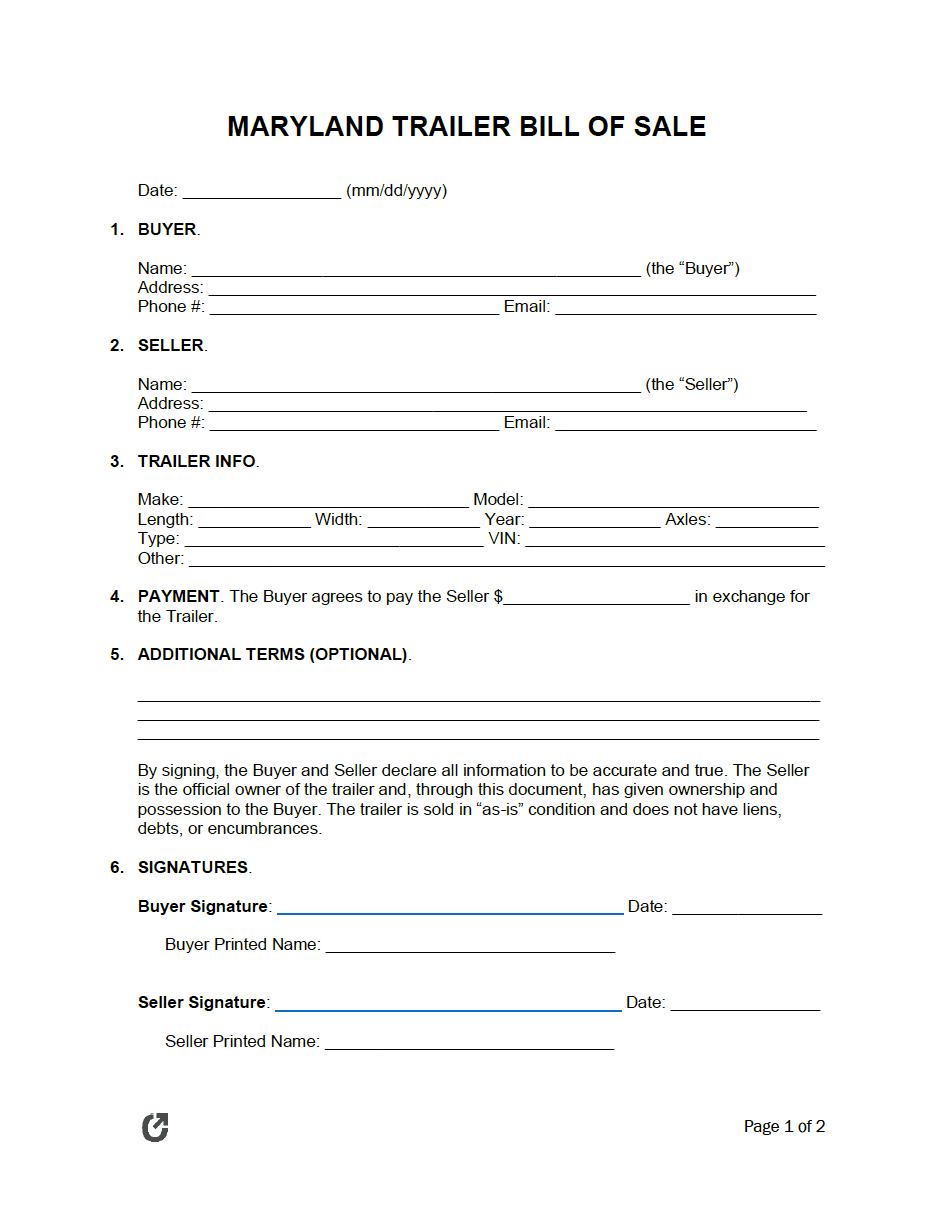

Maryland Trailer Bill of Sale Form

A Maryland trailer bill of sale form appertains to the shared agreement between a consumer and vendor. Upon signing the document, both parties must feel satisfied with the arrangement. Therefore, each person should outline their needs and expectations for the deal. The buyer and seller must agree to the opposing side before printing their names and signatures. After this step, neither person can back out of the sale, request reimbursement, or return the trailer.

What is a Maryland Trailer Bill of Sale?

A Maryland trailer bill of sale aims to facilitate accord between buyers and sellers when exchanging personal property. The form lists the trailer’s condition and value while recording each person’s credentials. Neither party can argue the deal once they sign. Both signatures concrete the inputted information and ensure the details therein are genuine. A notary public’s signature further solidifies the document by giving it legal power.

How to Register a Trailer (4 Steps)

Maryland law requires residents to register and title their trailers. Individuals moving into the state have sixty (60) days to transfer their title and/or registration. Failing to meet this deadline can result in fines and penalties, including losing tax credits. Owners must provide documentation to a Motor Vehicle Administration (MVA) branch office or licensed tag and title center.

Step 1 – Inspection

Trailers must go through an inspection before they can receive a Maryland title and registration. The examination must occur within ninety (90) days of the application. After the inspector approves the trailer, they provide the owner with a certificate, which they must give to the MVA. The vehicle identification number (VIN) on the certification must correspond with that of the trailer sticker and accompanying documents, such as the bill of sale.

Step 2 – Excise Tax

Individuals must pay excise tax on trailers seven (7) years or older. The state assesses a 6% tax on the purchase price or the set minimum value of $320.

The larger amount (between the purchase price and minimum value) determines the taxes. For example, if the buyer paid $600 for the trailer, they would owe 6% of $600. However, if they purchased it for $200, the MVA multiplies 6% by $320 to calculate the total.

Step 3 – Title and/or Registration

Most trailers in the state require a title but do not need registration. The owner must pass an inspection beforehand if they want to register their trailer. Individuals who only want to obtain registration (but not title) must satisfy the requirements as listed in the corresponding application (Form #VR-008).

Homemade trailer owners must take additional steps before titling and registering can occur. Individuals planning to carry 5,000 pounds or less can provide the documents by mail or in-person to an MVA full-service branch office or licensed tag and title service center. Loads 5,001 pounds or more require the owner to register at the Glen Burnie branch office. They must provide the necessary documents and two (2) photographs of it from the side and rear. Upon approval, they receive a VIN and serial plate, which must affix to the trailer.

Step 4 – Renew

Residents must renew their Maryland trailer registration every two (2) years. The state provides them with multiple renewal options, which they must take advantage of before their tags expire. They will receive penalties and fines if they do not meet the deadline.

So long as the owner does not have outstanding payments, tickets, issues with the law, or expired registration, they can apply online, by telephone, at a kiosk, or through the mail. However, they must visit a county treasurer’s office or title service agent in person if they need additional assistance.

| Mailing Address: |

| Maryland Motor Vehicle Administration 6601 Ritchie Highway N.E. Glen Burnie, MD 21062 |