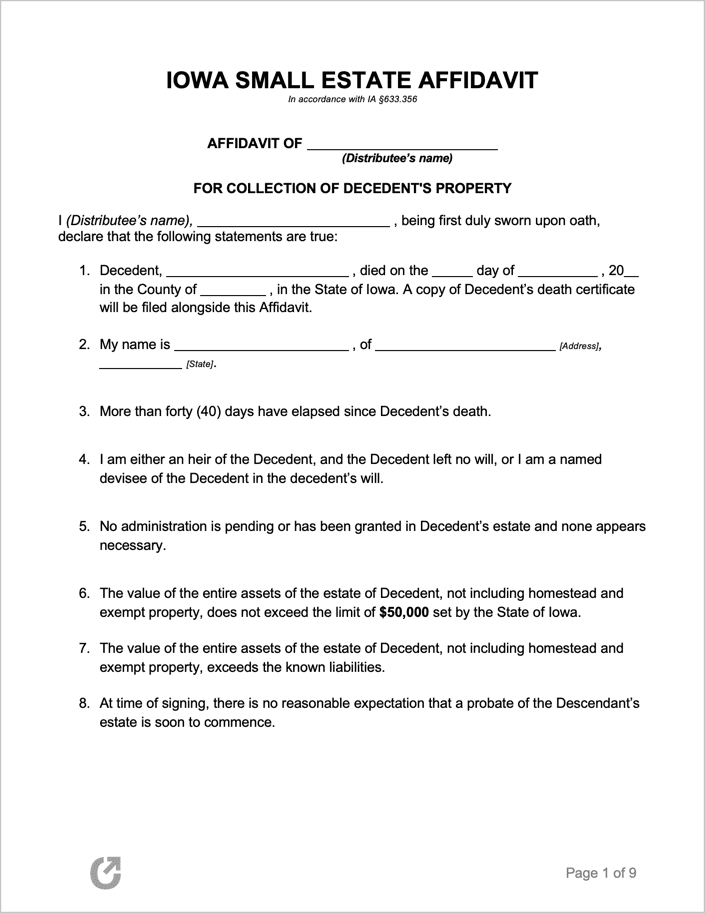

Iowa Small Estate Affidavit Form

The Iowa Small Estate Affidavit permits a successor, who is the rightful heir to a deceased individual’s possessions and property, with the authorization to collect the deceased’s belongings from institutions that are in possession of the estate assets (such as money in a bank, for example). State law, namely § 633.356(2) provides that in cases where the decedent died with a will (called “testate”), the successor is defined as any, “…Reasonably ascertainable beneficiary or beneficiaries who succeeded to the item of property under the decedent’s will.” On the other hand, if the decedent died without a will (“intestate”), the successor is defined as any, “…Reasonably ascertainable person or persons who succeeded to the property under the laws of intestate succession of this state.” In simple words, the Iowa-specific affidavit can be used for collecting property regardless of whether a will was in place, the state simply requires the successor be identified by state requirements if a will wasn’t written before the decedent died.

Laws: § 635.1 to § 635.13

Requirements

Maximum Estate Value: $100,000

Required Conditions: In accordance with Chapter 365, an authorized petitioner is granted the right to petition a clerk or court to issue letters of appointment for administration so long the following holds true:

The document includes:

- The decedent’s name, domicile, and date of death.

- The surviving spouse’s name and address (if any).

- The proposed personal representative’s (the successor) name and address.

- Whether the decedent died intestate or testate.

- If the decedent died testate, the date of execution of the will.

- A statement pertaining to the fact that the assets in question comply with the conditions set out by § 635.1 as well as “the approximate amount of personal property and income for the purposes of setting a bond.”

In small estate claims without a will, an authorized petitioner is considered one of the following parties, as per § 633.227:

1. Surviving spouse.

2. Any heirs of the decedent.

3. Creditors (people that the decedent owed money to).

4. Other persons proving they have reasonable grounds to be the successor.