Kansas Motor Vehicle Bill of Sale Form

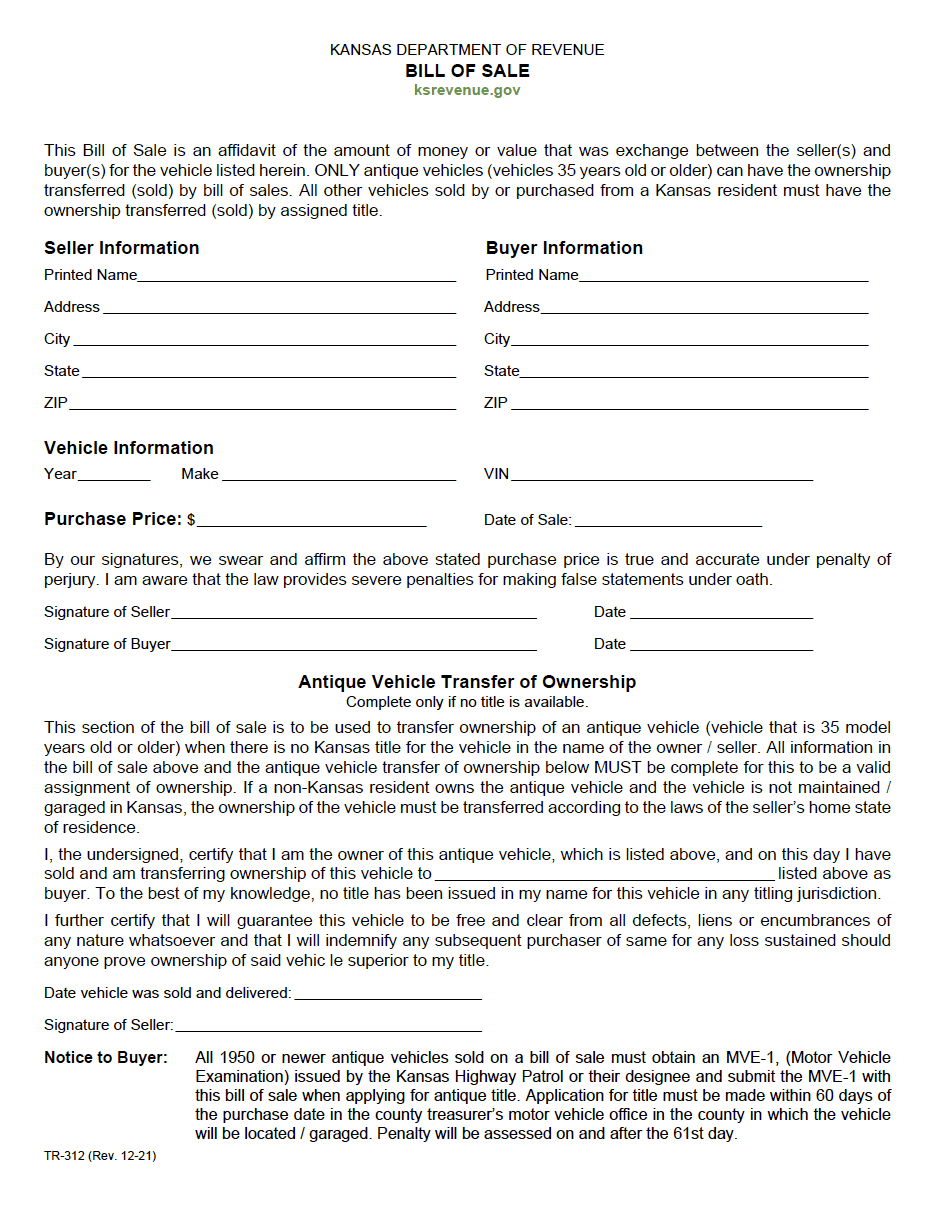

A Kansas motor vehicle bill of sale form reports a car’s manufacturing information and the personal details of the transferor and transferee. The individuals involved use the document to transfer ownership of vehicles thirty-five (35) years or older, also known as antique cars. It does not transfer ownership of standard cars, however. Instead, it accompanies the title to list additional details about the sale.

|

County Versions (PDF)

What is a Kansas Car Bill of Sale?

