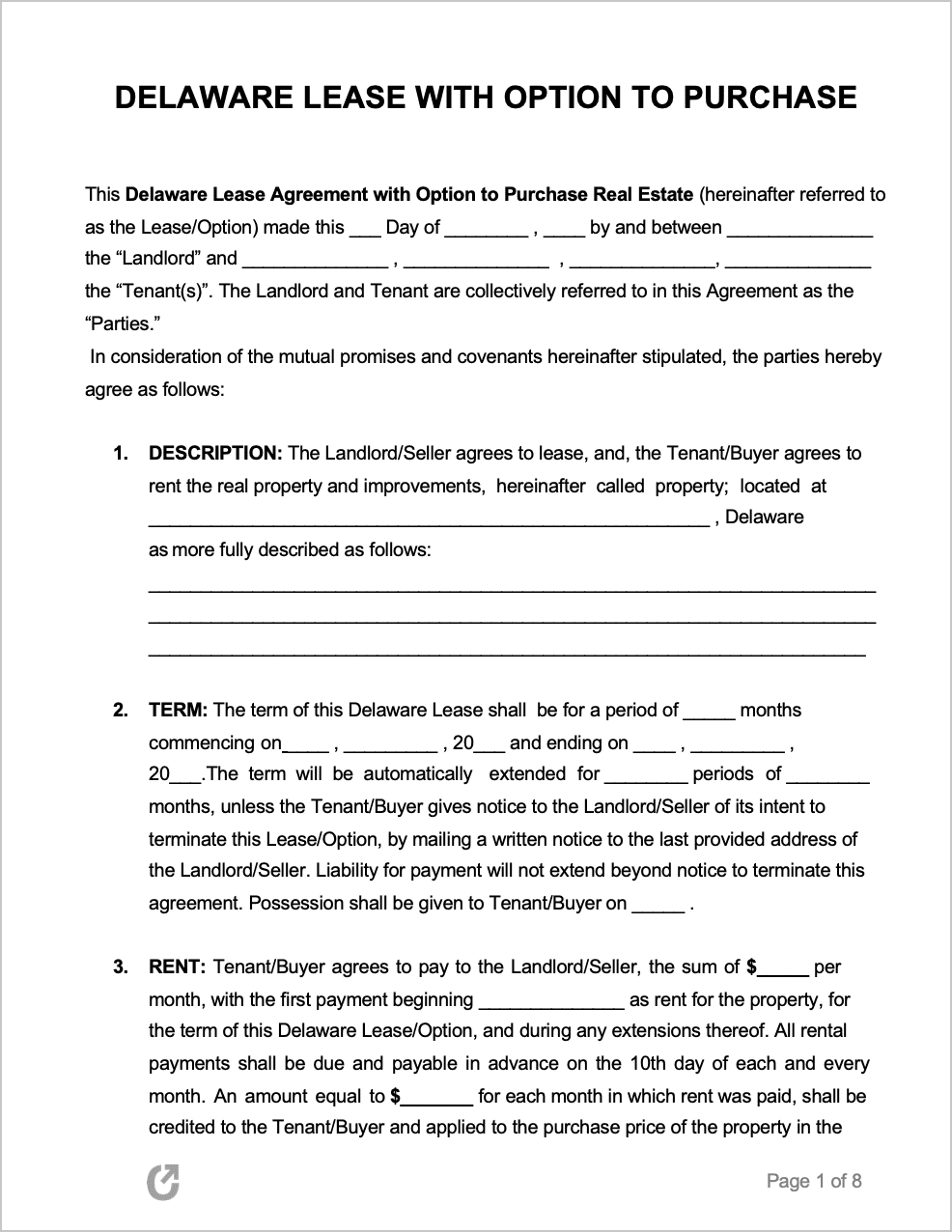

Delaware Lease to Own Agreement

The Delaware Lease to Own Agreement is a versatile contract that serves as both a residential lease agreement and a purchase agreement, often referred to as an “Option to Purchase.” This type of agreement is ideal for individuals who lack the upfront capital to buy a home outright or those who want to experience living in the property as a rental before committing to purchasing it. It’s crucial to understand that entering this contract does not obligate tenants to buy the property, as the “option” allows them to decide whether or not to proceed with the purchase at the end of the lease term.

Pros and cons of a lease-to-own agreement in Delaware:

Pros:

- Provides a trial period for tenants to determine if the property is a good fit.

- Allows time for tenants to improve their financial situation or credit score.

- A portion of the rent may be applied towards the purchase price.

Cons:

- Potentially higher rent payments compared to standard rental agreements.

- Tenants may lose the option fee or rent credits if they decide not to buy the property.

- Property value fluctuations may impact the purchase price or the tenant’s decision to buy.