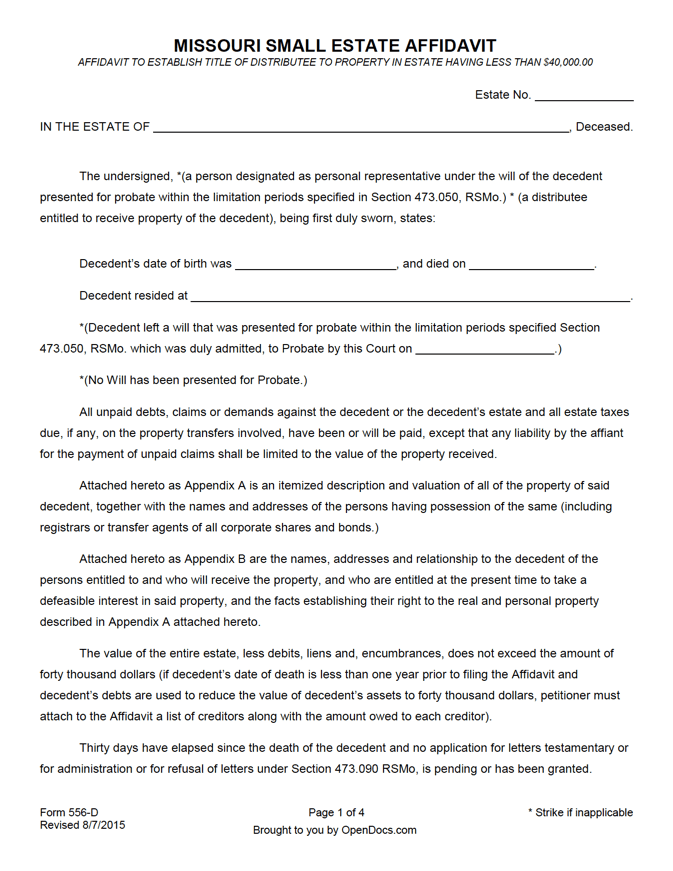

Missouri Small Estate Affidavit | Form 556-D

The Missouri Small Estate Affidavit (Form 556-D) gives a rightful heir (also called the “successor”) the means to collect the personal property from a person that recently died (the “decedent”). To be qualified as the successor, the heir must be stated in the will to receive property, or be the only remaining blood-relative to the decedent. State law, namely § 473.097, establishes the right for the qualified individual to obtain the small estate of a deceased Missouri resident “without awaiting the granting of letters testamentary or of administration.” The form is a total of four (4) pages. For the affidavit to be accepted, the successor will need to attend to several requirements, of which range from filing certain forms to verifying that specific mandatory acts have taken place.

Laws: § 473.097

Requirements

Maximum Estate Value: $40,000

Required Conditions:

- The person executing the affidavit must have legal grounds to be named a successor.

- The affidavit must only be filed thirty (30) days after the decedent’s death.

- The decedent’s death certificate must also be included.

- An itemized description and valuation of the property of the decedent must be affixed to the Affidavit (Appendix A),

- The names, addresses and relationship(s) to the decedent of all individuals who are “entitled to and who will receive, the specific items of property remaining after payment of claims and debts of the decedent” must be affixed to the Affidavit (Appendix B).

- It is mandatory for the certificate of the clerk to be annexed to or endorsed on the Affidavit. The certificate must show, “the names and addresses of the persons entitled to the described property under the facts stated in the Affidavit and shall recite that the will of decedent has been probated or that no will has been presented to the court and that all estate taxes on the property, if any are due, have been paid.”

- Once completed, both of the documents must be filed in the office of the clerk of the probate division and copies of the Affidavit and certificate must be furnished by the clerk.

- In cases where the value of the property is more than fifteen thousand dollars ($15,000), a notice must be published “in a newspaper of general circulation within the county which qualifies under chapter 493.” It must be published once a week for two (2) consecutive weeks. Proof of publication of notice must be filed not later than ten (10) days after completion of the publication. The notice must be in substantially the same form as that is provided by § 473.097(5).

- If there is a Last Will and Testament, it must be filed within one (1) year from the date of the decedent’s death and it must be the original will.

- A copy of the funeral bill and proof of payment is required.

- Mandatory processing fees must be paid to the Probate Division:

- Affidavit to Establish Title (Small Estate): $73.50

- Publication fee for assets totaling $15,000 to $40,0000: Columbia Tribune $70.00; Columbia Missourian $50.00

- The successor will need to verify to the Court that the property is only in the decedent’s name.

- A surety bond must be filed by the successor (the bond may be waived if certain conditions are met).

- All unpaid debts, claims or demands against the decedent or their estate, as well as any estate taxes due, on the property transfers involved must have been or will be paid.