A Kansas car bill of sale offers protection to both parties when selling and acquiring an automobile. The state provides a form for residents to use under these circumstances. Buyers and sellers must provide their birth-given names and addresses. They also need to include the automobile’s year, make, vehicle identification number (VIN), purchase price, and the date of the sale. The bill of sale becomes official once the purchaser and vendor sign.

When completing the form for an antique vehicle, the seller must provide the buyer’s name, the sale and delivery date, and their signature at the bottom. In addition, they must provide a completed Motor Vehicle Examination (Form MVE-1) for antique cars with the model year of 1950 or newer. The document is not available online as only the Kansas Highway Patrol (or their designee) can issue it. The buyer needs both forms (i.e., the bill of sale and motor vehicle examination) to register and title it in their name. They do not need the bill of sale if a valid title exists, but they should create one anyway for protection purposes.

What are the Buyer’s Tasks?

The buyer must follow the steps listed below when purchasing a vehicle.

- Research. Potential buyers must determine their need for the vehicle. They must consider the minimum and maximum amounts they plan to spend and if they want a new or used automobile. In addition, the individual must think about whether they wish to purchase privately or through a dealer.

- Inspect. The person viewing the car should thoroughly look over it to ensure it does not have rust, damage, or other structural issues. Per federal law, sellers must inform the buyer of the car’s accident and damage history. They must also disclose necessary repairs and the vehicle identification number (VIN), which must match the number on the title.

- Online Search. After obtaining the VIN, the interested party should run it through websites like Carfax to check its recorded history. They should also look up the value on another similar service.

- Bill of Sale. Once the buyer decides to purchase and determines a price with the seller, both parties must complete a bill of sale form. They must include the car’s mechanical information and their contact details. The document becomes valid once signed.

- Title & Registration. The seller must complete the applicable sections of the title and transfer it to the buyer. It needs signatures from all parties involved, including co-owners. When putting their name on the car’s legal forms, they must also give the purchaser the current registration to bring to the county treasurer’s office.

What are the Seller’s Tasks?

The seller must carry out the sale in the manner requested by the state. If they fail to take the necessary steps, they may receive fines or other unwanted penalties. For example, if the seller does not notify the state of the transfer, they could have the responsibility of paying for damages or tickets acquired by the purchaser. Therefore, they must take the following steps to ascertain they tie loose ends before and after selling.

- Assess buyer. The seller must use their best judgment upon meeting the interested person. If they notice red flags or have concerns, they can decide not to sell to the individual. This step holds importance as it can protect the owner from scams or fraudulent transactions.

- Bill of Sale. Once both parties agree on the terms of the deal, they should complete a bill of sale form. The document informs third parties that the buyer paid the seller, and the seller gave up ownership of the car in exchange. It describes the vehicle’s condition during the sale and includes its damage history and other relevant details.

- Title & Registration. Buyers need the transferred title and registration upon purchasing the vehicle. Sellers need to fill out the title and sign it. If the car does not have a title or registration, both parties must use the bill of sale as proof of purchase.

- License Plates. The person selling their vehicle must remove their license plates. New owners cannot use the previous license plates as they must obtain registration and title in their name. The seller can transfer the plates to another car or turn them into the treasurer’s office.

- Seller’s Notification of Sale. Per state law, the seller must inform the county of the vehicle transaction using the required document. This step protects the previous owner from paying for damages or tickets acquired by the new owner. In addition, it gives the state physical evidence of the transfer, which they keep in their permanent records.

How to Register a Car in Kansas (4 Steps)

Residents must register their vehicle with the county treasurer’s office no more than sixty (60) days after purchasing it. Appointments must occur at the location nearest the applicant. Late submissions result in additional charges.

Individuals moving into Kansas must obtain registration within ninety (90) days. They must also get a VIN inspection for their out-of-state car. This process must happen at an official VIN inspection station.

Step 1 – Insurance

All vehicles operated in Kansas need an insurance policy. The owner must ensure they obtain a plan that aligns with the state’s standards.

According to local law (§ 40-3107), the driver must have the following coverage:

- Bodily Injury: $25,000 per person / $50,000 per incident;

- Property Damage: $25,000 per accident;

- Uninsured/Underinsured Motorists: $25,000 per person / $50,000 per incident; and

- Personal Injury Protection.

