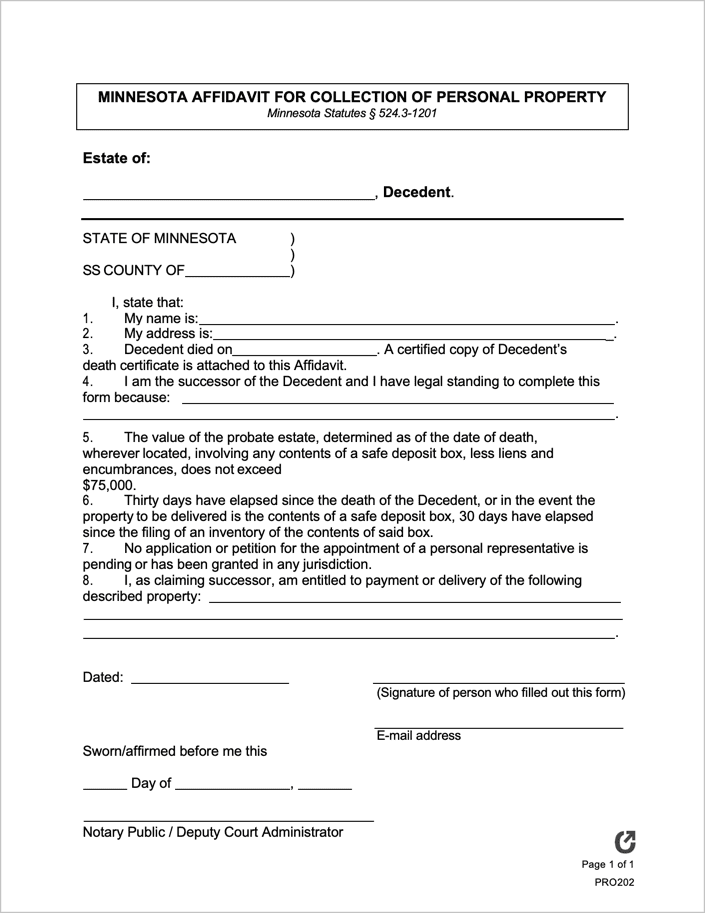

Minnesota Small Estate Affidavit | Form PRO202

The Minnesota Small Estate Affidavit is a document that is used for transferring the personal property of a recently deceased individual to the rightful heirs, who are typically family members. It is used for going around the probate process, which can not only be a lengthy process (3-9 months); it can cost over five percent (5%) of the decedent’s entire estate value. In general, the Minnesota-specific affidavit should be used in the following circumstances:

- The individual planning on filing the form is blood-related to the decedent or has a legal interest in the estate.

- The decedent only had a modest sum of money or personal property when he/she died (under $75,000).

- The decedent did not have a will at the time of their death.

Once completed, the document can be presented to any person or business (such as a bank or stock company) that is in possession of property or owes a debt to the decedent to lawfully collect it form them.

Laws: § 524.3-1201

Requirements

Maximum Estate Value: $75,000

Required Conditions: The required conditions for Form PRO202 are summarized below:

- Thirty (30) days must have elapsed since the decedent’s death (in cases where the decedent’s property is the contents of a safe deposit box, thirty (30) days must have elapsed since the filing of an inventory of the contents of the box in line with § 524.3-1201.

- No real property is subject to the estate claim.

- A certified death record of the decedent must be presented alongside the affidavit.

- There is no existing or planned application or petition for the appointment of a personal representative.

- The claiming successor is within their rights to claim the estate, as per state law provisions.

Instructions: Form PRO202 Instructions (.pdf)