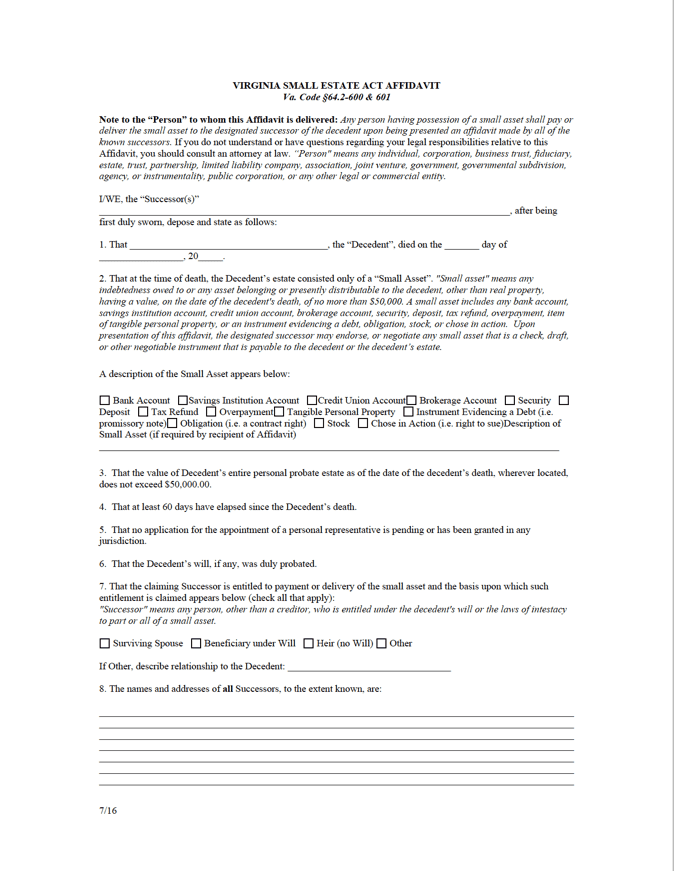

Virginia Small Estate Affidavit Form

The Virginia Small Estate Affidavit gives the surviving family of a recently deceased Virginia resident the means of retrieving their loved one’s belongings. With the form, the probate process can be skipped, saving the family both time and money. As noted by § 64.2-600, a “small asset” includes:

any bank account, savings institution account, credit union account, brokerage account, security, deposit, tax refund, overpayment, item of tangible personal property, or an instrument evidencing a debt, obligation, stock, or chose in action.”

Because many of the items highlighted by law above are unable to be collected unless the retrieving party has sufficient proof, the affidavit, once displayed, legally requires the entities holding onto the decedent’s assets to turn them over to the successor.

Laws: Virginia Small Estate Act (§§ 64.2-600 to 64.2-605)

Requirements

Maximum Estate Value: $50,000

Required Conditions: Virginia state law sets out various requirements for a successor to follow if they wish to file a Small Estate Affidavit (these requirements must also be stated in the affidavit):

- It has been a minimum of sixty (60) days since the death of the decedent.

- A personal representative may not be appointed or due for an appointment.

- If the decedent left a will, it must be duly probated.

- The successor must be qualified and in line with state law provisions to receive the small estate.

- All successors’ names and addresses must be recorded.

- The successor designated to collect the small asset on behalf of the other successors must have “a fiduciary duty to safeguard and promptly pay or deliver the small asset as required by the laws of the Commonwealth.” That is, unless they qualify to be discharged from this duty in accordance with § 64.2-601(B).