Maryland Motor Vehicle Bill of Sale Form

A Maryland motor vehicle bill of sale form defines the limits of a car transaction between two (2) parties. The buyer can use it to show they lawfully purchased a vehicle, while the seller utilizes the form to prove their release in liability for it. If anything happens to the car after the sale, the previous owner is not responsible for repairs or costs associated with it. However, they are accountable if they allow the new owner to use their license plates. For this reason, the seller must remove the plates before giving the keys to the buyer.

|

What is a Maryland Car Bill of Sale?

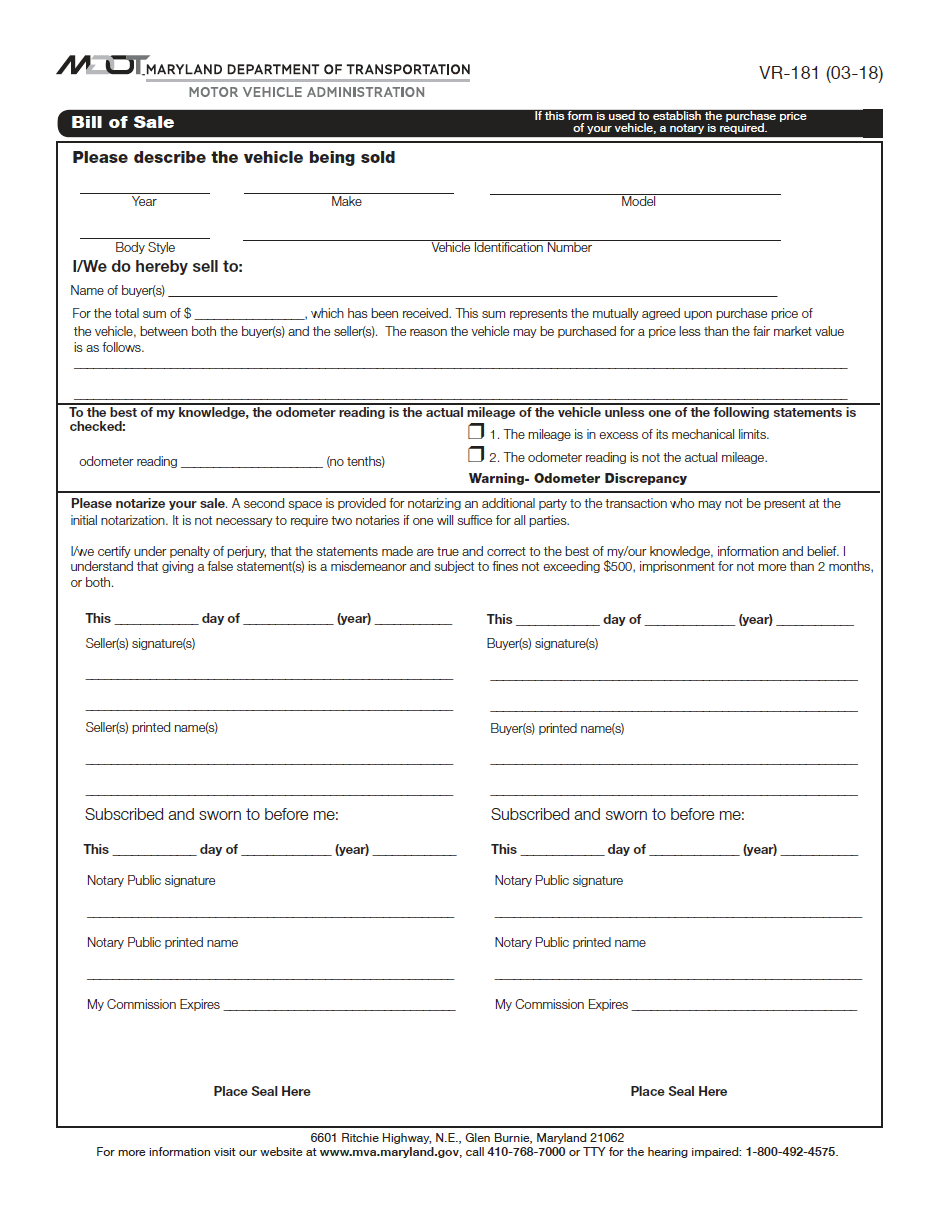

A Maryland car bill of sale gives residents a state-provided form to record their vehicle transfers. They must use the document (Form #VR-181) for the Maryland Motor Vehicle Administration (MVA) to accept it as proof of sale and ownership. It requires the buyer and seller to provide the car’s year, make, model, body style, vehicle identification number (VIN), purchase price, date of the sale, and the odometer reading. Both individuals must visit a notary public to present their identifications (IDs) and sign their names.

