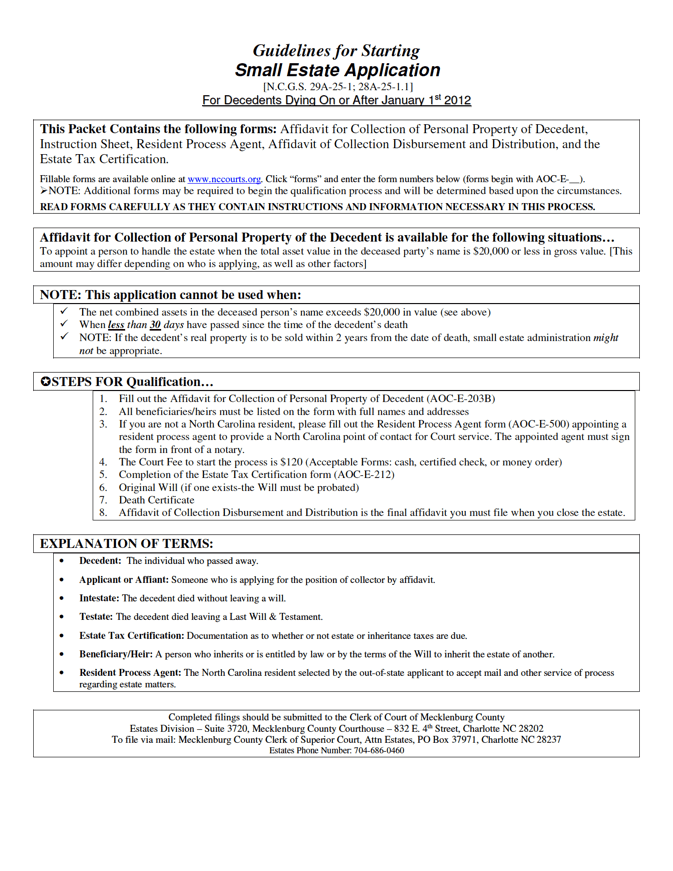

North Carolina Small Estate Affidavit | Form AOC-E-203B

The North Carolina Small Estate Affidavit (AOC-E-203B) is a form used for legally taking ownership of the estate (assets) of an individual who passed away. The form can be used only if the estate is valued at $20,000 or less. The two (2) page legal form, provided by the NC Administrative Office of the Courts, allows the individual who completed the form (the “affiant”) to approach anyone who is in possession of the decedent’s (person who passed) property listed in the affidavit to demand the payment, delivery, transfer, or issuance of the property. The types of items usually held by third (3rd) parties are typically non-material possessions such as savings accounts and other balances.

North Carolina law regarding affidavits is based upon whether or not the decedent left a will before passing away. If a will was left, the act of doing so is called “testate.” On the opposite hand, if a will was not left, it is called “intestate.”

Laws: §§ 28A-25-1 to 28A-25-7

Requirements

Maximum Estate Value: $20,000 (a surviving spouse may be entitled to a maximum of $30,000)

Required Conditions: State law permits the use of the form in cases where a decedent died intestate (without a will) or testate (with a will). The provisions § 28A-25-1 and § 28A-25-1.1 – 1 respectively outline the required conditions that the Affiant must abide by.

Requirements for both testate & intestate cases:

- It has been thirty (30) days since the passing of the decedent.

- The affidavit must concern either “tangible personal property or an instrument evidencing a debt, obligation, stock or chose in action belonging to the decedent.”

- The form includes the decedent’s a) name and b) residence at the time of their death c) date and place of their death.

- The petition for a personal representative has not nor will not be processed.

- A description of each part of the real property the decedent owned is sufficiently detailed (enough for identification purposes).

- Additional information, outlined in § 28A-25-1 (for intestate cases) and § 28A-25-1.1 – 1 (for testate cases), will be required if the Affiant is the surviving spouse who a) is entitled to the entirety of the decedent’s property, and b) wishes to collect the decedent’s property up to $30,000 in value.

- Before the affiant presents the completed affidavit to any party who is in possession of the decedent’s property, they must file it in the clerk of superior court’s office, of which must be located in the county where the decedent was residing at the time of his or her death.

Unique requirements for intestate cases (no will was created):

- The affiant’s name and address as well as the fact that they are, “the public administrator or an heir or creditor of the decedent.”

- The personal property left behind is within the value limit established by North Carolina law ($20,000).

- The names and addresses of anyone entitled, as per the Intestate Succession Act, to the Decedent’s personal property and their relationship to them (if any).

Unique requirements for testate cases (a will was created):

- The affiant’s name and address are included on the form, as well as the affiant is, “the public administrator, a person named or designated as executor in the will, devisee, heir or creditor, of the decedent,” according to NC affidavit law.

- The decedent died with a will that included personal property within the upper-value limit dictated by North Carolina.

- The fact that the decedent’s will has been:

- Admitted to probate in the court of the appropriate county.

- Recorded in each county where any real property owned by the decedent at the time of their death (the will must be duly certified).

- A copy of the decedent’s will is attached to the affidavit.

- The names and addresses of anyone entitled to the decedent’s property as well as their relationship to them (if any).