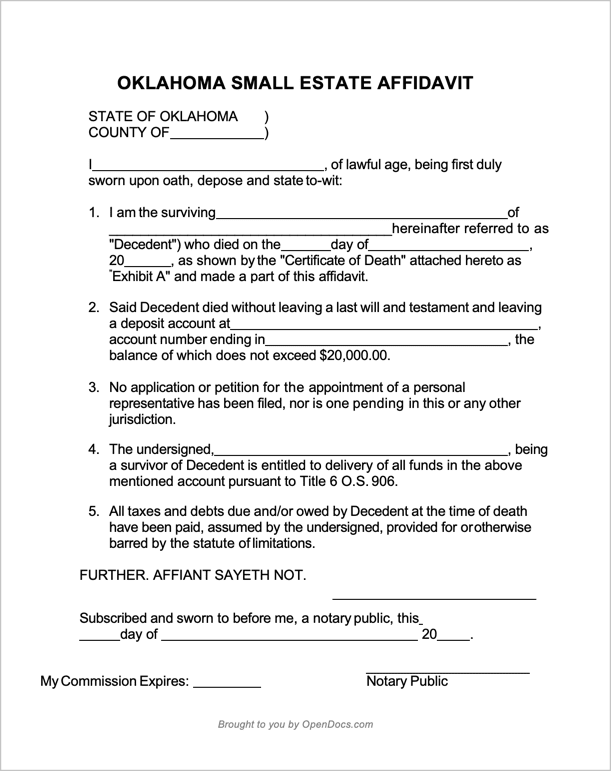

Oklahoma Small Estate Affidavit Form

An Oklahoma Small Estate Affidavit allows a surviving beneficiary to collect a deceased person’s possessions from entities currently holding them, such as a bank withholding a savings account.

The individual (the “successor”) completes this form when the decedent dies without leaving a last will and testament. Per state law, the successor must have a reasonable connection to them, such as being their spouse, child, or parent. Oklahoma requires beneficiaries to wait at least ten (10) days after the decedent’s death to complete a small estate affidavit. They cannot complete the form if the estate’s total value (assets minus liabilities) is $20,000 or less.

Laws: OS 58 § 393 | OS 6 § 906

Requirements

Maximum Estate Value: $20,000

Required Conditions: The following must occur for the successor to use the form:

- Ten (10) days since the date of the decedent’s death must have elapsed.

- A personal representative cannot be currently assigned, nor can there be a plan for one to start serving.

- The successor must have a valid reason to fulfill the role.

- The decedent’s taxes and debts related to the estate must have already been paid and/or accounted for.

- Specific conditions must be upheld to access any deposit made by the decedent in their bank or credit union or to access their safety deposit box in a bank or credit union. The conditions of these cases are outlined in OS 6 § 906.

Motor Vehicles

Small Estate Affidavit (Form 405) – This form must be completed to obtain a motor vehicle that is part of the decedent’s estate.