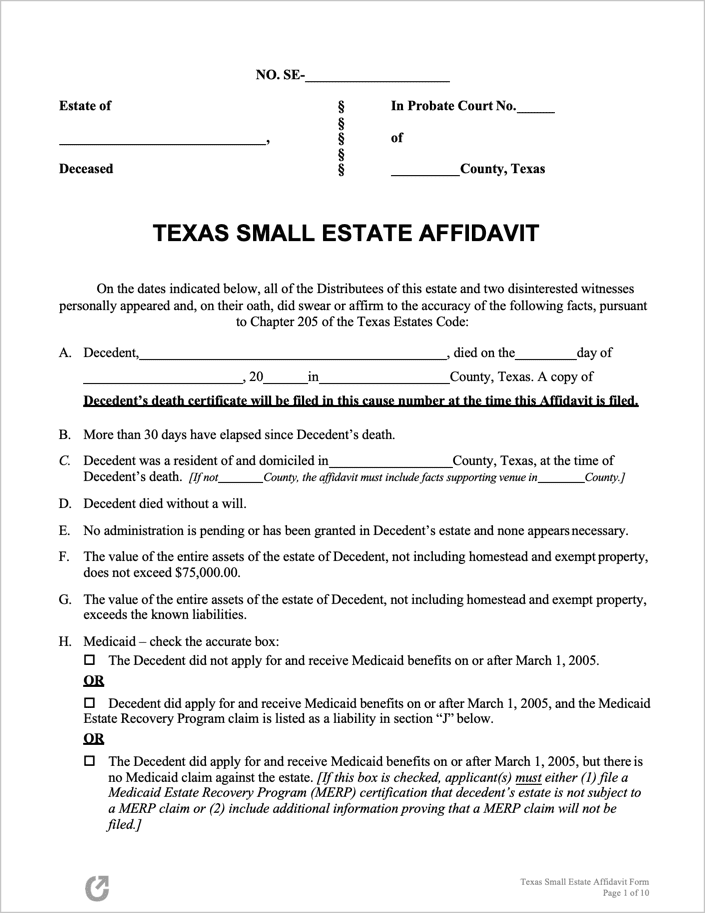

Texas Small Estate Affidavit Form

The Texas Small Estate Affidavit is a legal form that is used for lawfully acquiring the assets of a Texas resident (typically family) that passed away. It may only be filled out by a person known as the “distributee”, who is a person with the legal grounds to claim ownership of an estate. In order for the distributee to use the form, the total estate value must be $75,000 or less (assets minus liabilities). Additionally, the affidavit must be sworn to by two (2) witnesses upon its completion.

Laws: § 205.001

Requirements

Maximum Estate Value: $75,000

Required Conditions:

- It has been at least thirty (30) days since the decedent died.

- No personal representative has been appointed to manage the estate, nor is there a petition for their appointment.

- The affidavit upholds all of the requirements stipulated in Sec. 205.002.

- The affidavit is filed with the clerk of the court, of which must take place in the estate’s jurisdiction and venue.

- The judge must examine and subsequently approve the affidavit for use.

- The distributees are required to provide a certified copy of the affidavit to anyone who:

- Is indebted to the estate.

- Currently holds property tied to the estate.

- “Acts as a registrar, fiduciary, or transfer agent of or for an evidence of interest, indebtedness, property, or other right belonging to the estate.”