What are the Buyer’s Tasks?

Buyers should make themselves aware of Maryland’s private sale policies before purchasing. The state, or Motor Vehicle Administration (MVA), does not regulate non-dealership transactions. In other words, buyers cannot contact for matters involving legal actions, warranties, or consumer rights.

Since the state does not protect private buyers, the interested person should ensure it fits their standards. In many cases, the purchaser has a mechanic inspect the vehicle before purchasing. This step ensures the car does not have major, costly issues impacting its value.

Purchasers should not carry out a deal without a completed title. If the seller cannot present the title as required, both parties must complete a bill of sale (Form #VR-181) with the required information and have it notarized. In addition, the state requires it if the vehicle is seven (7) years old or newer and sold for less than the book value. Buyers should always obtain the original title and/or security of interest filing as they do not accept copies.

What are the Seller’s Tasks?

The seller must follow state laws when selling, gifting, or donating their vehicle. Before transferring the car, they must have the original, untampered title in hand. Illegible, damaged, or stolen documents require the owner to apply for a duplicate (Form #VR-018).

Buyers and sellers cannot exchange the title until they complete the section called “assignment of ownership.” It must contain the seller’s printed and signed name, the buyer’s name and address, the odometer reading, the sale price, and the date of the purchase. If the title does not include this information, both parties can provide it on a notarized bill of sale (Form #VR-181) instead. The seller must also submit a security of interest filing form to prove they paid off the vehicle before transferring ownership.

Individuals cannot sell their vehicle to another person with their license plates. Instead, they must return their plates to the MVA or transfer them to another car before canceling their insurance plan. If they cancel insurance before returning or reassigning their plates, the state immediately assesses a $150 fine.

If the seller moves out of the state, they must inform the MVA and send the required documentation. The forms include 1) a copy of the registration from the titling state, 2) the titling date in the current state, 3) the Maryland tag and title number, and 4) the insurance policy information (i.e., the start and end dates of the policy if the person did not yet title it out of the state).

How to Register a Car in Maryland (6 Steps)

New residents must register and title their car within sixty (60) days of moving to Maryland. Owners who do not apply for documentation within this time frame lose their tax credit eligibility on the titling tax paid in another state. The MVA also assesses a citation for having an out-of-state registration.

If a person had an in-state title, then moved to another state before moving back to Maryland, they must hand in their out-of-state title to the MVA. Then, they must apply for a duplicate Maryland title (Form #VR-018).

Step 1 – Inspection

Vehicle owners must have their car inspected before registering and titling it. The safety inspection must occur through a licensed Maryland inspection station (i.e., a car dealership, service station, or specialized automobile service center).

The resident must have their vehicle inspected within ninety (90) days of titling it. Examiners provide an inspection certificate in which the owner must present the MVA. The certification’s vehicle identification number (VIN) must match the car’s label and ownership documents. Individuals cannot provide certificates with crossed-out information, whiteout, or any other alterations as the state does not accept tampered documents.

If someone purchases a used vehicle and cannot transport it to the inspection station, they must request a thirty (30)-day temporary registration. This document allows them to transport the car legally and/or have the necessary repairs performed. Residents can only request a short-lasting registration once; therefore, they must schedule appointments and plans ahead of time to ensure they have enough time to carry out the required tasks. In this case, the examiner provides the individual with a temporary inspection waiver (Form #VR-129) in exchange for a $20 fee.

Step 2 – Excise Titling Tax

Maryland charges residents a one-time excise titling tax on the car’s purchase price. Owners automatically pay this tax upon purchasing their vehicle through a dealership. Dealers calculate the amount based on the car’s worth and processing fees.

The MVA sets a 6% excise tax for residents who purchased their vehicle through a private seller. Owners must verify the deal by presenting a notarized bill of sale (Form #VR-181) and other required documents, such as an official publication of car values with the assessment.

The state can adjust the taxes based on the mileage, especially if the car has a lower or higher odometer reading than average. They also assess vehicles seven (7) years or older by the purchase price or minimum book value ($640) – whichever amount is greater.

Step 3 – Insurance

All vehicles within state borders must have a valid insurance policy. The MVA assesses a penalty of $150 to uninsured motorists for the first thirty (30) days. After this time, the individual receives a $7 charge for each day after that with a maximum of $2500.

The state redirects individuals to the Central Collections Unit (CCU) if they do not respond to the insurance notifications. The CCU can impose fines up to 17% and take away the owner’s income tax return.

