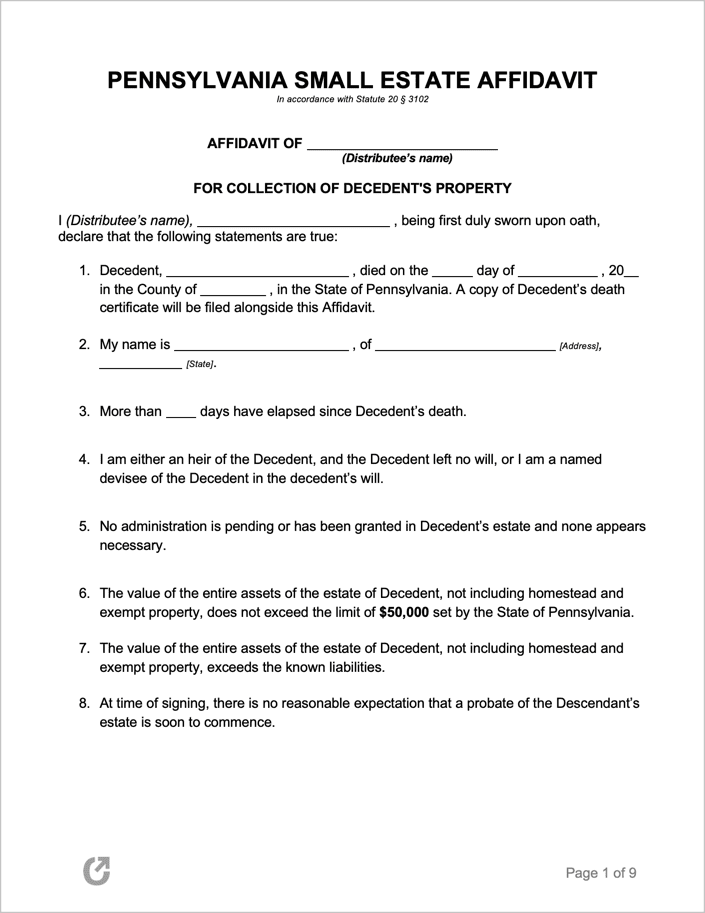

Pennsylvania Small Estate Affidavit Form

The Pennsylvania Small Estate Affidavit grants an individual (called a “petitioner”) with the power to retrieve the material and non-material assets of a Pennsylvania resident that passed away. With the exclusion of real property, the person completing the form may petition the court with the affidavit to transfer a deceased individual’s personal property into their possession. The court where this is required to be done must be in the same division as the county where the deceased individual (the decedent) lived at the time of his or her death.

Additionally, the small estate in question cannot have a total net value (liabilities subtracted from assets) of over $50,000 in order to use the form.

Laws: 20 § 3102

Requirements

Maximum Estate Value: $50,000

Required Conditions:

- The form must be filed a minimum of sixty (60) days after the decedent has passed.

- The affidavit must be filed in a court in the division of the county where the decedent lived when they passed.

- The affidavit can only be used for transferring personal property – it is unlawful to use the affidavit for the purpose of transferring real estate and other property.

- The petitioner must be qualified under state law to obtain the decedent’s property.

Claim Other Property Types

The affidavit provided for free only addresses the distribution of the decedent’s personal property. Other types of property may be claimed pursuant to relevant state laws (such as the provisions found in § 3101), noted in the table below:

| Type of Property | Maximum amount that can be claimed | State laws |

|---|---|---|

| Wages, salary, or employee benefits due | $10,000 | 20 § 3101(a) |

| Deposit account | $10,000 | 20 § 3101(b) |

| Patient's care account | $10,000 | 20 § 3101(c) |

| Life insurance payable to the estate | $11,000 | 20 § 3101(d) |

| Unclaimed property | $11,000 | 20 § 3101(e) |

Another consideration that should be kept in mind relates to the improper distribution of the estate. As 20 § 3102 states, any qualified party has the right to file a petition to revoke the court order regarding the estate if they have legal grounds to believe an improper distribution took place. They must make the petition within one (1) year of a court order pertaining to the distribution of the decedent’s estate.