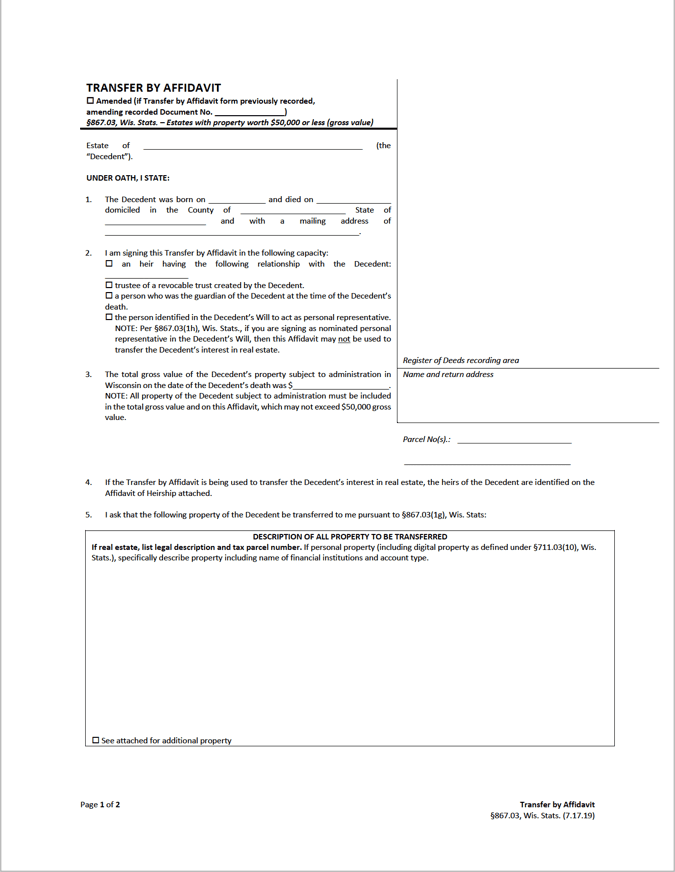

Wisconsin Small Estate Affidavit Form

The Wisconsin Small Estate Affidavit “Transfer by Affidavit” is a legal document that is used to transfer the estate of a person that died to another individual, who is typically related by blood. The form provides an alternative to the probate process, which is a notoriously lengthy and complex process. Any heir, trustee, or guardian of the decedent, or a personal representative who is named in the decedent’s will, is qualified under WI law to use the affidavit. The purpose of the form is to legally empower the parties to acquire the portion of the decedent’s estate that they are lawfully owed. When filling out the form, it should be kept in mind that the mandatory guidelines (as found below) must be respected, otherwise, the offending party could be in breach of state laws.

Laws: § 867.03

Requirements

Maximum Estate Value: $50,000

Required Conditions: A party permitted under state law to use the document must ensure that:

- The affidavit includes a statement describing the property in question. The value of the property to be transferred, as well as the total value of any property subject to administration, should be noted.

- As per § 867.03(1g)(c), the affidavit must state if the decedent or their spouse received services under the following situations, if it was provided as a benefit:

- A long-term care program

- Medical assistance

- Long-term community support services

- Aid

- The restrictions for a personal representative to claim the decedent’s property are respected, as outlined by § 867.03(1h) and § 867.03(1j).

- Any notices required by law must be executed, as provided by § 867.03(1m) and § 867.03(1p).