor vehicle (Form ITD 3413 should be used instead).

- Appoint a personal representative if one has already been appointed.