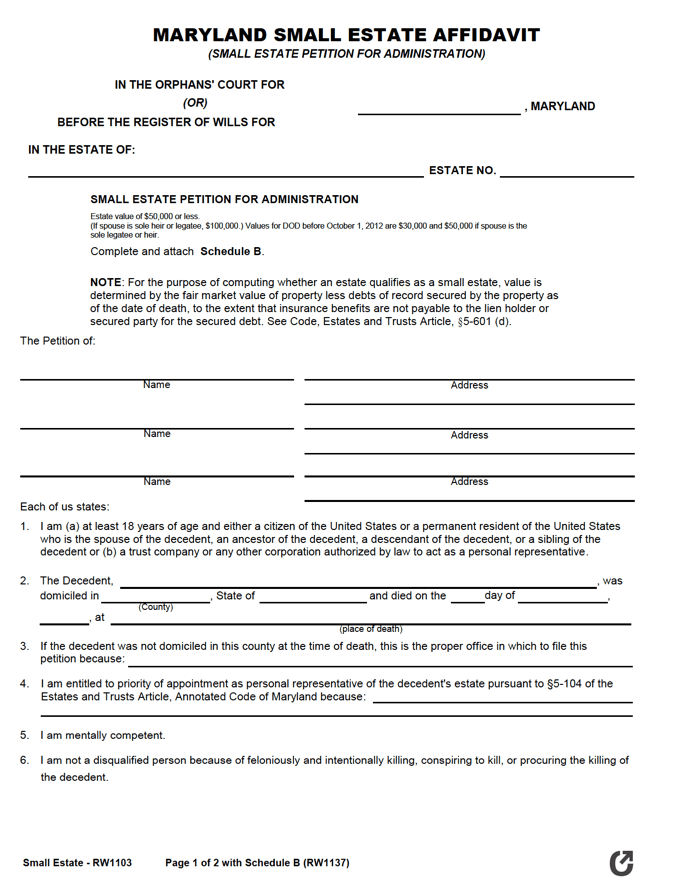

Maryland Small Estate Affidavit | Form RW1103

The Maryland Small Estate Affidavit (also called a “Petition for Administration – Form RW1103”) is a legal form filed with the Register of Wills that gives those that inherited a recently-passed away family member’s estate to collect their assets without the need to go through probate. The individual filing the form (called the “Petitioner”), must ensure they make all declarations that are demanded of them in the two-page form truthfully. They must also complete a form called Schedule B, which requires the petitioner to list out the debts and expenses of the deceased in order to calculate the total estate value. Both of these forms are included in the free download.

Laws: §§ 5-601 to 5-608

Requirements

Maximum Estate Value: Spouses (if the sole legatee or heir of the decedent): $100,000; Descendants: $50,000

Required Conditions: The affidavit must be filed prior to the appointment of a personal representative. It must be filed at the Register of Wills office in the locality of the decedent’s permanent home or were living at the time of their death. The filing must take place in conjunction with the filing of the form “Schedule B: Small Estate – Assets and Debts of the Decedent.pdf“.

As stated on the website of the Office of the Register of Wills, the following documents will also need to be furnished for the form to be accepted:

- The decedent’s Last Will and Testament.

- Their death certificate.

- Their funeral contract/bill.

- Title the deceased individual’s automobiles and/or other motor vehicles.

- The names and addresses of persons interested in the estate (noted in the “List of Interested Persons” form)

Resources

The Office of the Register of Wills provides a number of useful resources that may be helpful for a Petitioner to refer to:

- “Decedent’s Estates” Frequently Asked Questions (FAQ)

- What To Do If You Need To Open An Estate

- Administration of Estates in Maryland (Pamphlet)

The Petitioner must be aware of the fact that transferring an estate has certain tax implications. More information about the tax implication of transferring an estate can be found in the following resources: