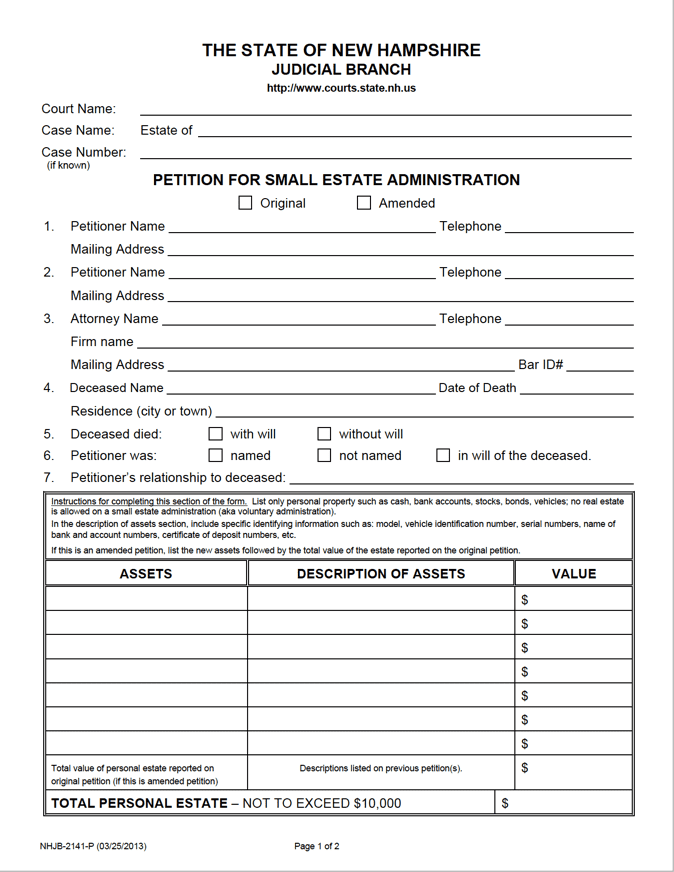

New Hampshire Small Estate Affidavit | Form NHJB-2141-P

The New Hampshire Small Estate Affidavit (Form NHJB-2141-P), also called the “Petition for Small Estate Administration”, is a legal form that enables a person to collect the estate of another person that recently died. The form is completed by a person known as the “Heir”, who collect the estate of the “Decedent”. The form can only be used if the estate is worth $10,000 or less. The process in which the affidavit is used is called the “Wavier of Full Administration”, which is an ideal way for an Heir to obtain the estate given its relative speed and low cost.

Laws: § 553:32

Requirements

Maximum Estate Value: $10,000

Required Conditions: There are several requirements that must be in place in order to use Form NHJB-2141-P to process a small estate claim. The circumstances which qualify are outlined in Section 553:32, as noted below:

If the decedent dies testate (with a will) and:

- In the will, the surviving spouse is a) named as the sole beneficiary of their estate and b) is appointed to be the administrator of the estate.

- In cases with no surviving spouse, and an only child is a) named in the will as the sole beneficiary of their estate and b) is appointed to be the administrator of the estate.

- Should there be no surviving spouse or child, a parent or parents is/are permitted to be the sole beneficiary/beneficiaries of the decedent’s estate and serve as the estate’s administrator/co-administrators.

- A trust created by the Decedent is named as the estate’s sole beneficiary, and the trustee is appointed to serve as an administrator or any appropriate person is appointed to serve as an administrator with the assent of the trustee.

If the decedent dies intestate (without a will) and:

- The surviving spouse is a) the sole heir and b) is appointed to the role of administrator of the estate.

- In cases with no surviving spouse, and an only child is the sole heir of the Decedent’s estate and is appointed to the role of administrator.

- Should there be no surviving spouse or child, a parent or parents is/are permitted to be the only heir(s) and become the administrator(s).

It is vital that the appointed administrator files the affidavit, “not less than 6 months or more than one year after the date of appointment of the administrator”. If they do not do so within this time frame the administrator will be in default.

Once the filing has taken place and the probate court has approved the affidavit, the administration of the estate will be complete.

Useful Resources

The New Hampshire Judicial Branch provides a useful resource called the Guide on Administering an Estate. It is a multi-page booklet divided into chapters that offers guidance to anyone who is considering claiming an estate in the state.

Any estate claims regarding real estate must be pursued by filing Form NHJB-2144-P in the Probate Court.