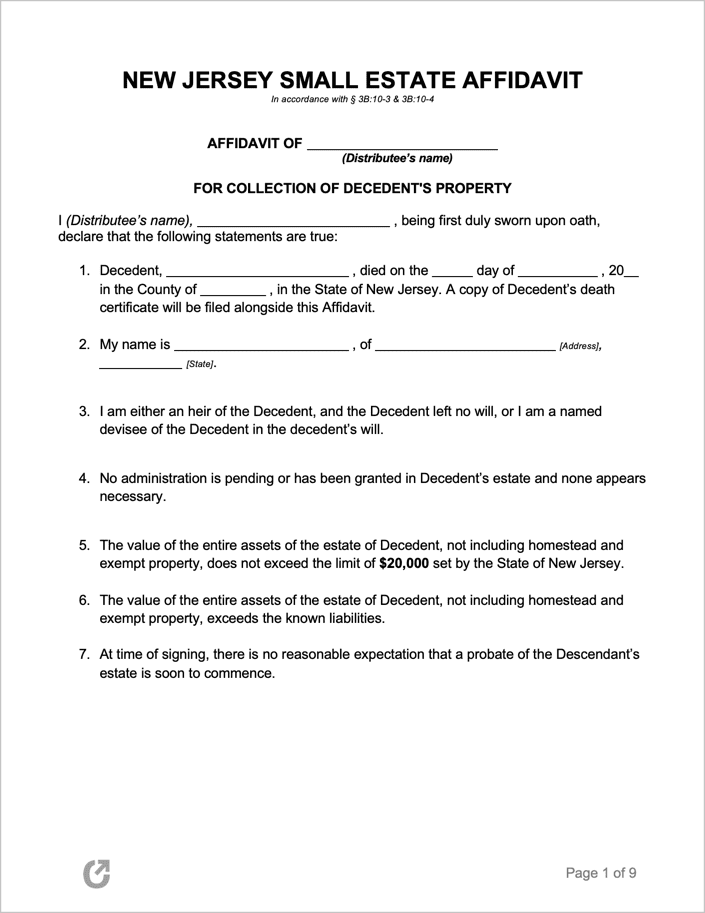

New Jersey Small Estate Affidavit Form

The New Jersey Small Estate Affidavit is an official legal document that is used for situations in which a family member dies (the “decedent”), and their estate needs to be collected and distributed by the rightful family member (officially known as the “affiant”). The affiant may either be a) a surviving spouse or domestic partner of the decedent or b) another individual qualified under state law to execute the affidavit. It should be noted that different legal guidelines apply depending on the nature of the affiant’s relationship with the decedent.

Requirements

Maximum Estate Value: For a surviving spouse or domestic partner: $20,000; For other heirs if there is no surviving spouse, partner in civil union, or domestic partner: $10,000.

Required Conditions:

1. For a spouse / domestic partner, the following requirements exist (as per 3B:10-3). The affidavit must:

- Be executed before the Surrogate of the county where a decedent without a will resided at their death. If the decedent resided outside of New Jersey, the execution must take place either before the Superior Court or where any of the decedent’s property is located.

- State the affiant’s position as the surviving spouse or domestic partner of the decedent.

- State the value of the decedent’s real and personal assets is within the state-mandated limit.

- State the “nature, location and value” of the decedent’s assets.

- Be filed and recorded in the office of such Surrogate or, if the proceeding is before the Superior Court, then in the office of the clerk of that court.

- Be signed and notarized by a Notary Public.

2. For other heirs if there is no surviving spouse or domestic partner, the following requirements exist (as per 3B:10-4):

- One (1) of the decedent’s heirs must have received written consent from the remaining heirs (if any).

- The affidavit must be executed before the Surrogate of the county where a decedent without a will resided at their death. In cases where the decedent was a nonresident of New Jersey, the form should be executed where any of the intestate’s assets are located, or before the Superior Court.

- The affidavit must note:

- The decedent’s residence.

- All heirs’ names, residences, and relationships.

- Specific identifying details about real and personal assets.

- The value of the assets, of which must not surpass $10,000.00.

- The consent and the affidavit shall be filed and recorded, in the office of the Surrogate or, if the proceeding is before the Superior Court, then in the office of the clerk of that court.

3. Whether a surviving spouse, domestic partner, or another qualified party, the affiant must file the affidavit along with a copy of:

- The decedent’s death certificate, will, codicils and related writings, and any trust agreements.

- Deed for the property listed in the affidavit.

- The Executor’s or Administrator’s certificate (letters of testamentary or of administration).

Real Estate

For estates involving real estate, Form L-9: Affidavit for Real Property Tax Waiver: Resident Decedent should be used.