Residents must provide proof of their current insurance policy when registering the vehicle. The document or card verifying the plan must include: 1) the insurance company’s name, 2) the policy number, 3) the owner’s name, 4) the coverage’s start and end date, and 5) the vehicle’s year, make, and VIN.

Step 2 – Title

The titling process differs for new and used vehicles. Owners should collect and file the paperwork accordingly.

When transferring the license plate, the individual must provide the MSO (for new cars only), proof of insurance, a sales tax receipt, and payment for property taxes. They must also submit the current registration receipt for the vehicle with the license plates for transferring. The owner must sell or dispose of the previous car within sixty (60) days of obtaining the new one and inform the office of the buyer’s name and the purchase date. Lastly, the name on the new title must match that of the previous registration.

New Vehicle

In most cases, the dealer reviews the documents with the customer and obtains signatures as needed. Then, they send the forms and fees to the county treasurer, who issues a title and registration. However, the dealership does not always include this amenity in its sale package. In this case, owners must register themselves by providing the following to a county treasurer:

- Manufacturer’s Statement (or Certificate) of Origin (MSO or MCO);

- Proof of Insurance;

- Sales Tax Receipt; and

- Property Taxes.

The office provides the registrar with temporary paper plates while waiting for their official license plate. It takes approximately three (3) weeks for the plates to arrive by mail.

Used Vehicle

Private sales require the new owner to handle the titling and registration process. Unlike dealership sales, the seller is not responsible for sending documents to the county office. The purchaser must make an appointment with the treasurer and submit the documents below.

- Title. The seller must assign the title to the new owner. Its backside should include the purchase price, sale date, odometer reading, and the names and signatures of the buyer(s) and the seller(s).

- Power of Attorney. If both parties agree for the buyer (or a third party) to take care of the transaction, the seller must complete and sign a power of attorney (Form TR-41).

- Lien Release. Owners with a lien on the title must take care of it before selling. The lienholder can release it using the title, a notarized lien release (Form TR-150), or by writing a letter.

- Inspection. Out-of-state and antique vehicles require an in-state inspection before transferring the title. The owner must collect a pink copy of Form MVE-1 and bring it to the county office.

- Proof of Insurance. Upon transferring the title, the new owner must have a valid insurance policy.

- Sales Tax Receipt. If the purchaser paid the car’s sales tax, they need the receipt. However, if they did not pay the taxes, they must bring payment to settle the loan at the office.

- Property Tax Payment. Upon titling the vehicle, the owner must pay its assessed property taxes.

Owners do not have a physical version of the title as Kansas uses electronic titles (or E-Titles). However, they can use the documents listed above to obtain a physical version. If they want a sixty (60) day paper permit, they must also submit an electronic title sales agreement (Form TR-39A), a copy of the seller’s registration receipt, and proof of insurance.

Sellers can assign buyers as their representatives when transferring ownership of the vehicle. To accomplish this task, they must fill out a power of attorney (Form TR-41) and a purchase price and odometer disclosure for the electronic title (Form TR-40).

The seller must eliminate all liens before the sale. They can accomplish this task by providing a lien release or clear paper title. Exceptions include lienholders who consent to the ownership transfer before the seller pays the loan. In this case, the lienholder must complete and sign a lienholder’s consent to transfer ownership (Form TR-128).

Step 3 – Register

The car owner must have the title in hand before registering their vehicle. They must begin the registration process by collecting the necessary forms and making an appointment with their local county treasurer’s office.

| Bring the Following: |

Step 4 – Renew

Kansas vehicle registrations last for one (1) year. The registrar can renew online, through the iKan app, by mail, or face-to-face. Renewal dates are based on the first letter of the owner’s last name.

Renewals can happen online as long as 1) the owner has their individualized PIN or access code number listed in the mail notice, 2) the insurance company participates with the department’s online portal, and 3) the payer can provide an electronic form of payment. Individuals who did not receive a renewal notice must reprint the notice or contact the Division of Vehicles at 785-296-3621.

| Mailing Address: |

| Titles and Registration P.O. Box 2505 Topeka, KS 66601-2505 |