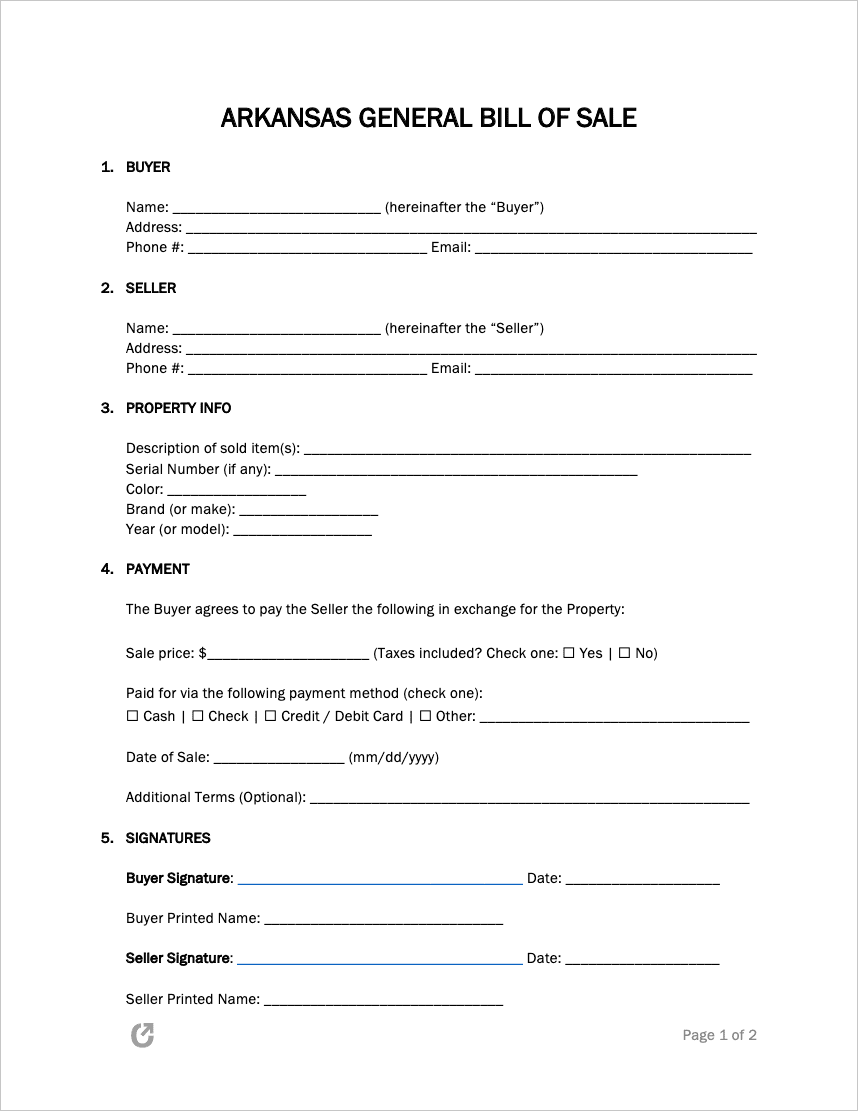

Arkansas General Bill of Sale Form

An Arkansas general bill of sale form represents a compromise between a buyer and seller. It signifies that both parties agreed on an item’s price, mode of transfer, and payment method. Individuals should opt for a generic bill of sale form when the property does not fall under an existing category. Buyers and sellers often use this document for family heirlooms, electronic games, cameras, and other miscellaneous objects.

| Signing Requirements: The signatures of the buyer and seller are necessary. |

What is an Arkansas General Bill of Sale?

An Arkansas general bill of sale supplies two (2) residents with documentation for transferring a nonexclusive item. It summarizes the transaction by outlining the main points. The topics include a description of the property, its value, and the amount the buyer paid.

Both parties should also consider how they plan to conduct the exchange and/or tours. Individuals living close to one another normally meet in person to make the transfer. However, the terms of the agreement can change if they live hours away from each other. Neither party should not exchange property or funds until they sign the bill of sale in person. This process ensures that the buyer pays the seller, and the seller gives the buyer the item.

Frequently Asked Questions (FAQ)

Learn more about Arkansas bill of sale forms by referring to the inquiries below.

1. How to Write a Bill of Sale in Arkansas

First, the buyer or seller must print or download the bill of sale form. Then, each person enters their name, address, phone number, and email.

In the next section (called “property info”), the merchant writes a description of the item and other applicable information, such as its serial number, color, make, or model.

The “payment” passage must contain the item’s sale price, taxes, payment method, date of the sale, and additional terms.

After documenting the information, the buyer and seller sign the form. Although a general bill of sale does not require notarization, both parties can have it done for further verification. They would wait to sign until in front of a notary public in this case.

2. Is a Bill of Sale Required in Arkansas?

Arkansas does not require residents to use bill of sale forms. The only exception to this rule is if the seller claims a vehicle or trailer as a tax credit, then uses the funds to buy a replacement. The revenue office handles tax and car-related matters of this kind. Even if this situation does not apply, residents should highly consider a bill of sale to verify the purchase.

3. Does an Arkansas Bill of Sale Have to Be Notarized?

Arkansas bill of sale forms do not require notarization. Nonetheless, buyers and sellers can have the document notarized. Notaries verify that both parties conducted the trade fairly and equally. State or government officials, judges, and companies are more likely to accept forms with a licensed party’s stamp, seal, or signature.

4. How Many Witnesses are Needed on an Arkansas Bill of Sale?

The state does not require witnesses to observe the buyer or seller’s signatures. However, the people involved can request a witness if they wish to do so. Overall, the form and transaction appear more authentic with a third party’s approval. The witness must provide their full name, contact information, and signature.