California General Bill of Sale Form

A California general bill of sale form constitutes the removal of ownership for a non-specific item. The seller, or the person relinquishing possession, completes the document to cease liability. In turn, the buyer legally obtains control and responsibility for the property. If unexpected damages or issues happen after the transaction, the new owner cannot blame the seller. Since they own the item, they must handle all costs and requirements, such as repairs, disposal, or state-issued mandates.

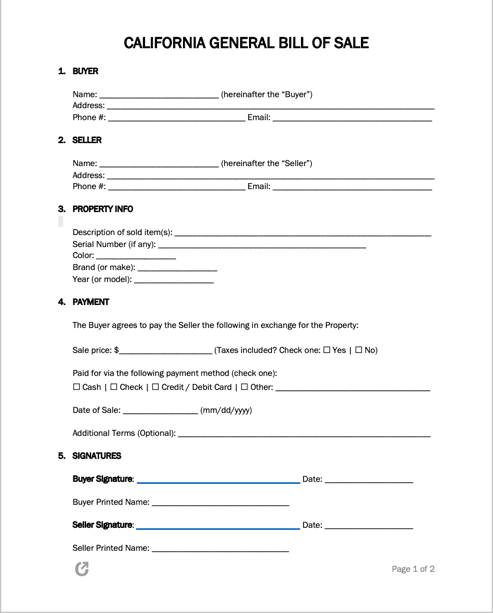

| Signing Requirements: The buyer and seller must sign to validate the form. |

What is a California General Bill of Sale?

A California general bill of sale assigns the buyer the new owner of personal property. It attests that they carried out a business operation with the previous owner, thus duly paying for the item. The form must contain essential information about the products or goods. A bill of sale has enough information when someone can quickly locate or recognize the object solely by its description.

Residents utilize the form when transferring uncategorized property, like kitchen utensils, cookware, picture frames, and similar items. However, the state does not impose limits, meaning that a person can complete the general bill of sale for any object except boats and cars. Instead, property of this nature requires the use of the DMV-provided form.

Frequently Asked Questions (FAQ)

The numbered list below provides additional information on California bill of sale forms.

1. How to Write a Bill of Sale in California

The buyer and seller must complete all five (5) sections of the bill of sale form. California does not require the presence of a notary public, although both parties can notarize the document if they wish to do so.

In the first two (2) sections, the buyer and seller must enter their birth-given name, home address, phone number, and email. Next, they must list the description of the item sold, including details like its serial number, color, make, and/or model.

The payment section contains essential information about the deal as it references the value and selling price of the property. It informs the DMV and other entities of tax payments the buyer made (or did not make) on the item.

In addition, it has the payment method, date of the sale, and terms to identify the transaction further. Lastly, each person must include their name, signature, and date to acknowledge their approval.

2. Is a Bill of Sale Required in California?

The state of California does not require a bill of sale form. The buyer and seller only need a bill of sale if they exchanged a vehicle and did not sign the title. Otherwise, dealers and private sellers do not have to complete it. While not a requirement, the state recommends a bill of sale form to prove that a deal occurred.

3. Do You Have to Sign Before a Notary Public or Witness?

Per CVC § 1652, a bill of sale does not require notarization or witnesses. However, this law does not mean that the buyer and seller cannot have a notary public or witness observe the signing. It simply means that the state does not require it when reviewing a bill of sale document. Notarization and witnesses can help authenticate the form and, therefore, serves as a beneficial addition to any sale.