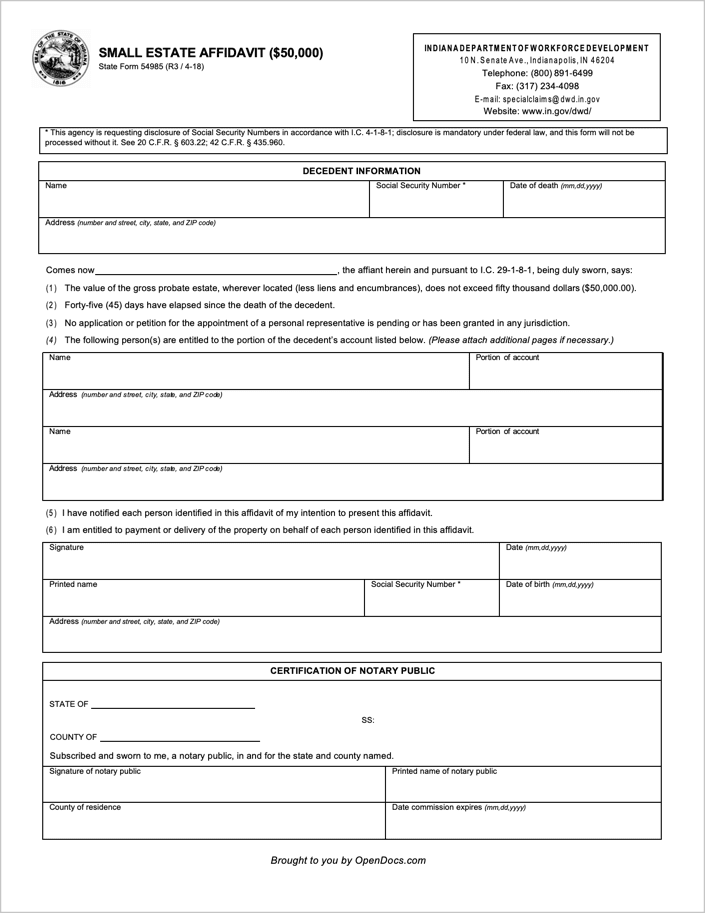

Indiana Small Estate Affidavit | Form 54985

The Indiana Small Estate Affidavit (Form 54985) is a legal form that gives a family (or family member) a convenient means of obtaining the small estate (total assets) of a loved one that resided in the state of Indiana at the time of their death. So long the deceased’s assets do not have a value of over $50,000, the document can be used. In general, a person who plans to establish that they have the grounds to obtain a small estate in Indiana has two options: 1) Initiate probate (a drawn-out and expensive process that involves going through the court) or 2) Use the small estate affidavit. If the second option is selected, they simply need to present any individual who is indebted to the decedent with the completed affidavit to receive the payment or personal property they are due.

Laws: § 29-1-8-1

Requirements

Maximum Estate Value: $50,000

Required Conditions: Although relative to initiating probate an affidavit is a straightforward process, it nevertheless must be made in accordance with state law. State law, specifically § 29-1-8-1(b) mandates that the following is required in order to qualify for using an affidavit:

- The estate’s value is $50,000 or less.

- It has been forty-five (45) days since the day the decedent died.

- No application or petition exists in any jurisdiction for the appointment of a personal representative.

- The name(s) and address(es) of each distributee are clearly stated.

- The part of the property each distributee is entitled to is included.

- The applicant has given due notice to each distributee of their intentions in regards to the affidavit and that they are “entitled to payment or delivery of the property on behalf of each distributee identified in the affidavit.”

Motor Vehicle / Watercraft

In cases where a motor vehicle or watercraft is part of the decedent’s estate, state law (§ 29-1-8-1(c)) permits the transfer of the certificate of title, provided that:

- It has been five (5) days since the day the decedent died.

- A personal representative has not or will not be appointed.