Arkansas Bill of Sale Forms (5)

An Arkansas bill of sale form confirms the sale of an item from one party to another. It is essential for both the buyer and seller to disclose all relevant details of the deal, as this information helps protect both parties from potential legal disputes in the future. The parties agree to all terms and conditions upon signing the form and accept responsibility for the content provided.

Summary

|

Types (5)

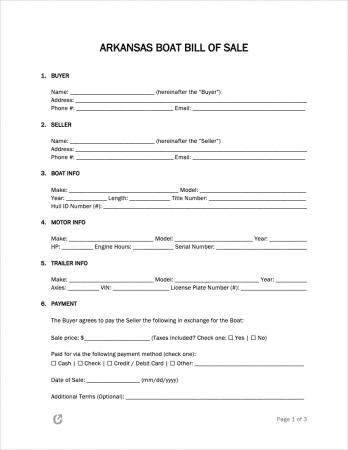

Boat Bill of Sale – This form proves that the owner legally possesses a boat.

Boat Bill of Sale – This form proves that the owner legally possesses a boat.

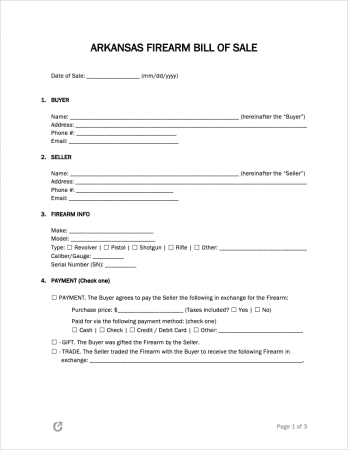

Firearm Bill of Sale – This document informs others of an individual’s gun ownership.

Firearm Bill of Sale – This document informs others of an individual’s gun ownership.

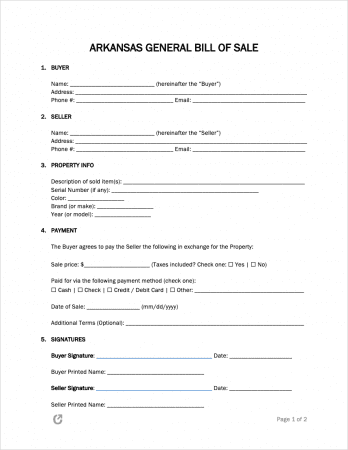

General Bill of Sale – Serves as a guide for how the transaction of a non-specific item transpired between two individuals.

General Bill of Sale – Serves as a guide for how the transaction of a non-specific item transpired between two individuals.

Download: PDF

|

Trailer Bill of Sale – Records the happenings of a deal for a tow behind between a buyer and seller.

Trailer Bill of Sale – Records the happenings of a deal for a tow behind between a buyer and seller.

Signing Requirements

| Bill of Sale Type | Buyer Signature | Seller Signature | Notarization |

| Boat | Required | Required | Not required |

| Firearm | Required | Required | Not required |

| General (others) | Required | Required | Not required |

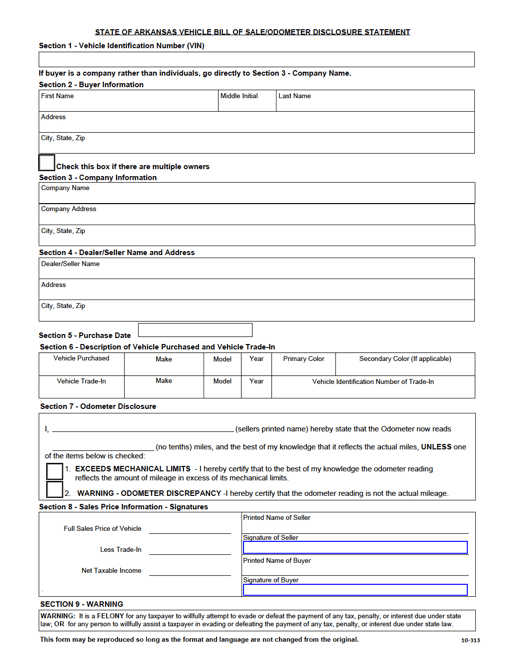

| Motor Vehicle | Required | Required | Not required |

| Trailer | Required | Required | Not required |

What is an Arkansas Bill of Sale?

An Arkansas bill of sale records the agreement between two parties by outlining the terms of the ownership transfer. This form specifies the item’s condition and its value at the time of the sale. Both parties must provide an accurate valuation, even in cases where the owner gifts it to the new owner. The state may require additional forms in this scenario.

Each party involved should retain a copy of the bill of sale to maintain a transfer history. The new owner may need the document for registration purposes, proof of ownership, or when reselling the item. It is advisable to securely store the bill of sale, as obtaining a replacement can be challenging, especially if the previous owner is unreachable. Safeguarding the document also helps prevent legal issues if someone wrongfully claims the item as lost or their own by stealing the bill of sale.

Registration Forms: Boats

Owners must present registration documents and fees to a state revenue office.

|

Registration Forms: Firearms

Arkansas gun owners do not need to register their guns or obtain a permit to carry or buy. Nevertheless, individuals can decide to get a license to open and concealed carry in additional locations. They must bring the following forms to an Arkansas state police headquarters location.

|

Additional (Optional) Documents

- Change of Name and/or Address Notification Form – Used for replacing a concealed handgun carry license after moving or changing a name.

- Lost, Destroyed, or Replacement License Request Form – For individuals with a concealed handgun carry license who have lost or destroyed it.

Registration Forms: Vehicles

Set up an appointment with a Department of Finance (DFA) office to register a car in the state or use the online service.

|

Additional (Optional) Documents

- Arkansas Motor Vehicle Power of Attorney – This form appoints a person to make automobile-related choices for another person.

- Lien Contract / Security Agreement – Needed if a lienholder holds the title.

- Personal Property Tax Number (PPAN) – Assigned by the county assessor.

- Proof of Paid Taxes – Verification of taxes paid by October 10th of the year before.

- Official Release of Lien (Form 10-315) – A lienholder completes this form when the owner pays off the loan or requests a replacement title.

- Tax Assessment – A form proving that a county assessor has appraised the car or has plans to in the future.

Registration Forms: Trailers

Bring the necessary forms and payment to a DFA office for trailer registration.

|