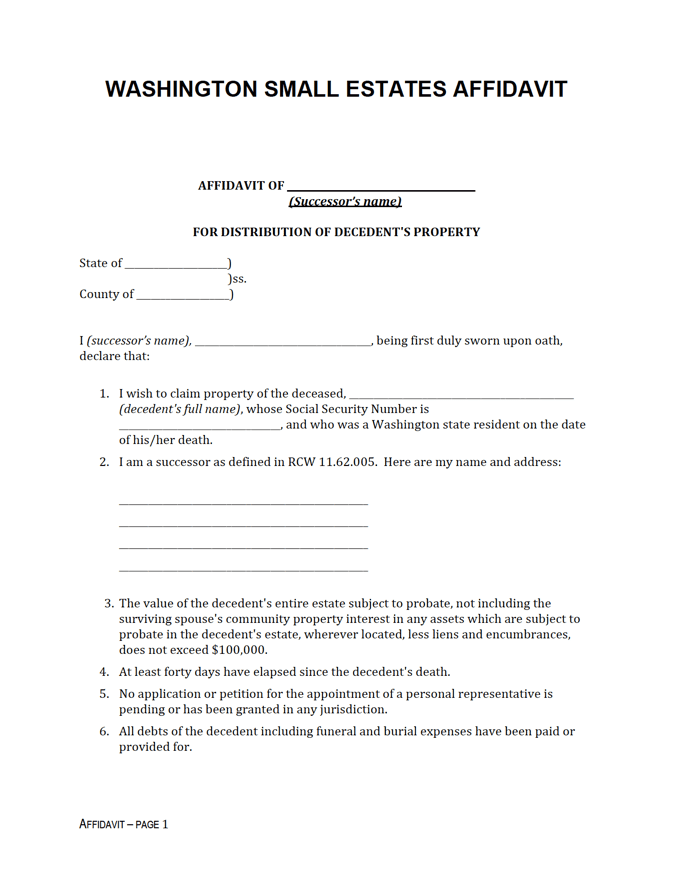

Washington Small Estate Affidavit Form

The Washington Small Estate Affidavit is a means of retrieving the property of a blood relative that passed away (a person known as the “decedent”). The form is used to receive the decedent’s personal property from any party who is either a) holding the personal property, or b) indebted to them. The estate as a whole cannot be valued in excess of $100,000 in order to use the form as a means of estate resolution. Furthermore, WA law requires that the affidavit may only be executed after the decedent has passed for a minimum of at least forty (40) days.

Laws: RCW 11.62.010

Requirements

Maximum Estate Value: $100,000

Using the Form: After a minimum of forty (40) days have passed since the decedent’s death, the affidavit may be presented to any relevant parties. It is necessary for a copy of the affidavit, of which must include the decedent’s social security number, to be mailed to the state of Washington, Department of Social and Health Services, Office of Financial Recovery.

Guide

Do-It-Yourself Affidavit Procedure for Small Estates.pdf – Provides a step-by-step procedure of using the form, information on who is qualified for completing the form, answers to common questions, and a host of other information relating to collecting estates in Washington.