Car owners moving to Maryland who wish to continue insurance coverage from their previous state must contact the company or agent to notify them of the transfer. The business or representative must have a valid Maryland license. If they do not, the person placing insurance on the vehicle must obtain a policy from another licensed entity.

The coverage must include $30,000 for the bodily injury of one (1) person, $60,000 for the injury of two (2) or more people, and $15,000 for property damage.

Step 4 – Title

The titling process differs for new and used vehicles. Owners must provide documents based on the procedures for their specific situation. Titling must happen before registration can occur.

Used Vehicles

After purchasing a used vehicle, the owner must title it by submitting the required documents to their nearby MVA branch office or service center. The forms include:

- Proof of Ownership. The buyer must provide the current Maryland title assigned to them by the seller. The completed document functions as the application for titling and registration. If the owner bought the car in a non-title state, they must provide the registration and bill of sale (Form #VR-181) instead.

- Application. Owners who have possession of a title signed over to them do not need to fill out a title and registration application. Instead, they can use their completed title as the application. If the individual cannot provide the title, they must submit a certificate of title (Form #VR-005) and proof of insurance.

- Purchase Price Proof. Maryland accepts bill of sales (Form #VR-181) signed by the buyer and seller as verification of the purchase price. A notary public must witness the signing if the car is less than seven (7) years old, the selling price is $500 more or less than the book value, or the buyer decided to base the excise tax (6%) on the sale price rather than the book value.

- Odometer Disclosure Statement. When completing the title, the seller must include the mileage in the respective areas. They must provide a separate odometer disclosure statement (Form #R-197) if they cannot enter the details into the title.

- Inspection Certificate. Per state law, the owner must provide the official Maryland Safety Inspection Certificate indicating the car’s approval. The inspection must occur within ninety (90) days of titling and registering the vehicle.

- Lien Information (Optional). The application must include the lien’s contact details if the title has a loan. If two (2) liens exist, the state requires a security interest filing statement (Form #VR-217). The state requires a lien release when the owner pays off the lien.

- Power of Attorney (Optional). A limited power of attorney (Form #VR-470) is only required if the buyer or seller wants someone to take their place when handling vehicle-related matters. The owner must establish the boundaries the agent must abide by when buying, selling, or registering the car.

New Vehicles

Generally, dealers handle the titling and registration for the customer after purchasing a car. They provide them with a bill of sale (Form #VR-181) and temporary cardboard or permanent metal license plates. The new owner receives the official title certificate once the dealership mails it to them. If a lien exists, the dealer sends the security interest filing statement (Form #VR-217) to the lienholder.

Out-of-state dealers usually do not handle titling and registration for the owner. Therefore, they must provide the MVA with the application (Form #VR-005), insurance policy, certificate of origin, bill of sale (Form #VR-181), odometer disclosure statement (Form #R-197), and fees. In some cases, they may also need to provide the lien information and/or a power of attorney.

Gift

An owner can only gift a vehicle to an immediate family member. If both parties have a different last name, they must provide proof of their relationship. Maryland law requires the new owner to provide a gift certification (Form #VR-103) when titling and registering the vehicle. Aunts, uncles, nieces, and nephews of the original owner must also provide a certified statement (Form #VR-299).

The vehicle does not need inspection when the transaction occurs between spouses or parents and children. Otherwise, the new owner must have it inspected in their name.

The license plate can transfer between two (2) spouses or a parent and child if both names exist on the title. Individuals can also give their license plates to parents or children without their names on the title. Aside from these specific circumstances, other owners must obtain a new license plate and pay the transfer fees.

If the vehicle has an active lien, the seller must call customer service at 1-410-768-7000.

Step 5 – Register

The owner must title their vehicle before registering it. They must make an appointment with the MVA to provide the necessary documents and payment.

Unless otherwise specified, the owner must obtain a new license plate by checking the appropriate box on the registration application.

Bring the Following:

|

Step 6 – Renew

Maryland vehicle registrations last for two (2) years. They must send the required information before their card expires. The state allows renewals using the following methods:

- Online;

- By telephone (1-410-768-7000);

- At a kiosk;

- Via the mail;

- Through visiting a county treasurer’s office; and

- By making an appointment with a title service agent.

If the individual has issues with their insurance or other MVA legal matters to manage, they cannot renew by mail or virtually. Instead, they must visit a full-service location. They must also settle outstanding parking tickets with the district that charged them (i.e., not the MVA).

After renewing, the owner should receive their registration card and sticker within ten (10) days. In the meantime, they can use the temporary sticker to verify their information.

| Mailing Address: |

| Motor Vehicle Administration 6601 Ritchie Highway Glen Burnie, MD 21062 |