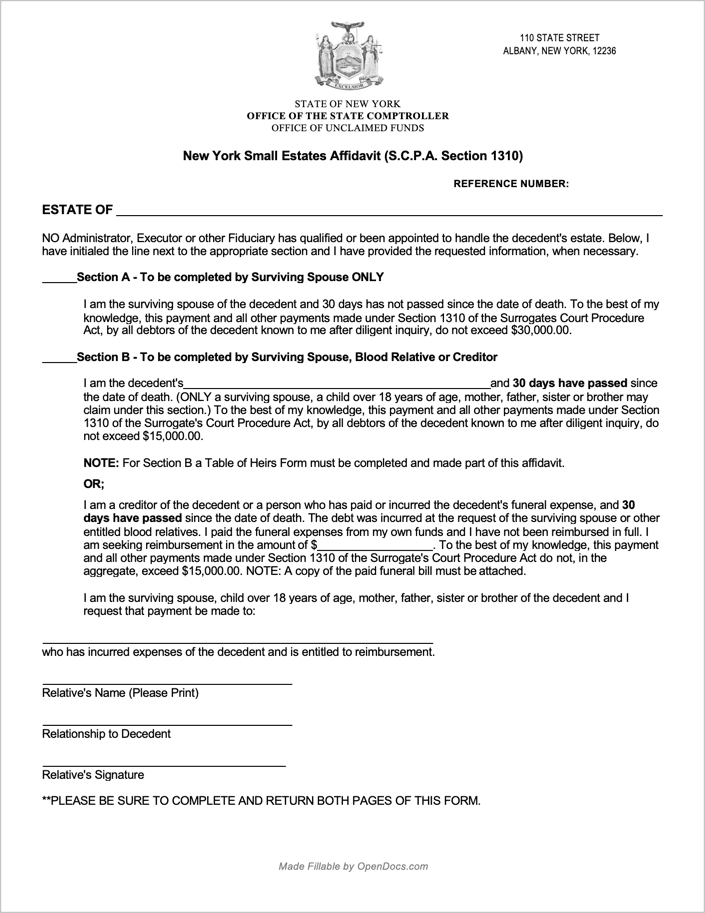

New York Small Estates Affidavit Form

The New York Small Estates Affidavit (officially referred to as an “Affidavit of Voluntary Administration”), is a form provided by the state of NY to allow an individual the means to collect the estate of a family member that recently passed away (the “decedent”). The person collecting the estate (the “Voluntary Administrator”) needs to be the designated claimant as stated by the decedent’s will or another rightful means.

Laws: §§ 1301 to 1312

Requirements

Maximum Estate Value: $30,000

Required Conditions: The form may be lawfully executed if:

- The estate is comprised of only personal property (although § 1302 provides that the decedent’s ownership of an interest in real property does not prevent the use of an affidavit in administering his or her personal property).

- The person who seeks to become the Voluntary Administrator of the decedent’s estate qualifies for this position under § 1303.

- The completed affidavit must be filed with the clerk of the court of the decedent’s domicile (home).

- A certified copy of the death certificate of the decedent must be filed with the clerk.

- The $1.00 filing fee that is charged for the clerk’s services must be paid.

Checklist

Small Estate Affidavit Information Checklist.pdf – Provided by the NY Unified Court System for assisting anyone wishing to execute an affidavit in the state to ensure it is done so correctly.