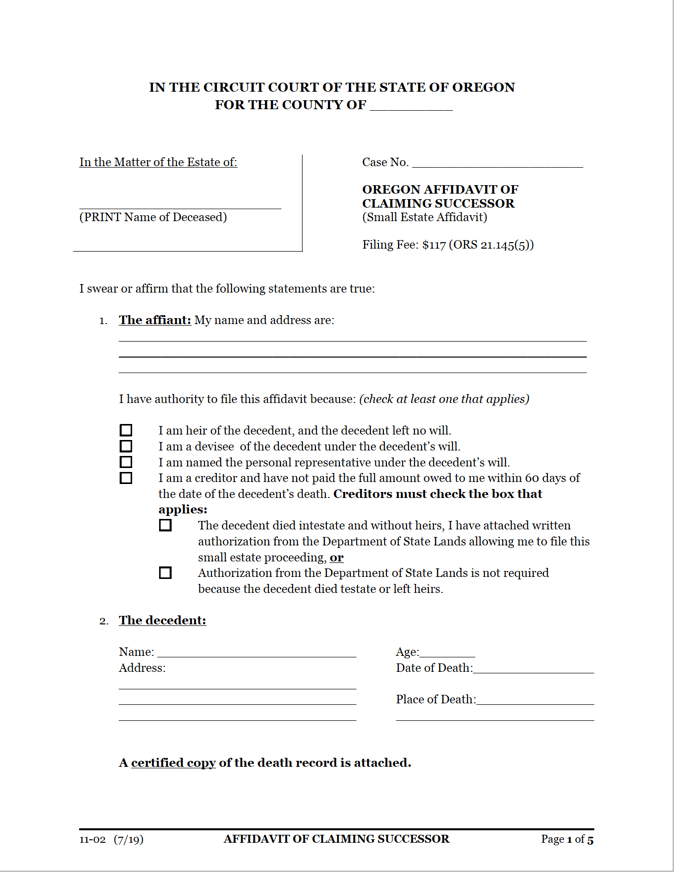

Oregon Small Estate Affidavit Form

The Oregon Small Estate Affidavit “Affidavit of Claiming Successor,” is a form that allows a person to collect the real and/or personal property that was owned by an individual at the time of their death. The form is completed by an heir, devisee, or creditor of an estate, allowing them to go around the more lengthy (and costly) probate process. The form can only be used in situations in which the deceased owned no more than $275,000 worth of possessions (after subtracting debts and other liabilities).

An “heir” refers to a party who has legal grounds to the estate, despite the decedent dying intestate (without a will). In contrast, a “devisee” refers to a party named in the decedent’s will, if they died testate (with a will).

Laws: §§ 114.505 to 114.535

Requirements

Maximum Estate Value: A combined total of $275,000—of which a maximum of $75,000 may be attributable to personal property, and a maximum of $200,000 may be attributable to real property.

Required Conditions:

- The shortest period a person may wait before filing an Affidavit is thirty (30) days since the decedent’s death.

- The Affidavit must include certain pieces of information, as established by § 114.525.

- The heir, devisee, or creditor must pay any fees imposed by the probate court for filing the affidavit.

Instructions

Instructions of Filing Small Estates.pdf – Created by the Oregon Judicial Branch to assist those planning on, or currently in the midst of, collecting an estate through the use of an affidavit.