Kansas Bill of Sale Forms (5)

A Kansas bill of sale form legitimizes the ownership transfer of an item between two (2) entities. The deal can involve a business, such as a dealership, selling high-value property, such as cars, boats, and weapons. A buyer and seller can also use the form when engaging in a private sale. The new owner can pay by cash or check, or they can exchange an object of similar value. In addition, the previous owner can gift the item, meaning they receive $0 compensation. Each agreement should involve a bill of sale to outline the transaction details.

Summary

|

Types (5)

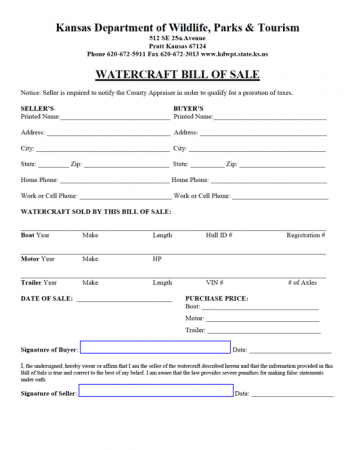

Boat Bill of Sale – For the selling of a water vessel.

Boat Bill of Sale – For the selling of a water vessel.

Download: PDF

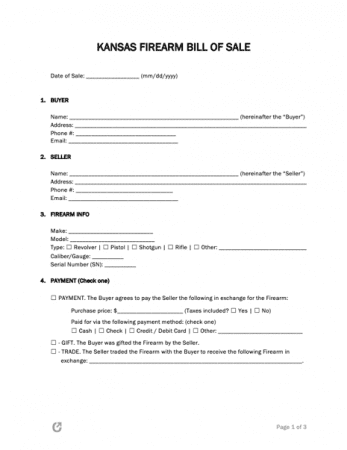

Firearm Bill of Sale – Used when the ownership of a gun changes.

Firearm Bill of Sale – Used when the ownership of a gun changes.

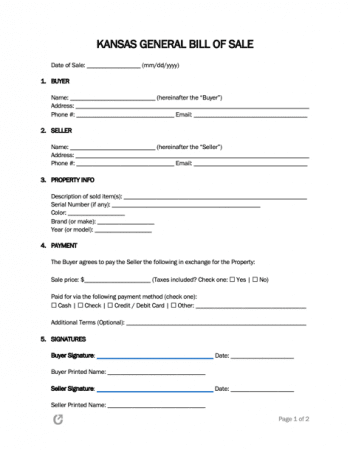

General Bill of Sale – Signifies that the sale of a generic item happened.

General Bill of Sale – Signifies that the sale of a generic item happened.

