Tennessee Small Estate Affidavit Form

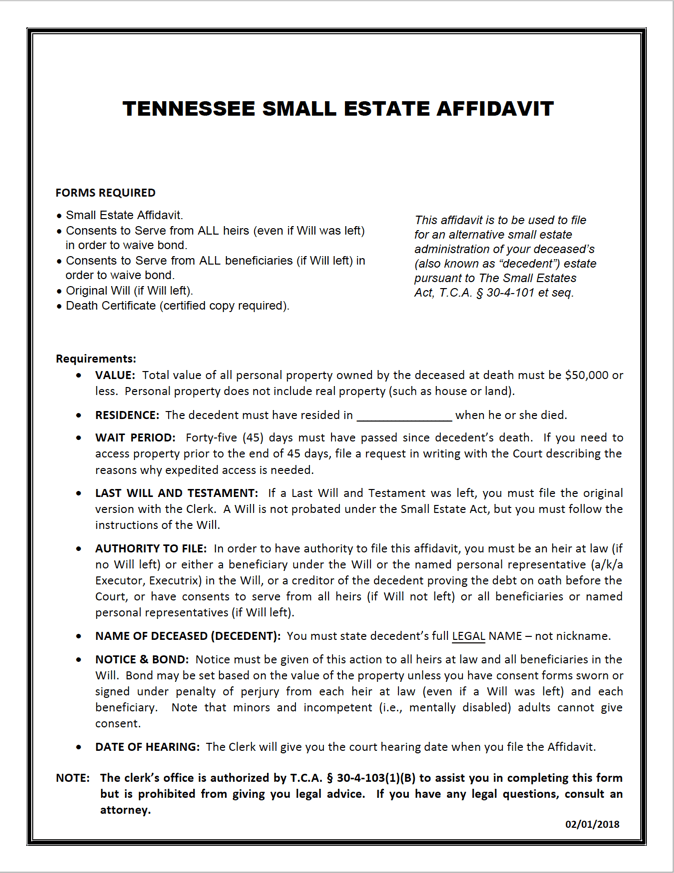

The Tennessee Small Estate Affidavit is a legal form that allows the surviving family of a person that passed away (the “decedent”) with a means of collecting their personal possessions. The form is fully compliant with the provisions found in Tennessee’s Small Estates Act. In comparison to the more standard probate process, the form is designed to make it simpler for an heir/legatee/devisee to claim their property as their own. In addition to a family member, a creditor who is owed part of the estate may use the affidavit to collect what is rightfully theirs.

In order to be valid, the form must be filed with the clerk of the court a minimum of forty-five (45) days after the death of the decedent, and the total value of the estate cannot be worth more than $50,000 (after subtracting debts and other liabilities).

Laws: §§ 30-4-101 to 30-4-105

Requirements

Maximum Estate Value: $50,000

Required Conditions: State law dictates that it is mandatory for:

- The filing of the affidavit to be held off until at least forty-five (45) days have elapsed since the decedent’s death.

- There to be no personal representative that is currently engaged in the estate proceeding (or planning to be).

- The person completing the form (formally referred to as the “affiant”) is required to be:

- a) An adult legatee or devisee or personal representative who was named in the decedent’s will (if a will was left).

- b) An heir or next of kin if no will was left.

- c) Any creditor who can prove that the decedent was indebted to them.

- The completed form to be filed with the clerk of the court.

- The form is compliant with the subjects outlined in § 30-4-103(1)(A) and § 30-4-103(1)(B).

- That the decedent’s will, if one exists, to be filed alongside the affidavit.

- The affiant to pay a processing fee to the clerk.

- The affiant to make bond payable to the state, if they are required to do so according to § 30-4-103(5) and § 30-4-103(6).