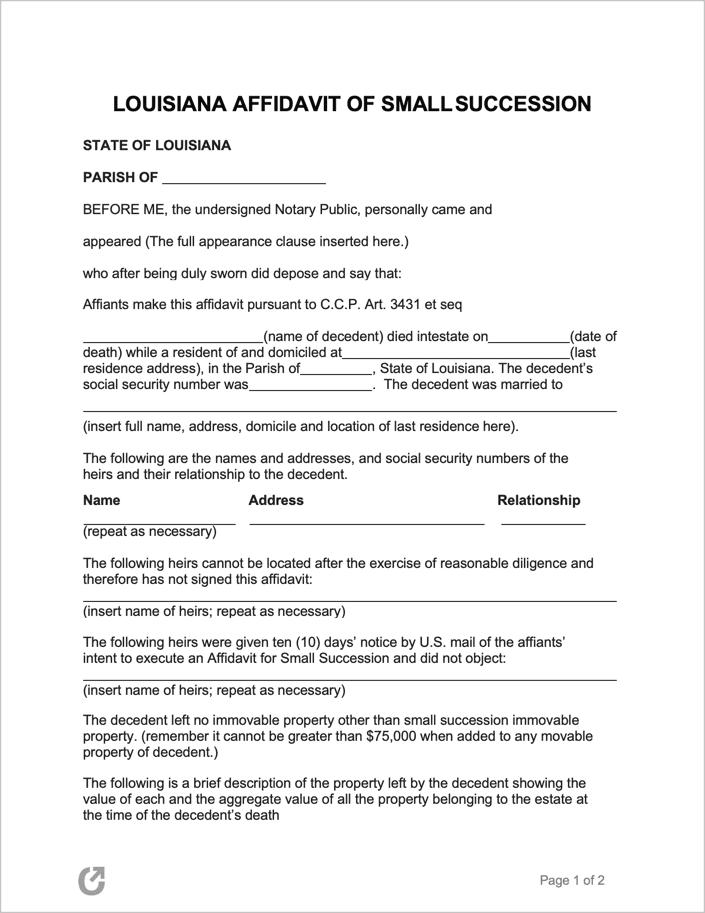

Louisiana Affidavit of Small Succession

A Louisiana affidavit of small succession transfers a deceased individual’s assets (estate) to their rightful heirs. This document is tailored to local laws, providing an alternative to the often lengthy and complex probate process for estates valued at less than $150,000, assuming all criteria set forth by the state’s small succession laws are met.

Per CCP 3431, eligible filers of this affidavit include a) descendants, b) ascendants, c) siblings or their descendants, d) the surviving spouse, and e) legatees named in a will legally recognized in another state. In some cases, the public administrator appointed by the governor may also file this affidavit.

Laws: CCP 3421 to CCP 3434

Requirements

Maximum Estate Value: $125,000

Eligible Filing Parties:

- The decedent’s descendants and ascendants.

- Siblings or their descendants.

- The surviving spouse.

- Legatees mentioned in a testament verified by a court.

Document Specifications: The affidavit must contain sections mandated by CCP 3432.

Notarization Requirement: A qualified official must notarize the affidavit, affirming its authenticity.

Recording Obligations: As stipulated in CCP 3434, attaching a certified copy of the deceased’s death certificate to the affidavit is necessary. These documents require formal recording, starting at most ninety (90) days following the individual’s passing.