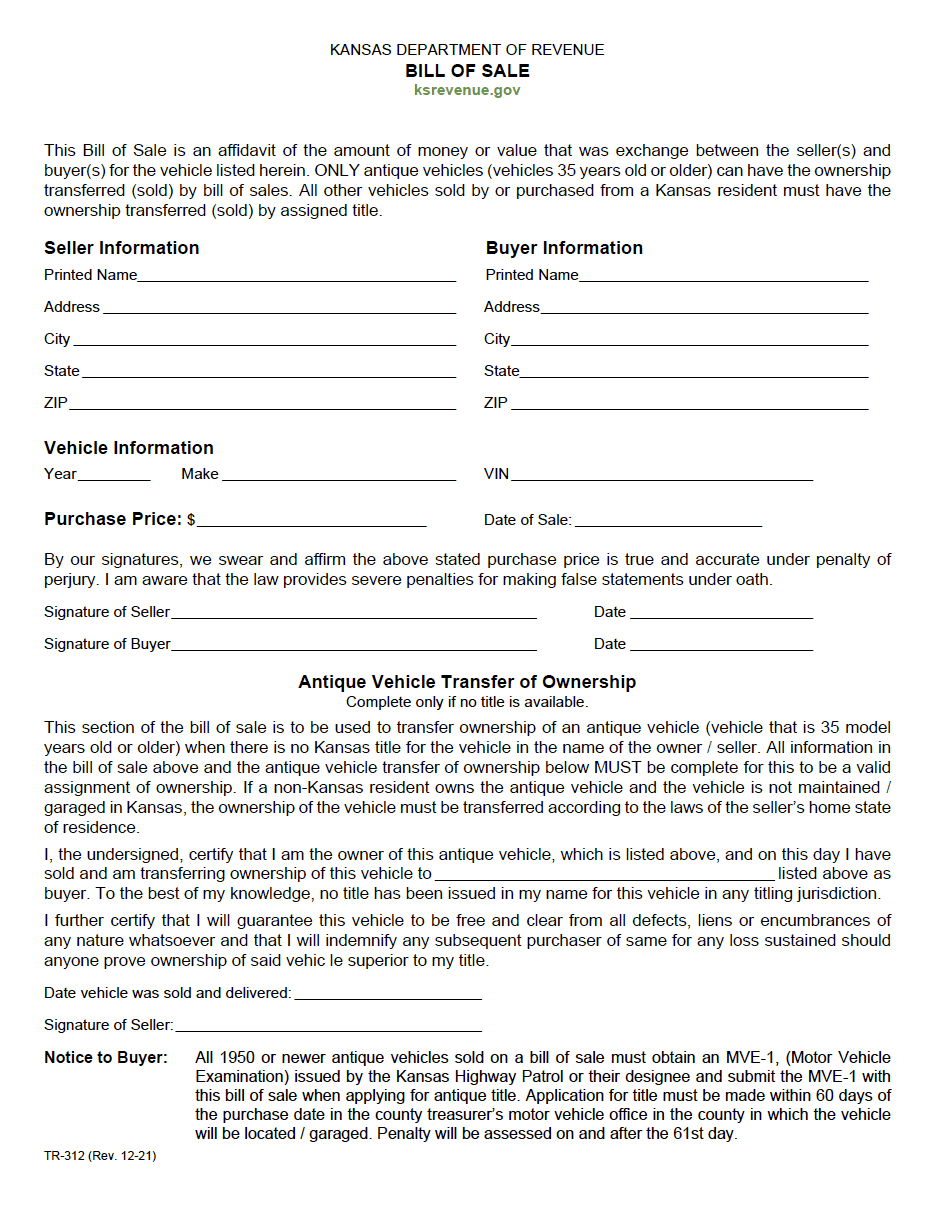

Motor Vehicle Bill of Sale Download: PDF

|

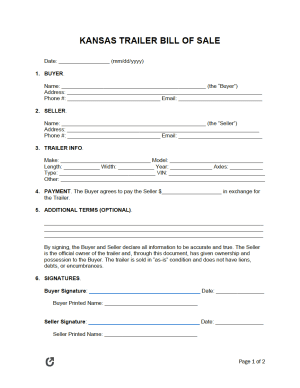

Trailer Bill of Sale – Provides evidence of a utility trailer transaction.

Trailer Bill of Sale – Provides evidence of a utility trailer transaction.

Signing Requirements

| Bill of Sale Type | Buyer Signature | Seller Signature | Notarization |

| Boat | Required | Required | Not required |

| Firearm | Required | Required | Not required |

| General (others) | Required | Required | Not required |

| Motor Vehicle | Required | Required | Not required |

| Trailer | Required | Required | Not required |

What is a Kansas Bill of Sale?

A Kansas bill of sale gives a person the ability to claim an item as their personal property. It shows that they legally paid for or acquired the object through trade or gift. They can use the form for registration, titling, or simply proving their ownership.

By claiming the possession, the owner has full responsibility for it. In other words, they must abide by the applicable federal and state laws. For example, if a person acquires a gun, they cannot use it while intoxicated. Similarly, if someone buys a boat, they must pay the yearly taxes. The bill of sale serves as the primary identifier of ownership and bestows these duties on the person named in the form.

Registration Forms: Boats

Kansas vessel registration can occur at a regional office, state park, or through a boat registration agent. Residents can also mail their applications and payment to the operations office.

|

Additional (Optional) Documents

- Application for US Coast Guard Documented Boats – Only for boats operated by the US Coast Guard.

- Aquatic Nuisance Species Certification Course – An online class that residents must complete if they want to operate their vessel at Council Grove City Lake, Herington City Lakes (both locations), and Father Padilla Pond.

Registration Forms: Firearms

Weapon holders do not need to register firearms in Kansas. To apply for a concealed carry handgun license, applicants must provide the correct forms and fees to a county sheriff’s office.

|

Registration Forms: Vehicles

All vehicle registration forms and fees go to a county treasurer’s office.

|

Additional (Optional) Documents

- Kansas Motor Vehicle Power of Attorney (Form TR-41) – For a car owner to give someone the power to handle their responsibilities for the vehicle.

- Kansas Resident / Business Out-of-State VIN Verification (Form TR-65) – Required if the owner bought the car in another state or has an out-of-state title.

- Lien Release (Form TR-150www) – The owner and lienholder complete this form after paying the lien.

- Manual Title Application (Form TR-720B) – A vehicle owner uses this document to add a lien or replace a title.

- Request for Release of Lien (Form TR-155www) – Individuals send this document and payment to their lienholder to remove their loan.

Registration Forms: Trailers

Residents must provide registration documents and payment at a county treasurer’s location.

|

Additional (Optional) Documents

- Motor Vehicle Examination (MVE-1) – For trailers titled or purchased out-of-state or boat trailers weighing over 2,001 pounds without a title. The owner receives an MVE-1 after passing inspection and must provide the pink copy to the county treasurer when registering.